If we focus specifically on economics in Europe and the US, there have been some signs of green shoots in certain data points, although the same cannot be said for China and Australia.

In Europe, we saw small revisions higher in French and German service (and composite) PMI data, while Italian service sector data expanded – No double-take needed, Italian data actually not only came out better than expected, but we even have expansion here.

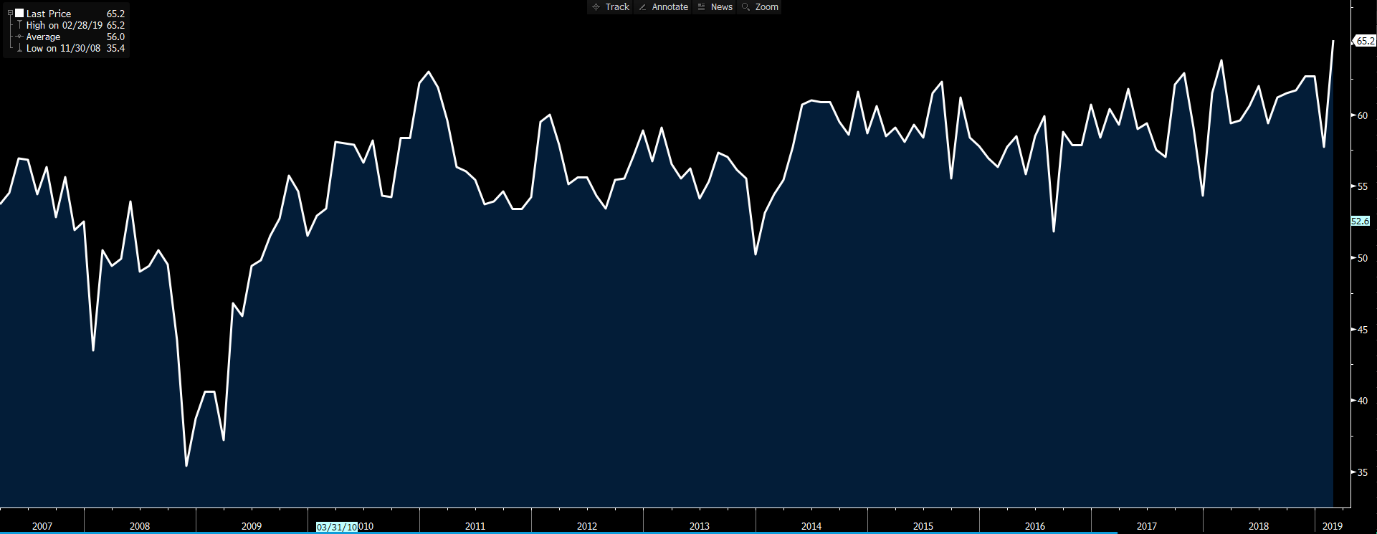

In the US, we saw new homes sales seemingly responding to the recent 60-basis point drop in US 30-year mortgage rates, with a gain of 3.7% MoM in December, which is made even more impressive after the 9.1% gain seen in November. Backing this good-will was a solid beat in the US service ISM data print, with the index coming in at 59.7.

The sub-components give us a belief that the service sector will continue to support growth, and as we can see from the Bloomberg chart below, the new orders sub-component (of the services ISM) saw the third biggest increase ever. For those who caught in the move in EUR/USD into 1.1286 then this data point was the trigger.

EUR/USD and the EUR crosses are firmly on the radar, with tomorrow’s ECB meet (at 23:45aedt) a clear risk. The rates market has really paired back its view on future ECB rate hikes, which is fair given the negative trend in the data flow, and while we know Mario Draghi is the master of suppressing volatility and promoting a weaker EUR, the bar is so low for a dovish surprise, that even he may struggle to out-dove this market. I will touch on the playbook in more depth tomorrow, but needless to say, we have our eyes firmly on the 15 February pinbar low at 1.1234, which marries nicely with the lower Bollinger band® on the daily.

With spot currently trading at 1.1306 (as I type), its interesting that the implied move over the coming two days, incorporating options implied volatility, is 65-points. If we’re looking for a higher probability long entry, perhaps as part of a mean reversion strategy, then I would focus on orders into 1.1240. We have three key reasons to expect buying support to kick in here, and it will take something quite punchy from Draghi to push it into and past 1.1200.

