Market Brief

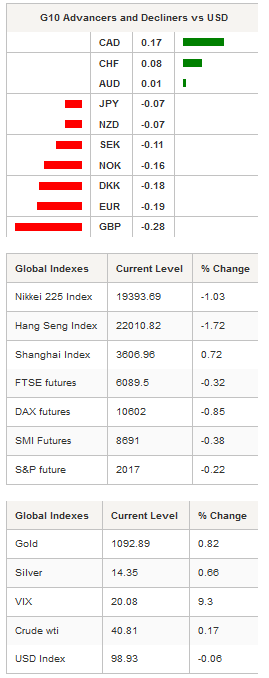

The weekend news flow was dominated by the Paris attacks keeping FX trading in tight ranges today. AUD/USD traded between 0.7130 and 0.7100 while USD/JPY was range bound between 1.0740 and 1.0687. S&P futures fell in Asian session putting pressure on regional equity indices. The Nikkei 225 index and Hang Seng were both in negative territory reflecting the weaker risk appetite across Asia, down -1.04% and -1.42% respectively. The Shanghai composite rose 0.73% the lone bright spot in Asia. US 10-Year yields dropped to near pre-payroll levels at 2.24%.

The FT has Boston Fed President Eric Rosengren suggesting that he favors a gradual pace of Fed tighten. However, he indicated that a faster pace could be warranted should direction in commercial real estate and large syndicated loans continue. Over the weekend, ECB Mersch reminded the market that the debate around additional easing is still ongoing and the ECB mandate was long term rather than focused on short term indicators. Finally, more rhetoric from the SNB indicated that more negative rates are on the way. The SNB Maechler stated that Switzerland is better off with negative interest rates. In Japan, 3Q real GDP contracted by 0.8% q/q marginally weaker than expectations at -0.2%.

The 2Q read was revised slightly higher to -0.7% q/q from -1.2% however the nation was still in a technical recession. Exports did improve in 3Q but CAPEX remained a noticeable soft spot. We anticipate today’s data will put further pressure on the BoJ to increase stimulus. That said we don’t expect that the BoJ will change its policy mix at Thursday meeting. In New Zealand, real retail sales 3Q climbed 1.6% q/q above the optimistic 1.4% and prior 0.1% 2Q read. Australia’s new motor vehicle sales fell 3.6% m/m in October (4.2% y/y) against upwardly revised improvement of 5.9% (7.8% y/y) in September. In Thailand, GDP growth 3Q increased 1.0% q/q well above expectations of 0.6%. This solid read puts that annual number at 2.9% in 3Q from 2.8% in 2Q.

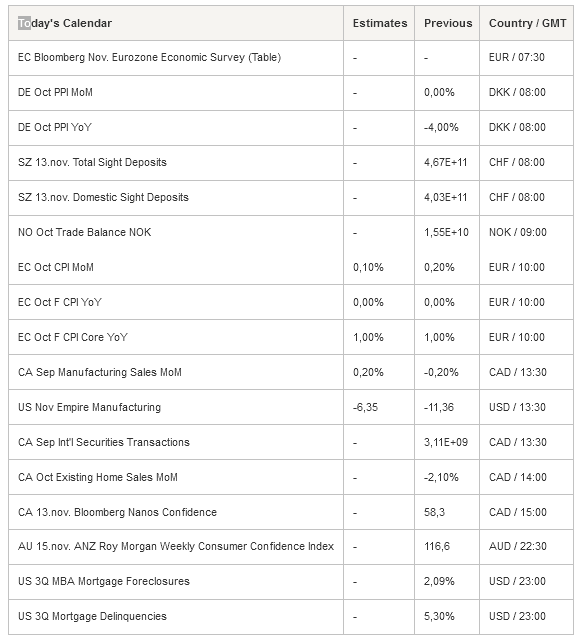

Tourism remains a bright spot adding 3.2% to the headlines GDP number however, private investment remains soft. We anticipated that trading will remain subdued today as participants will be focused on Paris headlines. In Euro-area, final inflation is anticipated to stay in line with the flash estimate at 0.0%y/y in October, although slightly increase in country reads up the risk to a strong read.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0741

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5188

S 1: 1.5027

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.86

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 1.0063

S 1: 0.9739

S 2: 0.9476