Stock indices down, US dollar up for six consecutive weeks

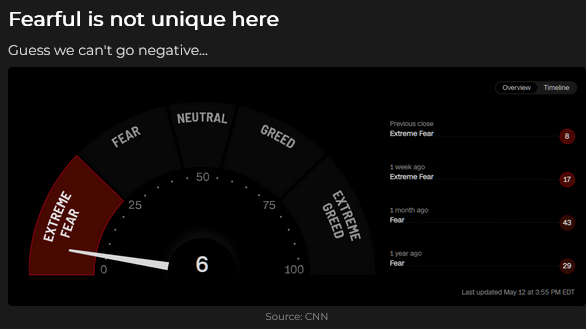

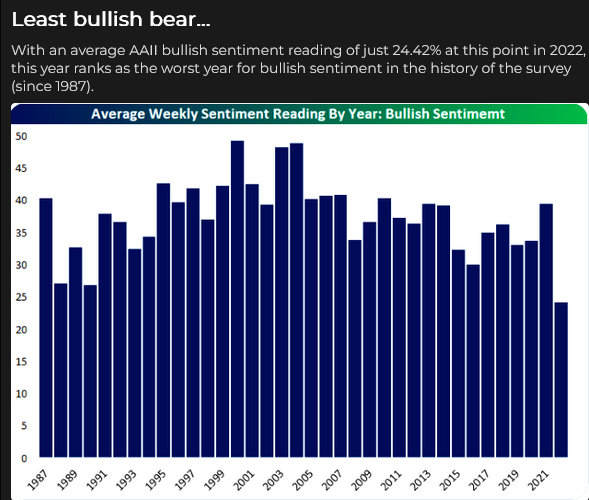

Looming American exceptionalism in monetary tightening (a determination to reign in no-longer-transitory inflation by discouraging demand) has magnified negative stock market sentiment (fear of inflation, then recession).

In contrast, the US dollar has surged higher against virtually all other currencies as capital flows to America for safety and opportunity.

The S&P came within a whisker of being down 20% from ATH this week when it touched a 14-month low.

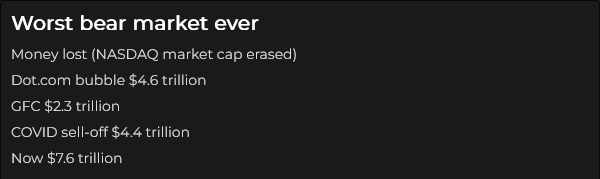

The NASDAQ hit a 19-month low this week, down 31% from November 2021 highs.

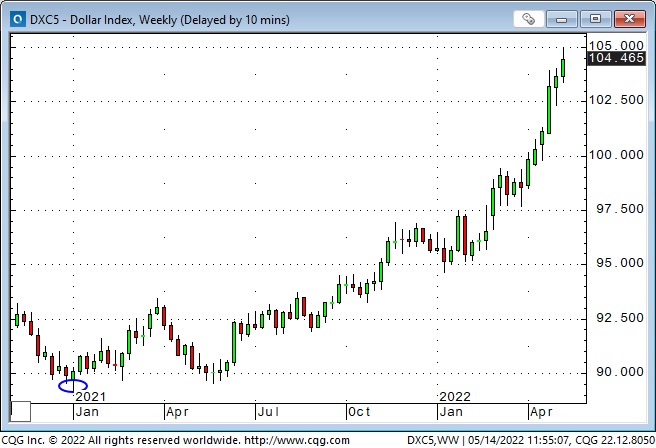

The US Dollar Index has rallied 18% from its Jan. 6, 2021 inflection point (when the mob stormed the Capitol Building in Washington) and this week traded to its highest level since 2002. It has rallied >7% since the end of March.

Since November, the sharp rise in interest rates has weighed on stock market sentiment but has boosted enthusiasm for the US dollar. The forward market is pricing short-term interest rates to rise until March/June of next year and then level off.

Is it different this time?

