Investing.com’s stocks of the week

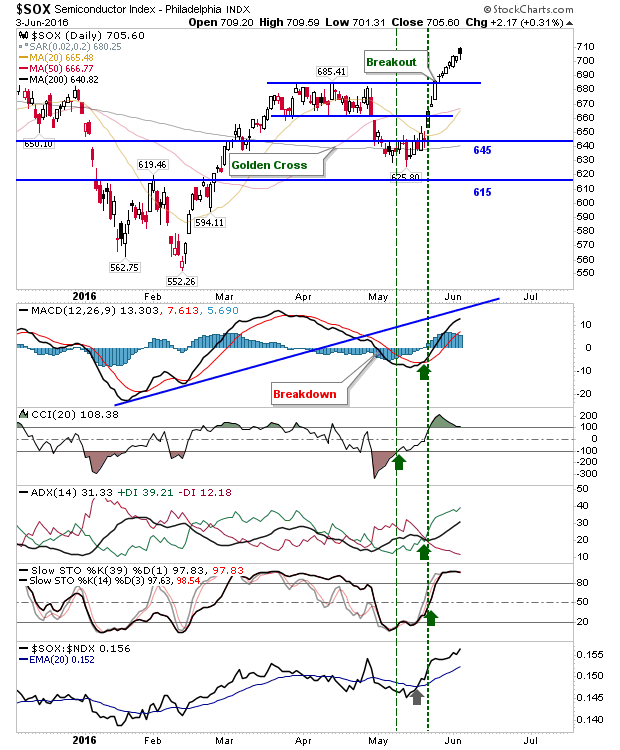

It was a low key Friday for markets which finished inished near Friday's highs, but the Semiconductor Index finished with a potential bearish 'black' candlestick (a lower close to open, but a higher close to the previous day). CCI for this index is ready to cut below the 200 marker.