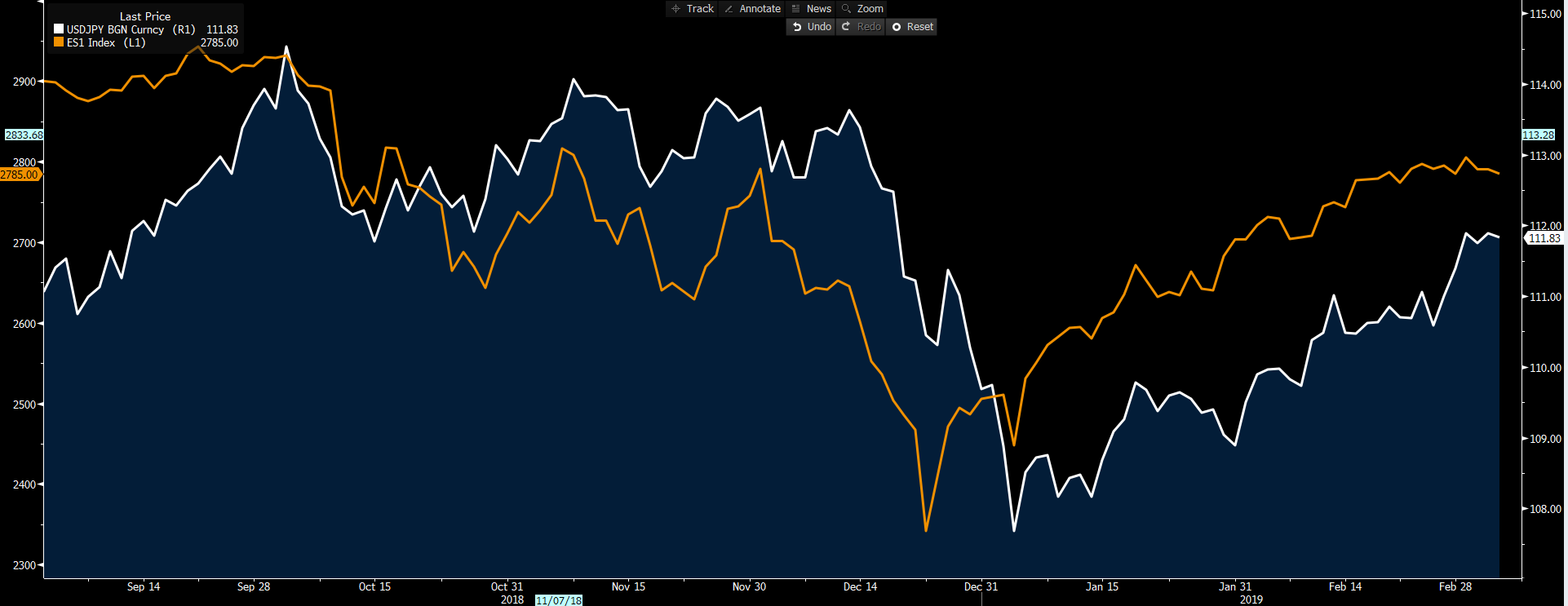

USD/JPY – The pair continues its consolidation, although the candles are showing signs of supply kicking into 112. Again, I am watching the trend support and the 100-day MA, where a break lower will promote a wave of sellers. That said, the bulls need a new catalyst, and that has to come from a higher S&P 500, which as you can see from the below chart is driving the show.

There is some focus on tonight’s US ADP private payrolls (due at 00:15 aedt) and December trade balance (00:30aedt), and these data points may influence to an extent, but the key driver remains the S&P 500, and my models are yet to give any clear signals on direction for the US equity index.

S&P 500 futures (orange) vs USD/JPY (white)

