I am a fan of watching leadership. When leaders get into trouble, they can have a huge influence over the broader markets. The above chart looks at the S&P 500 and the hottest sector and hottest key global stock index of late. Over the past year the SPDR S&P Biotech ETF (NYSE:XBI) is up almost 5 fold more than the S&P 500. The DAX, the German equities index, is up twice as much.

So how are the hottest of the hot doing?

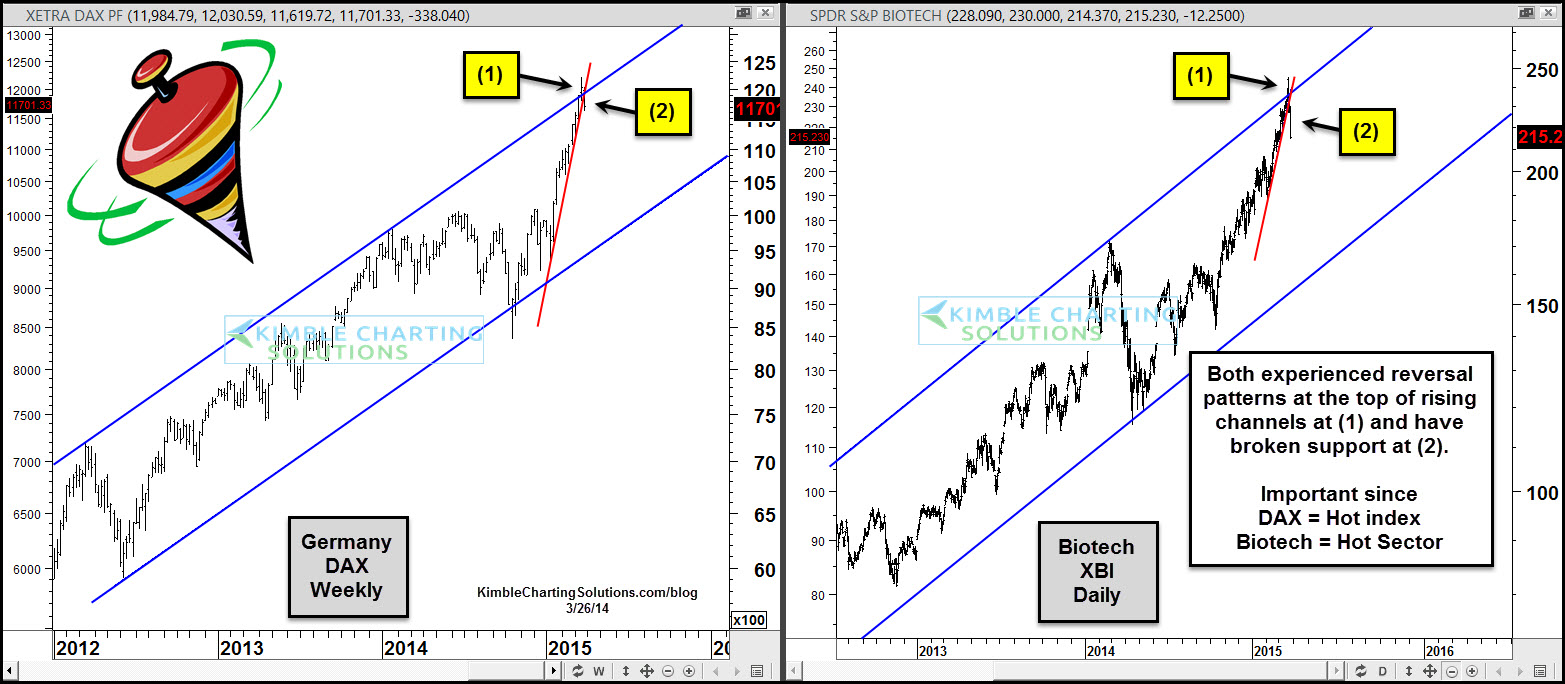

The 2-pack below looks at the patterns in the DAX XBI

What do the hottest of the hot have in common? Strong rallies over the past year that took them to the top of rising channels. Both look to have created reversal patterns (bearish wicks) at (1). Both are attempting to break rising support at (2).

As I shared at the start of this post, I humbly feel that keeping a close eye on leadership is very important. Investors might benefit from keeping a close eye on these two in case further weakness takes place, because selling pressure in leadership assets can spill over into lagging areas!