Top trade ideas for this week of January 5, 2015Intercontinental Exchange, (NYSE:ICE)

Intercontinental Exchange, ICE, has gone through a long pullback and reversal, creating a Cup, in 2014. The last 2 months may be the Handle to go along with it. This is a bullish pattern on a break of the Handle higher, but offers a downside trade as well on a new low under 215. The The RSI is holding in the bullish zone for now, but the MACD is running to the downside.

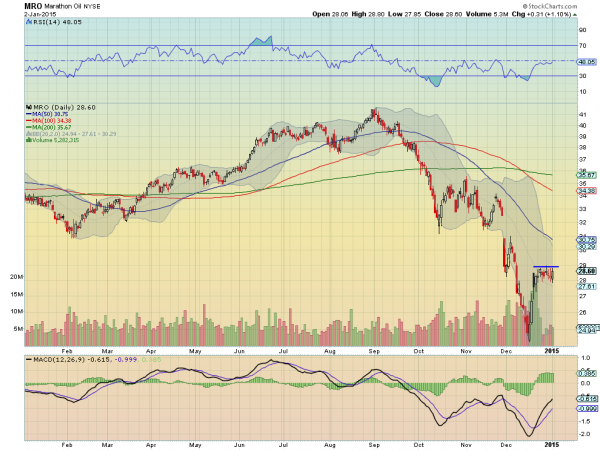

Marathon Oil, (NYSE:MRO)

Marathon Oil, MRO, was hit hard. like all Crude Oil names, before finding a bottom in mid-December. It is holding under resistance now with the 20 day SMA above and a gap to fill above that. The RSI is pushing against the mid line and the MACD is rising.

ON Semiconductors, (NASDAQ:ONNN)

ON Semiconductors, ONNN, is trading at 3 and a half year highs as it consolidates. A break higher could look to the 2011 highs and beyond. The RSI is strong and bullish while the MACD is leveling as the price churns. Watch the Golden Cross form as a possible catalyst.

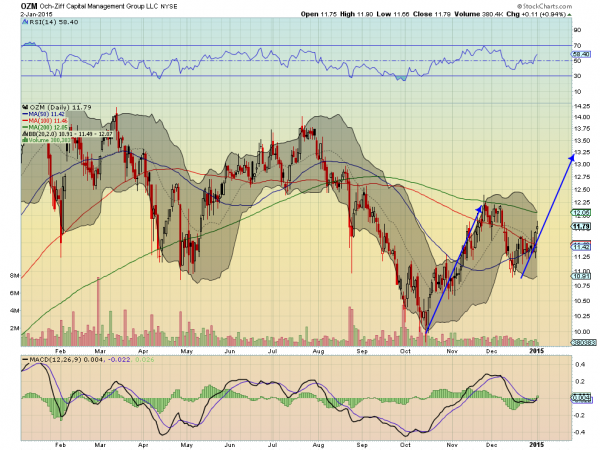

Och-Ziff Capital, (NYSE:OZM)

Och-Ziff Capital, OZM, bounced off of the October low and ran up to its 200 day SMA. It took a small pullback from there before reversing higher. The Measured Move targets 13.25 and has support from a rising and bullish RSI and a MACD crossing up.

Vertex Pharmaceuticals, (NASDAQ:VRTX)

Vertex Pharmaceuticals, VRTX, had been moving higher since August until it started to consolidate in a range in November. It is now peeking above the top of that range. A continuation has no resistance higher. The RSI is bullish and rising and the MACD is crossed up ( a buy signal) and running higher as well.

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed last Friday which, heading into the first full week of 2015 week, sees the equity index ETF’s looking as though they may continue to the downside.

Elsewhere look for gold to continue in its tight range while oil continues lower. The dollar looks strong and should continue higher while US Treasuries are biased higher, and on the edge of a breakout. The Shanghai Composite continues to look strong but very overbought while Emerging Markets are weak and biased to the downside. Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s: SPY, IWM, and QQQ, despite the moves lower this week.

Their charts show a downside bias with the QQQ leading the way and the IWM the strongest, possibly confirming a rotation from one to the other. The possible reversal candles seen Friday could always kick in and the indexes might move higher though.

Disclaimer:The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.