Traders and investors have different time horizons, but both wonder if the Fed will “back off” at some point. Fed Chair Powell commented this week that there will be “some pain” in the fight against inflation but that there would be more pain if inflation remains too high. This statement implies that the Fed will not “back off”—don’t fight the Fed.

However, even if the Fed remains determined to cool demand (the only way they can fight supply-shortage-induced inflation), there will likely be sharp bear market rallies (like the one we had from mid-March to the end of March) in an ongoing bear market.

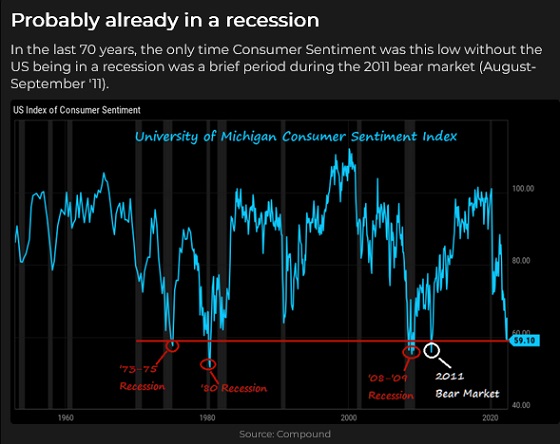

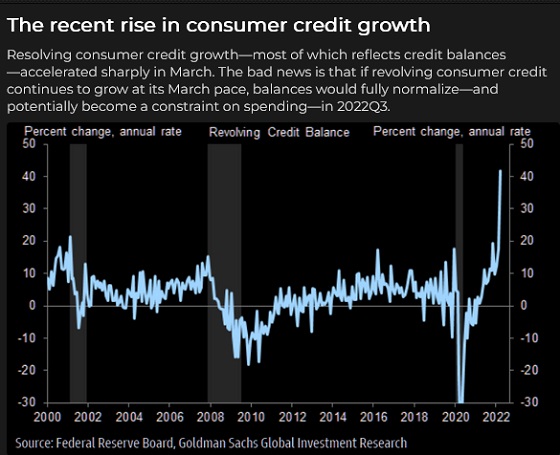

The recent sharp rise in consumer credit card balances may mean that people are maintaining their buying habits, even as prices rise, but that likely won’t last. Consumer spending is 70% of GDP; if it weakens, a recession (and/or stagflation) is likely.

A bear market rally in stocks will likely be accompanied by a correction in the US dollar—see the On my radar section below.

Energy

Higher energy prices = higher inflation. A recession will reduce energy demand, as happened in Q2 2020, but short of that, Western energy policies that have been (and continue to be) hostile towards fossil fuels and “dreamy” towards renewables will continue to have inflationary consequences.

For instance, hostility towards fossil fuels has constrained refining capacity, resulting in soaring costs and supply shortages of transportation fuels, which may result in rationing.

This chart shows wholesale gasoline at All-Time Highs—8X from the 2020 lows. Note that gasoline is now higher than in July 2008, when WTI was $147.

Precious metals

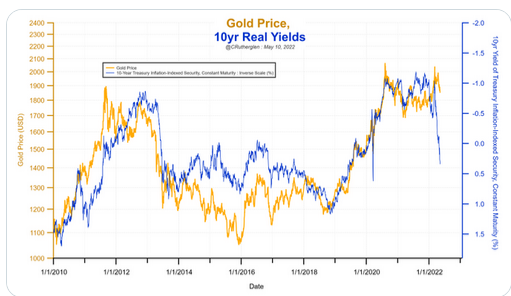

Gold soared to All-Time Highs ~$2075 following the Russian invasion of Ukraine, but prices dropped below $1800 this week. The ultra-strong USD and rising interest rates have hurt the gold price, which has fallen ~$200 over the last four weeks.

For the past several years, gold has been strongly correlated with real interest rates—it has rallied when real interest rates have become more negative. But recently, gold has not weakened as real interest rates have gone positive.

If gold had maintained its correlation with real interest rates, it would likely be at least $200 lower, which points to a “war premium” of more than $200 in the current gold price.

Silver touched a 22-month low this week, falling ~$6 (22%) over four consecutive weeks.