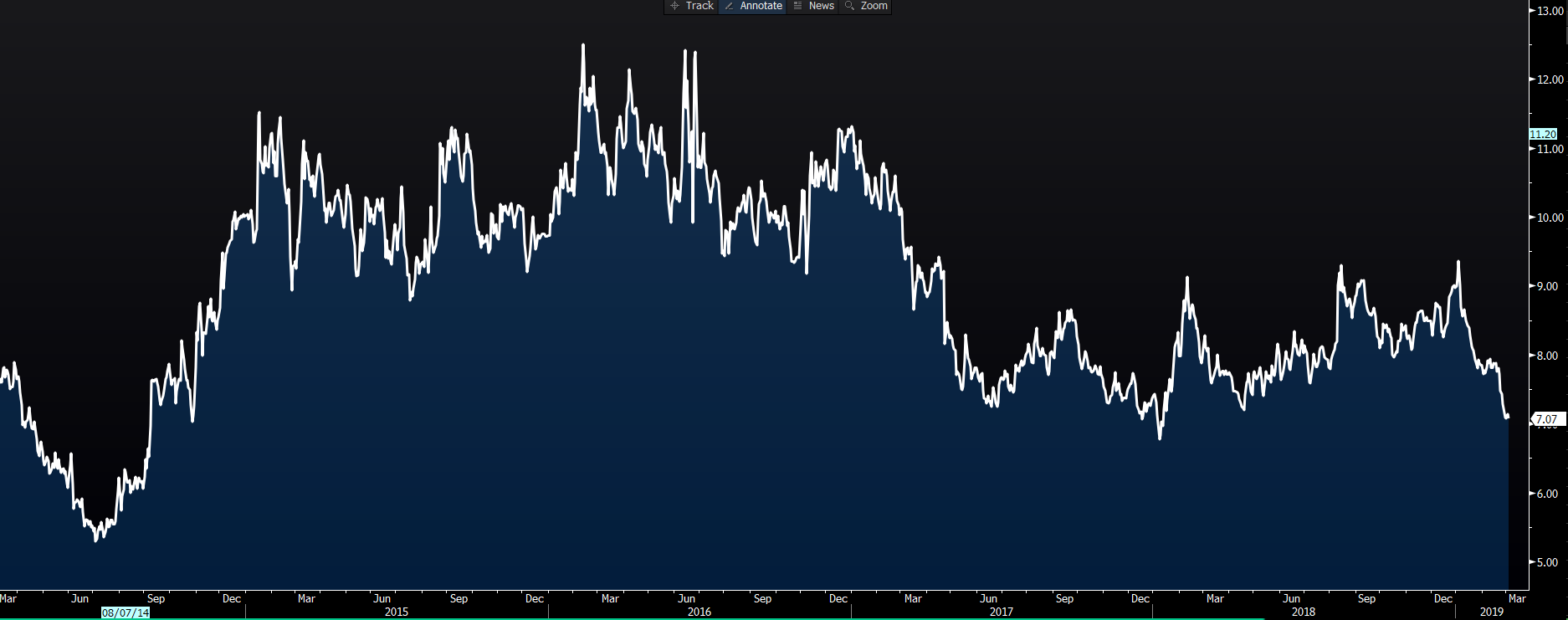

I continue to focus on volatility in the FX market as implied vol is shot to pieces and as we can see from the JP Morgan global FX volatility index. This will benefit specific strategies, but, by-and-large most traders I speak to like a bit of a pulse in these markets. What causes higher vols in FX markets? For my mind, its economic and central bank divergence and I can't see that happening too soon.

Australian data flow

After yesterday’s RBA meeting, the focus on the AUD today has been two-fold. Firstly, we heard from the RBA governor himself at 09:10aedt in Sydney. Again, I am not sure we heard anything that rocked the boat too greatly, even if the algo’s did promote small AUD sellers on the headline – it’s hard to think of a scenario where rates rise this year. I don’t think anyone will disagree with Dr Lowe here, but economists are more at loggerheads on the notion that the RBA don't see the labour market as a lagging indicator, and see the tight labour market as a source of growth going forward.

Secondly, at 11:30aedt we were treated to Aussie Q4 GDP. I had written about the downside risks to the consensus for the past two days, with the various GDP inputs coming below expectations, thus the consensus forecast moved down to 0.3%QoQ. The outcome was a 0.2% QoQ print, some 40bp below the RBA’s forecasts provided last month. Ok, there were some areas the optimists will point to, but there is far more ammunition for the rate cut camp and its this why AUD/USD is back testing the 12 February lows. A daily close through 0.7054 and we can talk about a 6-handle on the pair.

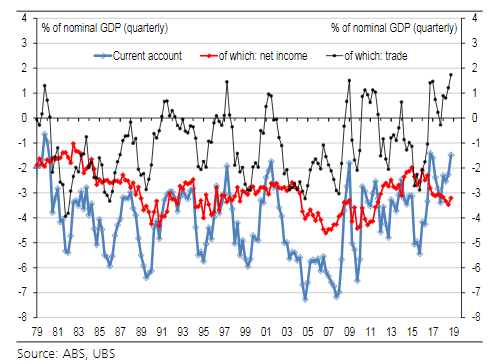

There seems little doubt that the AUD would be far lower if it weren't for relative current account dynamics. If we understand that current accounts do play a role in theoretical currency valuations, and therefore using the RBA's own visuals, we can see Australian current account improving. This reduces its reliance on offshore funding, which is a complete opposite of what the US is facing over the next few years and where the US Treasury department will be leaning more heavily on its primary dealers.

For those wondering why the AUD is not already sub-70c then I would be pulling this chart out.

Another interesting aspect of today's session is the ASX 200 is having another look at completing a bullish break of the recent price consolidation. The buyers stepped in from around 11 am and bid up the index into the GDP print, and from there the index caught another leg higher. ‘Bad news is good’ said one commentator. To me, this is a classic case where stock markets do not reflect economics, but where traders use the conditions in other asset classes to play specific themes in equity.

So, where we have seen Aussie bond yields falling 3 to 4bp across the curve today, and with ASX 200 implied vol at 11% and still so far below the five-year average, the hunt for yield in Aussie stocks is in play. REITS love lower bond yields, while the falls in the AUD have promoted further buying in healthcare.