With no vaccine available yet, governments around the world are struggling to put a check on the spread of deadly COVID-19. China remains by far the worst hit, with the death toll surpassing 3,000. Death toll in the United States rose to 11 after California announced its first coronavirus-linked death yesterday. The first known case of human-to-animal transmission came out yesterday when Hong Kong confirmed the infection in a pet dog.

The rapid spread of the virus has sparked fears of a global pandemic that could adversely impact global and U.S. economic growth. Investors continue to be extremely concerned as the outbreak spread from Central China to more than 78 countries as of Wednesday.

We saw strong reactions from global financial markets last week with major indexes losing drastically due to huge sell-off and recording their worst performance since 2008 financial crisis. While the U.S. economy remains strong, the growing uncertainty is raising the risk of a recession.

The Fed Reacts With an Emergency Rate Cut

Central banks worldwide, including the U.S. Federal Reserve, have lowered interest rates in an effort to curb the impact of Covid-19 on a global economy.

The Federal Reserve on Tuesday slashed interest rates in an emergency response to the growing concern. The cut, which amounts to 50 basis points, lowered the current target range to between 1% and 1.25%.

The Fed considers this move a strategic fit to support achieving “its maximum employment and price stability goals”. It was under tremendous pressure from financial markets after U.S. stocks went down drastically last week.

Major Indices Rebound Sharply

The market reacted positively to the monetary stimulus with major indices coming back sharply after Tuesday’s slump.

While the Dow Jones Industrial Average rallied 4.53%, during the Wednesday session, the S&P 500 and Nasdaq Composite appreciated 4.22% and 3.85%, respectively. The Russell 2000 gained 3.04%.

Investors have been flocking to safe-haven assets of late. The bond market also witnessed pressure, which resulted in the yield on the U.S. 10-year Treasury to sink below 1% on Wednesday.

With sustained fears of the outbreak becoming a pandemic, we expect the topsy-turvy ride of equities to continue.

Why Shouldn’t You Hold Back?

This mounting uncertainty might force investors to remain on the sidelines but they shouldn’t avoid equities altogether.

Domestic-focused Utilities are a good option now as their products are in constant demand irrespective of market volatility. Utilities are believed to be defensive stocks as not many people will be willing to live without electricity, gas and water.

Moreover, rate cuts help utilities to get funds from the market at a cheaper rate and boost their infrastructure strengthening initiatives. The demand for utility services does not fluctuate too much even in weak economic conditions.

REITs stand to benefit from the emergency rate cut as well. Their dependence on debt for business keeps investors positive about their performance, thanks to lower borrowing costs. REITs are often treated as bond substitutes for their high-dividend paying nature.

To ensure that your investments are safe, we have picked up some solid dividend paying Utilities and REITS for you. Dividend stocks pay out healthy yields, have strong prospects and are less vulnerable to market uncertainties. Dividend payers usually have sustainable business models with large customer base and long track record of profitability. They offer sizable yields on a regular basis, regardless of market direction.

Here’re the Utility Picks

Algonquin Power & Utilities Corp. (TSX:AQN) is a renewable energy and regulated utility conglomerate. It operates hydroelectric, wind, solar, and thermal facilities. The company currently has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has moved up 4.7% over the past 30 days. On top of that, its annualized dividend of 56 cents a share yields 3.5% right now.

Algonquin Power & Utilities Corp. Price, Consensus and EPS Surprise

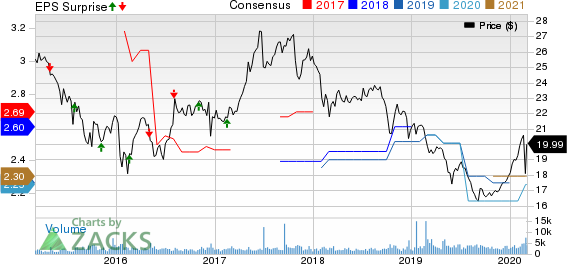

MDU Resources Group, Inc. (NYSE:MDU) is engaged in regulated energy delivery, and construction materials and services businesses in the United States. The company currently has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has risen 2.9% over the past 30 days. Its annualized dividend of 82 cents a share currently yields 2.9%.

MDU Resources Group, Inc. Price, Consensus and EPS Surprise

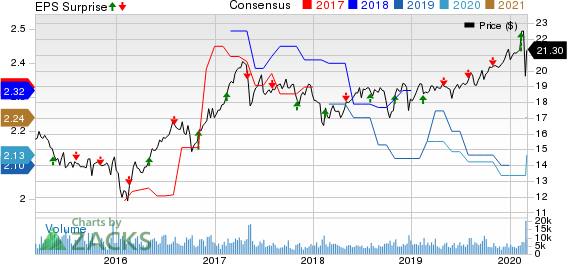

Spire Inc. (NYSE:SR) , a provider of natural gas to residential, commercial, industrial end-users carries a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has increased 2.6% over the past 30 days. It has a dividend yield of 2.7%.

Spire Inc. Price, Consensus and EPS Surprise

REIT Picks

ARMOUR Residential REIT, Inc. (NYSE:ARR) invests in residential mortgage backed securities in the United States. The company currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for its current-year earnings has risen 4.7% over the past 30 days. Its annualized dividend of $2.1 a share currently yields 10.5%.

ARMOUR Residential REIT, Inc. Price, Consensus and EPS Surprise

Innovative Industrial Properties, Inc. (NYSE:IIPR) engages inacquisition, ownership and management of specialized industrial properties leased to experienced, state-licensed operators for their regulated medical-use cannabis facilities. The company currently sports a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has risen 5.8% over the past 30 days. Its annualized dividend of $2.83 a share currently yields 2.9%.

Innovative Industrial Properties, Inc. Price, Consensus and EPS Surprise

Chimera Investment Corporation (NYSE:CIM) operates as a real estate investment trust in the United States. The company currently has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has increased 2.9% over the past 30 days. Its annualized dividend of $2 a share currently yields 9.4%.

Chimera Investment Corporation Price, Consensus and EPS Surprise

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

MDU Resources Group, Inc. (MDU): Free Stock Analysis Report

ARMOUR Residential REIT, Inc. (ARR): Free Stock Analysis Report

Spire Inc. (SR): Free Stock Analysis Report

Chimera Investment Corporation (CIM): Free Stock Analysis Report

Innovative Industrial Properties, Inc. (IIPR): Free Stock Analysis Report

Algonquin Power & Utilities Corp. (AQN): Free Stock Analysis Report

Original post