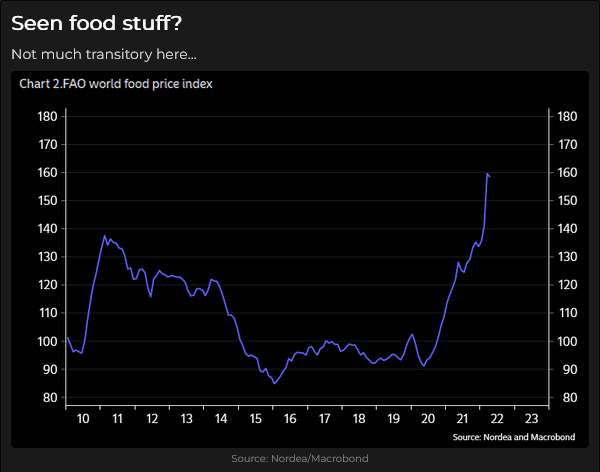

Food Prices

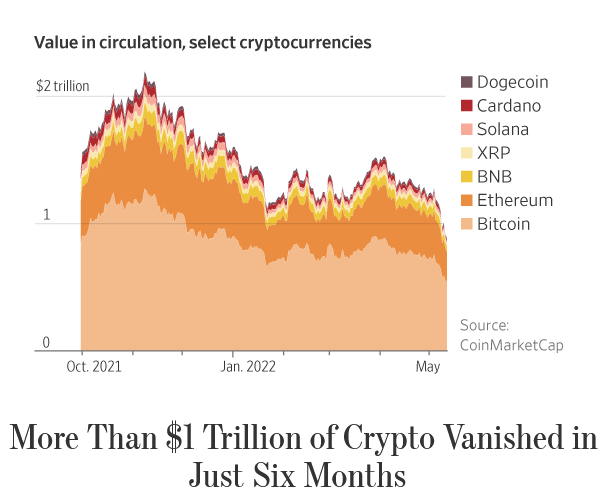

Crypto

On my radar

The steep drop in stock indices over the past six weeks and the accompanying extremely bearish sentiment have me looking for a rally. The daily chart pattern also looks tempting.

The sentiment that has driven stocks lower has also helped drive the USD higher, and it may be overdue for a correction.

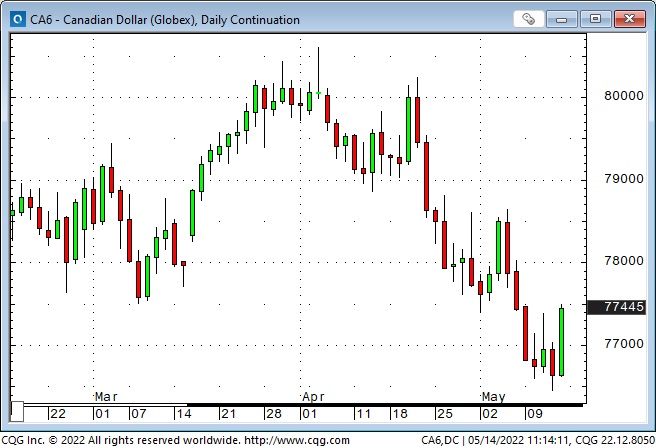

So I ask myself: what might be a good trade (in this current environment) if the stock market rallied AND the USD weakened? Answer: Buy the Canadian dollar.

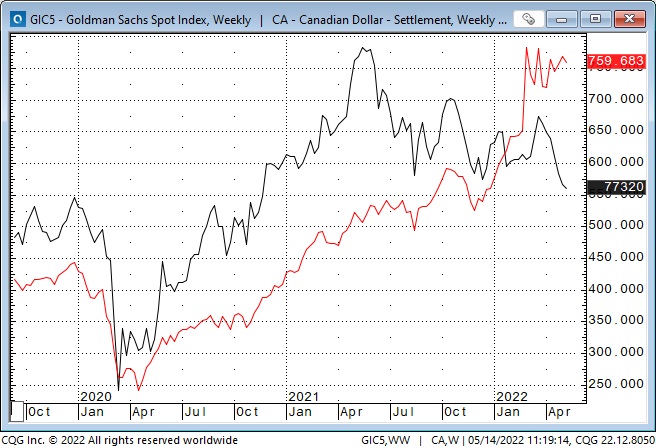

I have long maintained that the three principal factors driving the CAD were 1) the strength/weakness of the USD against most currencies, 2) commodity prices, and 3) risk on/of sentiment.

