Here are the Rest of the Top 10:

Alexion Pharmaceuticals Inc (NASDAQ:ALXN)

Alexion Pharmaceuticals, is heading toward support and the rising 50 day SMA. As it gets there this time the RSI has lost the mid line and is falling while the MACD is running down, both supporting more downside price action.

Express Scripts (NASDAQ:ESRX)

Express Scripts, broke the rising trend support Friday and is approaching horizontal support with a gap to fill below. The RSI is falling, but has worked off a technically overbought condition while the MACD crossed down and is moving lower supporting more downside price action.

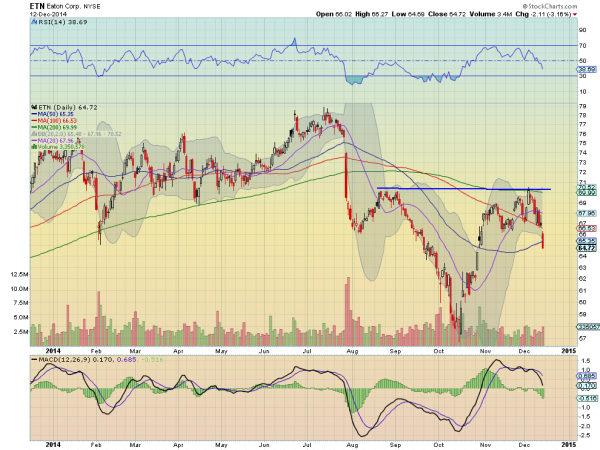

Eaton (NYSE:ETN)

Eaton rejected at resistance and Friday broke the consolidation range to a new lower low with a near bearish Marubozu candle. The RSI is into the bearish zone while the MACD is running lower, both supporting more downside price action.

3M Company (NYSE:MMM)

3M moved higher out of an expanding wedge in October and stalled at the target higher right around 163. After what could be consolidation it broke support Friday to a lower low. The RSI is cracking below the mid line and the MACD is running lower. These support more downside.

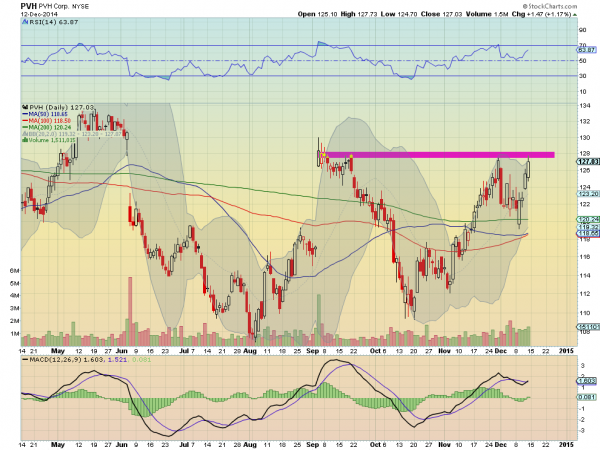

PVH Corp (NYSE:PVH)

PVH is approaching a resistance zone from a higher low as it bounced off of the 200 day SMA last week. The RSI held in the bullish zone and is turning back higher while the MACD just crossed up, both supporting more upward price action.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which, heading into the last full week of the year sees the equity markets showing weakness. Elsewhere look for Gold to continue its short term uptrend while Crude Oil continues the trend lower, but with perhaps a short term bounce. The US Dollar Index looks to move sideways in the uptrend while US Treasuries are biased higher. The Shanghai Composite is finally consolidating its strong move in the uptrend while Emerging Markets look to continue their fall lower. Volatility looks to remain slightly elevated in the low zone keeping the short term bias lower for the equity index ETF’s SPY, iShares Russell 2000 Index (ARCA:IWM) and QQQ. The S&P 500 and QQQ (NASDAQ:QQQ)look weakest and have room to pullback more while the IWM is consolidating but at the bottom of the range, so also vulnerable. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.