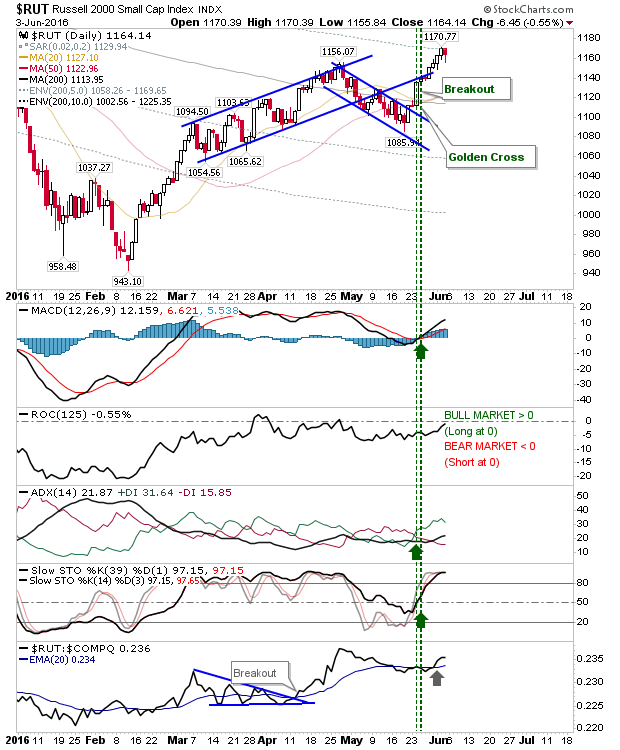

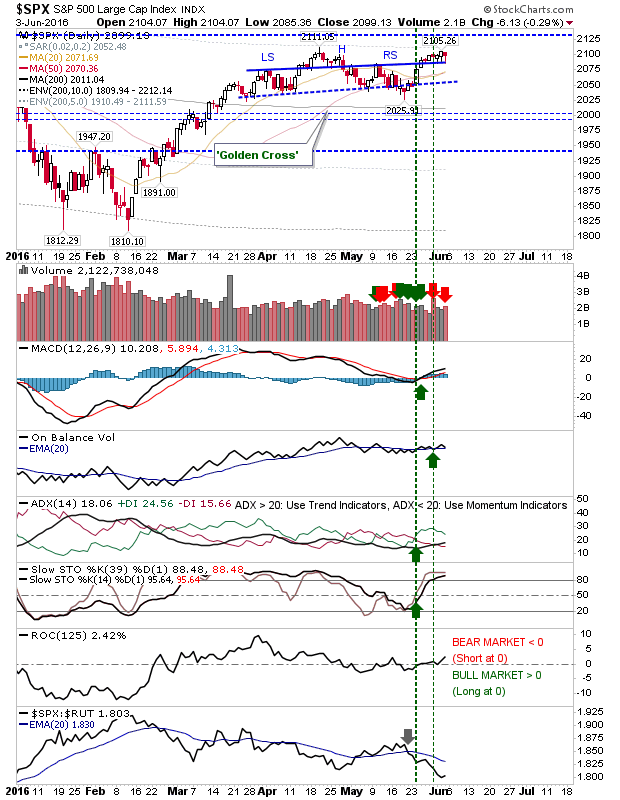

The Russell 2000 and S&P capped recent runs of gains, each with a bearish 'hammer'.

The S&P 500 registered a distribution day.

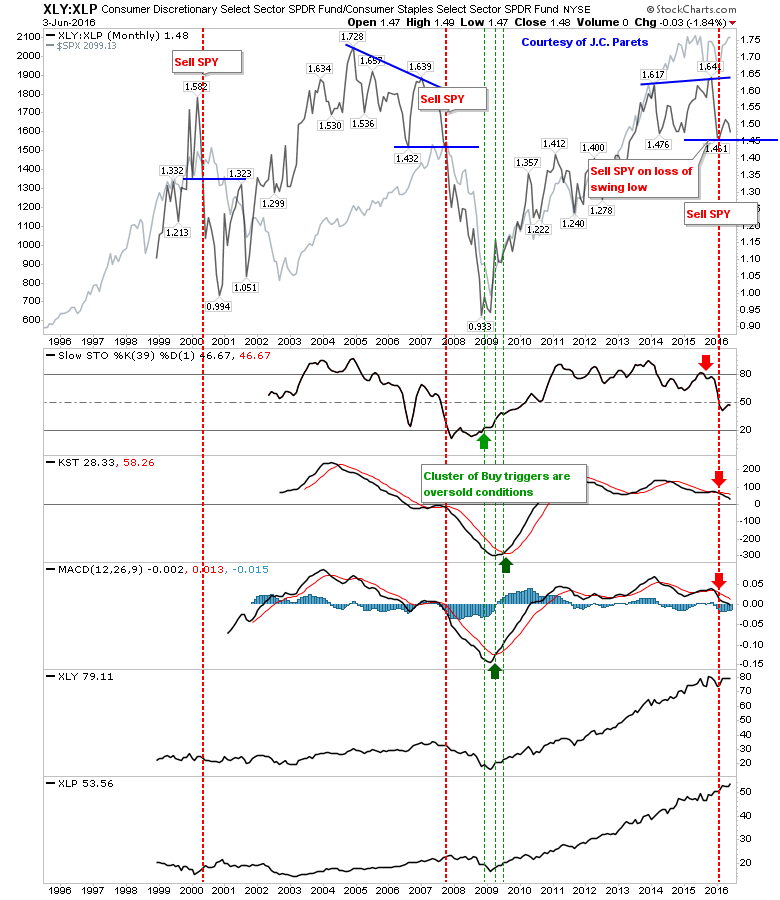

The relationship between Consumer Staples (via Consumer Staples Select Sector SPDR (NYSE:XLP)) and Discretionary (via Consumer Discretionary Select Sector SPDR (NYSE:XLY)) remains on the bear side with technicals all negative.

A loss of the swing low would confirm, but there is a considerable discrepancy in the relationship between the S&P and the Consumer ETF ratio.

Friday was a pause in consecutive days of buying, but the respectable finish keeps bulls in the driving seat. Look for further gains in the near term and a break of winter 2015 highs.