Interest rate differentials were significant from time-to-time, and other factors came into play, but the Big Three factors were crucial determinants.

1) The USD has been ultra-strong against nearly all currencies and is technically overbought. If it has a correction, the CAD should rally.

2) The CAD has a strong historical correlation with commodity indices. Lately, the CAD has not rallied with the commodity indices—the USD and negative risk sentiment may have been too strong. If the USD weakened and risk sentiment became less bearish, the CAD might benefit from the bullish tone of commodities, especially energy.

In this chart, the CAD is the black line; the Goldman Commodity Index is the red line.

3) One of my key measures of risk on/off sentiment is the S&P 500 Index, and lately, the CAD has had a robust correlation with the S&P. (h/t to Kevin Muir, the Macrotourist for this terrific chart.) If the stock market rallies, the CAD will probably also rally.

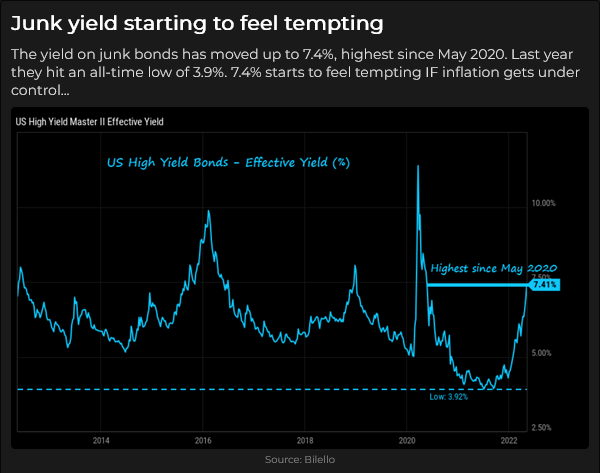

Another trade opportunity to look for: indiscriminate selling may mean that the “baby has been thrown out with the bathwater”—there may be some bargains!

For instance, uranium issues have tumbled with markets in a risk-off mode. If you think nuclear energy has a bright future, you might look at buying uranium at these lower prices.

Thoughts on trading

I still (after all these years) read, listen to podcasts and watch videos of “research guys.” I’m not looking for buy/sell advice, but every once in a while, they make me think about something in a way that is new to me, and I might see a trade idea.

The “trouble” with the research/economist guys is that they think (and they cause a lot of investors to think) that the way to make money is to have a great crystal ball.

It’s great if it works, and congrats to them for a good call, but I make money not by having an excellent crystal ball but by managing risk. What I do with a trade once it’s on is far more important than deciding to get into it in the first place. One caveat: a good entry point is an essential part of risk management!

One of my fundamental trading rules is to know where I will exit a trade if it goes against me before I get into the trade. My thinking is, “If the market goes to this level, I’m wrong, and I need to exit the trade.” I’ll put a stop at that level.

Typically, if the market moves in my favor, I’ll trail a stop behind the market in case the market goes much further than I thought – I need to allow the trade to be an out-sized winner.

Given the wicked short-term swings across markets lately, I’ve been shortening my trading time frames (the S&P can move more in an hour than it used to move in a week!)

I’m therefore thinking of changing my trailing stop habits—If I’m in a counter-trend trade, I’ll take profits if the market surges in my favor; if I’m trading with the trend, I’ll try to stay with the trade by trailing my stops.

My short term trading

I was flat to start this week and did not trade Monday as I “got used to” sitting in front of my screens after travelling last week.

I made 14 different trades in the S&P and the CAD Tuesday to Friday—mostly buys, but some shorts. Five trades were profitable; nine trades lost money. I was flat at the end of the week, and my P+L was up ~0.75%.

Quotes