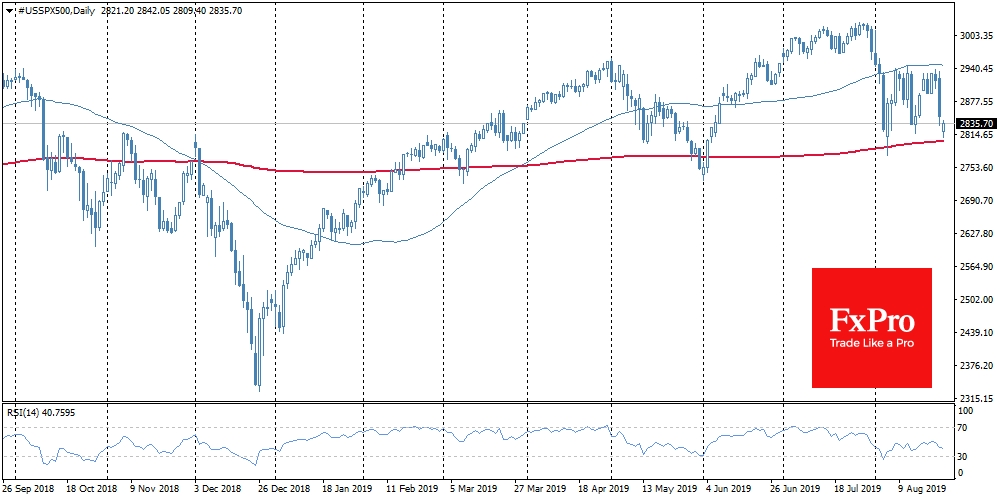

A new round of trade conflict escalation caused a sale of risky assets and a new round of demand for safe havens. S&P 500 and Dow Jones 30 Futures closed Friday with a decline of around 2.5%, and Asian trading platforms at the start of Monday picked up on this mood. Nikkei 225 is losing 2.1%, while Shanghai’s China A50 Futures is falling by 2.0%.

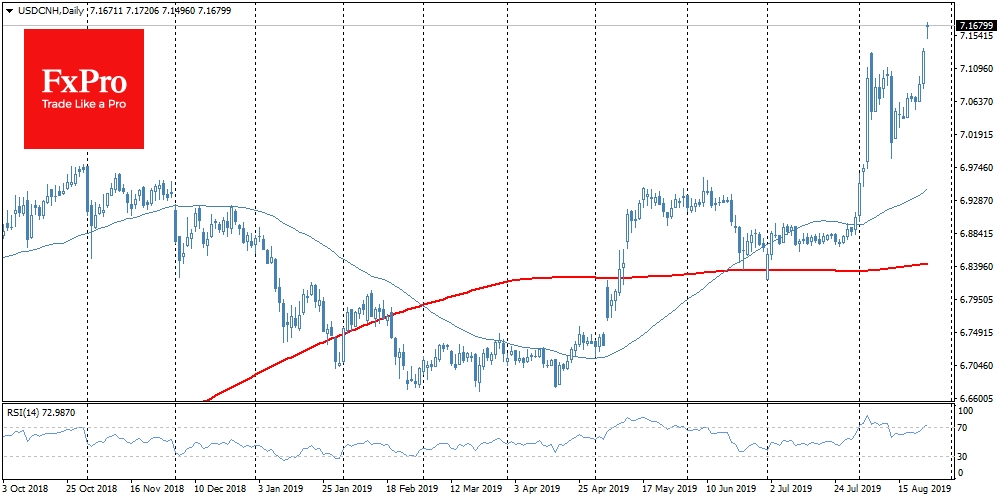

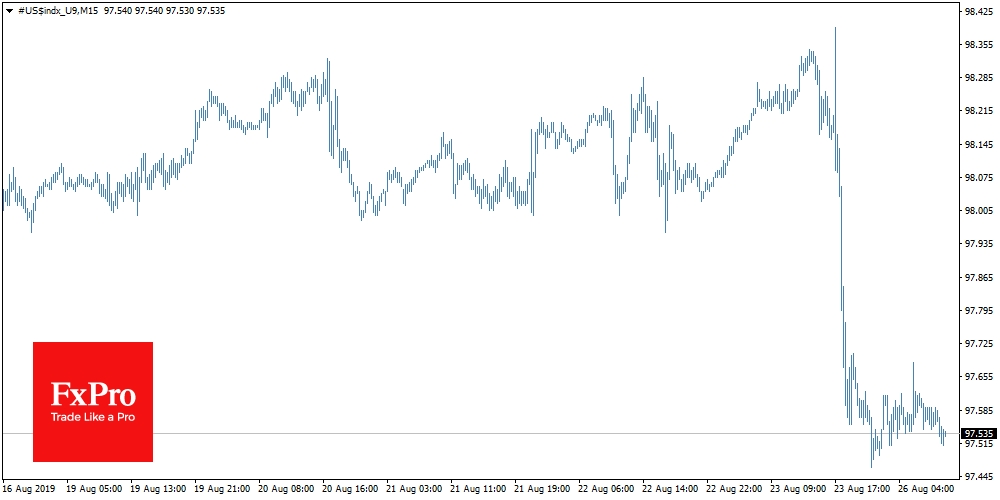

The offshore yuan also picked up momentum. The USDCNH is updating 11-year highs above 7.166, moving quickly from a mild strengthening to a sharp growth. At the same time, the U.S. dollar is also declining against its main rivals. The dollar index fell by 0.7% to 97.56 in response to Powell’s words at Jackson Hole.

On Friday, the head of the Fed indicated that the Central Bank is ready to soften the policy if conditions require it, but it depends not so much on the economy as on trade negotiations. This is a very important message for market participants, which allows them to judge the priorities of CB’s policy. Tariff wars promise to turn into a short-term surge of inflation, while the U.S. is already witnessing an acceleration in the rate of price growth while the economy slows down.

The Federal Reserve’s tolerance for the last surge in inflation and the expected further acceleration of inflation is holding markets back. Without Powell’s softness, Friday’s collapse could have been even deeper as the dollar’s decline has softened it.

But that brings us to another, more important problem. The central banks of the two largest economies, voluntarily or not, are involved in currency wars because they are forced to support the economy through policy easing, with side effects such as the weakening of the national currency.

Needless to say, the two per cent drop in markets is hardly a panic, as we have seen a similar amplitude many times in a month. However, if the decline of the dollar and the renminbi is stable, it can trigger a real panic in the financial markets.

In case of stronger demand for safety, investors may strengthen dollar purchases, despite the expected policy easing from the Fed. The history of the last 1 ½ years clearly shows that the escalation of trade conflicts causes the strengthening of the American currency, despite the easing of the Fed’s policy.

The FxPro Analyst Team