This market was custom-designed to destroy the spirit of the four stock market bears left on the entire planet. Hell, even the guys down in Gainesville have resorted to completely mealy-mouthed, anything-can-happen kind of talk, since anyone who steadfastly holds on to a bearish view is laughed at as a dullard and a fool. There is no doubt that blindly buying anything with a ticker symbol over the past 63 months has been the winning way.

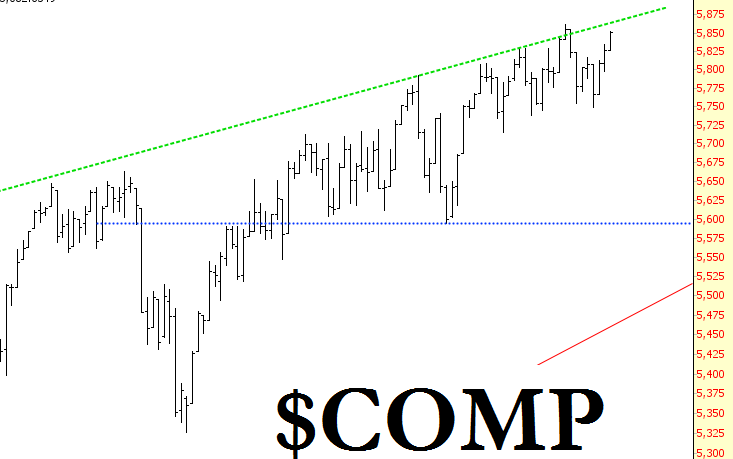

Even when the market looked like it was weakening just the tiniest bit, The Powers That Be ripped things higher. One glance at the NASDAQ Composite since mid-April shows this neatly. Sure, there are a few dips along the way, but on the whole, the market is jerking off to nude photos of Janet Yellen and celebrating The New World Order.

Logic be damned, Kayne West and Kim Kardashian are getting married, and that’s all that really matters.

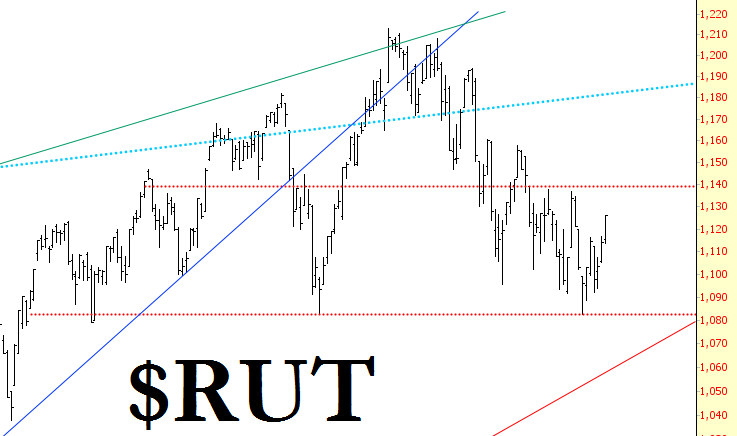

The Russell 2000 is still in what could, with a straight face, be described as a topping pattern. Unlike so many other indexes, it is nowhere near lifetime highs, and if – God willing – the market is allowed to re-weaken, it’s going to lead the way down.

Of course, the topic of a lower VIX has been kind of beaten to death by both me and a lot of other financial writers., but just one more time……….look how the VIX has been smushed into oblivion while the S&P 500 continues its no-volume, no-reason-needed melt-up.

And melting up right alongside it is the Dow Jones Composite, which has been floating just beneath its upper trendline for weeks on end.

Finally, on a totally different topic, it looks like interest rates are poised to tumble hard (which would, in turn, zip bonds to even higher levels). Bulls would argue plunging interest rates will just keep pushing money into the market; bears would argue that plunging interest rates are just an expression of the deflation looming on the horizon (after all, rates were in a tailspin in 2008).

I think if someone wants to buy the market, they should just save themselves the trouble of analysis and buy the SPDR S&P 500 (ARCA:SPY). There aren’t many honest-to-God great bullish setups out there, so if you think we’re going to keep gently melting up, that’s lovely, just buy SPYders. Or, you can be insane like me and keep hunting down promising short positions. I think ETFs are exhibiting sloppy, rotten patterns, but as horrid as this market is, there are still plenty of great opportunities for shorting stocks if you look closely enough. One thing’s for sure – - – the prices for shorting are certainly on the rich side.