State Street Corporation (NYSE:STT) has custody of over $1 trillion of assets, yet they have been in the news lately for a statue of a little girl. The Fearless Girl statute was a marketing piece for a new ETF that State Street’s investment management arm, SSGA, created. They have a lot of experience in ETF’s. They created the first one, the SPDR S&P 500 (NYSE:SPY), over 24 years ago. These two businesses, custody and asset management, drive their company.

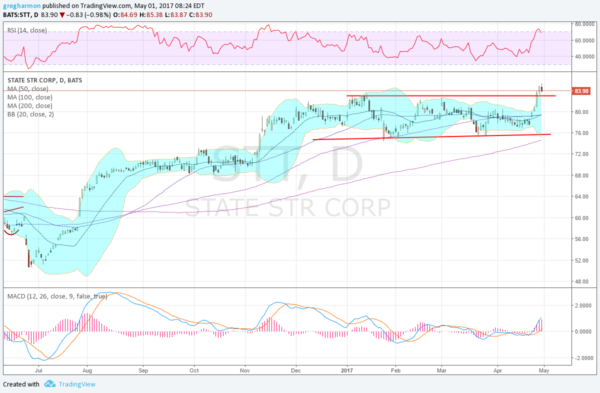

The stock price has had a less interesting news cycle over the last year though. It rose with the banks from July into a consolidation that began in September. That ran through the election when it jumped higher. But since that 2-day move up after the election it has churned sideways for nearly 6 months. That may have changed late last week. That is when the stock price broke above the channel.

This took it out of the Bollinger Bands® and it pulled back toward them Friday. The Bollinger® Bands have widened to allow a move, and the RSI is bullish. In fact it touched into overbought territory and is stalling. The MACD is rising. This is a bullish set up. The broader move into the long channel suggests a Measured Move to the upside to 90 at first and then to 110. Often a break out retests the break area before moving up and this may be happening with State Street.

There is no resistance above 85.38 and support lower comes at 83 and 80.60 followed by 77.50 and 75.50. Short interest is low at 1.1%. The company pays a 1.8% dividend but with the stock last going ex-dividend on March 30 it will not pay another until the end of June. The company is expected to report earnings July 26th.

The options chain for May show highest open interest at the 85 strike calls. This could draw the price higher. June options are lighter but have the biggest open interest at the 87.50 call strike. July is similar to June with open interest biggest at 87.50. The August options, the first after the next earnings report, are still building open interest and too light for a tell.

- Trade Idea 1: Buy the stock now (over 83) with a stop at 82.50.

- Trade Idea 2: Buy the stock now (over 83) with a May 82.5/80 Put Spread (75 cents) as protection. Sell the June 87.5 Call (85 cents) to pay for the hedge.

- Trade Idea 3: Buy the June 80/87.5 bullish Risk Reversal (18 cents).

- Trade Idea 4: Buy the June/July 87.5 Call Calendar (93 cents) and sell the June 80 Put (87 cents).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad market macro picture reviewed Friday, which heading into May, sees the equity markets making and testing highs again, but in a mixed fashion with strength shifting to the SPY (NYSE:SPY) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) and away from the iShares Russell 2000 (NYSE:IWM).

Elsewhere, look for gold to continue the pullback in its uptrend while crude oil consolidates deciding if it is a bottom or just a pause. The US Dollar Index continues to move lower while US Treasuries are biased lower in consolidation. The Shanghai Composite seems to have found support and Emerging Markets are biased to continue higher.

Volatility is back at abnormally low levels and looks to remain very low going forward, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show strength in the SPY and QQQ in the short term but the IWM rolling over. On the longer timeframe it is similar with the QQQ leading and the SPY turning up, but the IWM stalling at resistance. Use this information as you prepare for the coming week and trad’em well.