The interesting dynamic is how the US tech sector is a growing point of concern right now, while oil is an inspiration and various key central bank meetings are holding back trading activity. Certainly, there has been a pick-up in shorting activity on NASDAQ futures, which is always going to happen when Twitter Inc (NYSE:TWTR) and Apple (NASDAQ:AAPL) come out with poor results. Apple missing consensus EPS (adjusted) for the first time in 13 quarters means we could be facing the worst reaction in the cash market session since January 2013 (when it dropped 12%). Let’s see how Facebook (NASDAQ:FB) fare when they report post-market tomorrow, but make no bones about it, FB is a brilliant business and I’d rather be in Facebook than Twitter any day of the week. Pullbacks into $100 to $90 should be a great opportunity to buy.

One suspects FB earnings will be overshadowed by the April FOMC meeting, although this should be a key affair and the key focal point being whether the Fed re-adopt the view that inflation risks are ‘nearly balanced’. I suspect the Fed will not want to rock the apple cart and will want to keep the positive momentum lower in the USD and credit spreads going. Tomorrow’s Bank of Japan meeting, however, is a very different beast and one could expect fireworks in the Nikkei and JPY as there are elements of the market expecting a raft of aggressive easing measures and others calling for simply dovish rhetoric. Generally, when we get disagreement, we get volatility. I sit in the ‘why wait’ camp, and hope they throw the kitchen sink at trying to converge with their inflation outlook, although this is a sinking ship and while the sugar hit from markets will be brief, it simply delays the inevitable. We are already staring at the dynamic of the BoJ cornering the equity market, while owning the vast bulk of outstanding Japanese government bonds.

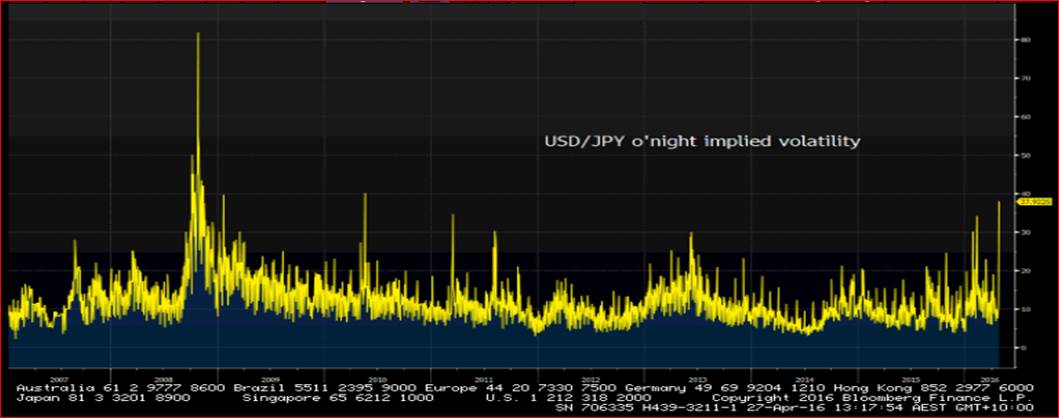

Just take a look at the implied (overnight) volatility in the options markets which sits at the highest since 2010. Clearly traders are expecting a huge move tomorrow.

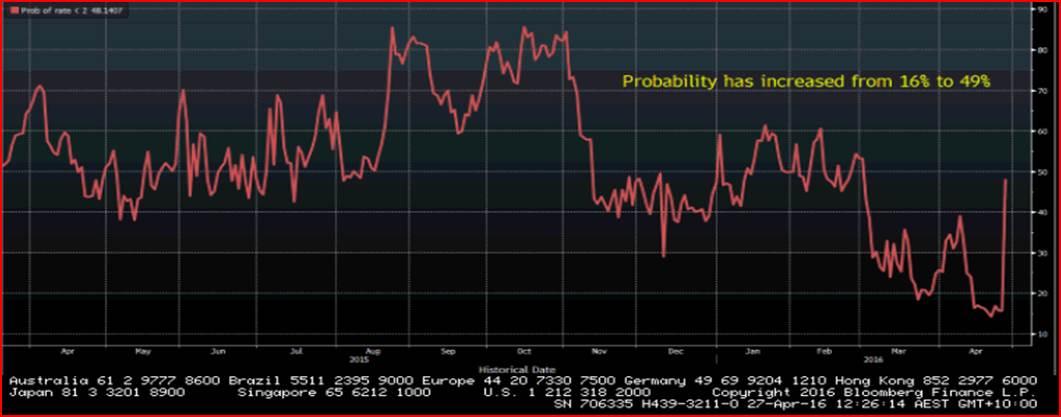

In Australia, the new news is that we have seen inflation become a major headache for the Reserve Bank of Australia. The fact we have seen headline inflation at 1.3% (the lowest since March 2015) and trimmed mean at 1.7% (the lowest since Bloomberg started recording the data) now puts the RBA’s 2-3% target at risk. There has been an absolute collapse in bond yields, led by the two- and three-year part of the curve. Aussie bond futures have seen huge demand, with monster volumes and this is a testament to a market that has been sanguine on future cuts for a while and is now pricing in a 50/50 bet for a May rate cut. This probability was 16% pre-inflation release, but although the implied probability has increased I suspect they may want to wait for the Q2 inflation print due on 27 July and may just amend the statement to become more dovish. One must also remember this is a market very long of AUDs as well, with the speculative community running the largest net long position in AUD futures since September 2014.

The fact we have seen iron ore futures fall by the daily limit today is another headwind now for the AUD, so the fact that Chinese authorities are trying to get in front of the moving juggernaut that the Chinese retail trader and the migration into commodity futures suggest there are downside risks to both steel and iron ore futures. AUD/USD itself needs to close below $0.7745 (yesterday’s low) to print a bearish outside day reversal, suggesting a continuation of the downside, however it will also close below the strong bids seen at $0.7695, which can be best seen on the hourly chart.

Certainly from the hourly chart shorts into $0.7680 to 0.7690 look compelling.

I suggested last week now was not the time to go short AUD/USD and AUD/JPY, but the wind has changed and the trading landscape is changing. With both the Fed and BoJ in play, this could be a dangerous policy to be too short of these pairs anyhow now, but it does seem that the longer-term trend resistance at $0.7823 I looked at last week could actually be the high of this move. Westpac announcing they are no longer lending to foreign property buyers seems a big deal as well.