While focus shifts to the FOMC, the BoJ continues dominating headlines, as the guessing game intensifies on speculations regarding the size of Prime Minister Shinzo Abe’s fiscal stimulus package.

FOMC-Expect the Unexpected

For the most part, it was a relatively quiet overnight session in risk. This relative calm is not surprising given the summer doldrums are setting in, and the proximity of the FOMC, which is materialising into a major event for the USD. Note the Nikkei fell 1.4% yesterday on the back of weakening USD/JPY but the reaction in Global Bourses was subdued.

With the current market factoring in a 60% probability of one hike in December and potentially two hikes in 2017, the Fed are unlikely to rock the boat. However, this week’s FOMC meeting is facing heightened importance due the uptick in US economic data since June’s NonFarm Payroll announcement. In all likelihood, the Fed may take a cautious stance highlighting Brexit concerns, but there is certainly some scope for the Fed lean hawkish. Let’s also not forget, that a potential June rate hike was also on the agenda if not for Brexit. The outlier May Non-Farm Payroll stopped the Fed pulling the trigger sooner. Since then, employment data has recovered, and US economic prints continue to beat expectations, providing the FOMC more than enough ammunition to provide some straight forward guidance of an impending rate hike.

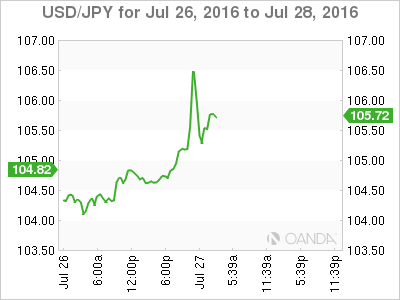

JPY -From Headline to Headline

Yesterday, the USD/JPY bubble burst when debate intensified on media reports that Japans policy makers planned to inject JPY6tn in direct budgetary outlays into the economy over the next few years. While double the amount initially planned, sadly it was shy of the 10 -20tn anticipated by traders. If there are any a helicopters circling, they are certainly stealthy ones!

USD/JPY plumbed to 104 lows overnight, but has since recovered as reports surface of growing support within the Bank of Japan ranks for further monetary easing, ahead of the two-day policy board meeting set to begin Thursday. On the BoJ policy front, the market is expecting at a minimum, a combination of a deeper move into negative interest rates territory, with an expansion of the monetary base. With expectations clearly elevated, we should expect an explosive reaction on any outcome. USD/JPY is unlikely to shy away as this week’s top headliner status

The major downside risk is perception since the market has set the bar extremely high for the Bank of Japan. Itchy trigger fingers are waiting.

Should the Bank of Japan decide to impart a policy delay to the September meeting, it is doubtful the forward guidance would be enough to sustain current USDJPY levels. We could quickly test 103 support and the expected wave of “ risk off” may set the stage for an ultimate test of Y100

With event risk jamming the Forex pipelines and failing any unanticipated drama, I would anticipate some consolidation to take effect,but be wary of headlines.

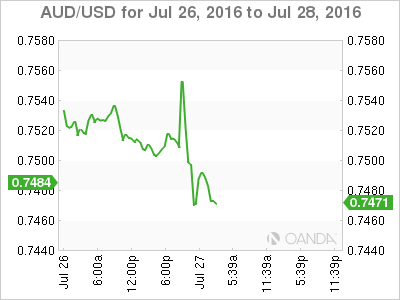

Australian Dollar – Significant Risk Event

In surprising developments, yesterday’s USD/JPY sell–off inspired a rally on the Antipodean currencies. The move was certainly counterintuitive to the fundamental outlook. Especially with both the RBA and RBNZ more than likely to cut interest rates this month. This surprise left many traders scratching their heads for answers. I can only surmise, given the destitute liquidity density, opportunists took advantage the YEN volatility to put a squeeze on both AUD and NZD short positions. Or more likely, some near-term Aussie shorts felt the strain ahead of today’s unnerving Q2 CPI print and decided to reduce speculative bets.

We are heading into today’s much anticipated Australian Q2 CPI, with huge expectations for a weaker print as a precursor for the RBA interest rate cut. If the CPI prints top side, I would expect a clear out of short Aussie positioning and a re-explore of the .7650 level

Lastly, keep in mind that the previous CPI print was more than ample enough to convince the RBA that the disinflationary trend is bonafide. It was viewed as a policy game changer. So there is much at stake on today’s number.

In markets where the current mantra is “ Expect the Unexpected ”, dealers are sitting on razors edge this morning while continuing to pare Aussie shorts ahead of the CPI print.

Australia CPI QoQ for Q2 comes at 0.4% (expected 0.4%)

Australia CPI YoY comes at 1% (expected 1.1%)

AUD/USD has rallied higher on the data 0.7550

Aussie dollar has jumped on the better than expected CPI reading. We’ve seen a wave of weak short position trimming who were hoping for a print below .4 level. While this may add some complications to the RBA narrative, the data indicates deflationary headwinds and the CPI inspired rally may be short lived

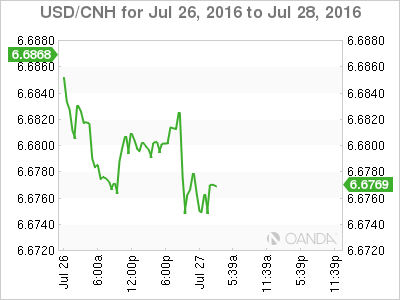

Yuan -Meandering Along

The major headline events pending, the FOMC and BoJ continue to dominate traders psyche. Not surprisingly the Yuan continues to firm against the trade-weighted basket on follow through from suspected interventions before the G-20 meeting in Chengdu.

Most traders are waiting for the dust to settle on the Japanese Yen and

Finally, comments from a Professor in PBoC Zhengzhou training school are making the rounds in early trade arguing that there should be an implicit easing bias, stating that before the G20 summit in September, the focus has to be on reassuring market confidence so that internationalisation can begin going forward