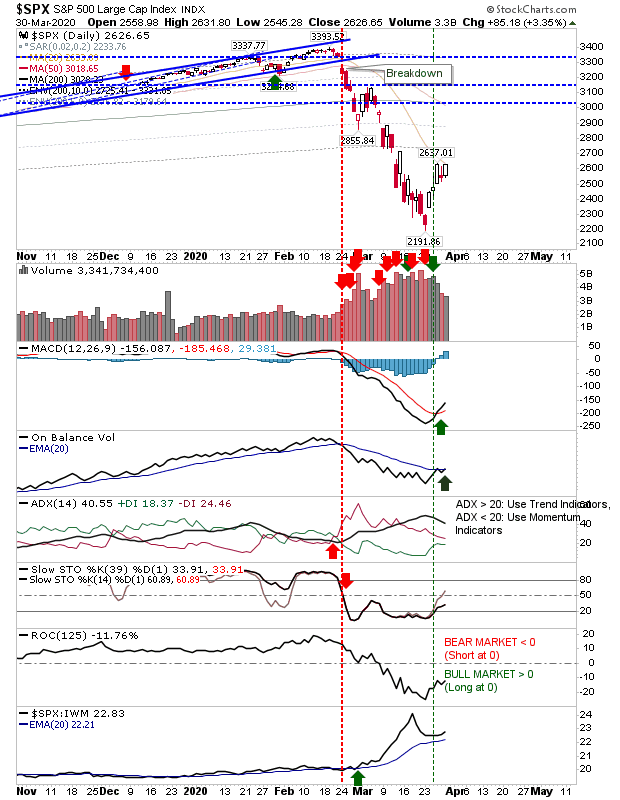

Friday's bearish doji had the natural look of a swing high for a bear bounce given the midline tag for stochastics and 20-day MA resistance—but this wasn't the case. In the end, Monday was another solid day of buying, bringing indices back to Thursday's highs. However, despite yesterday's gains, buying volume was light and technicals remain mixed.

For the S&P 500, despite the lighter volume there was enough volume to reverse the 'sell' trigger in On-Balance-Volume.

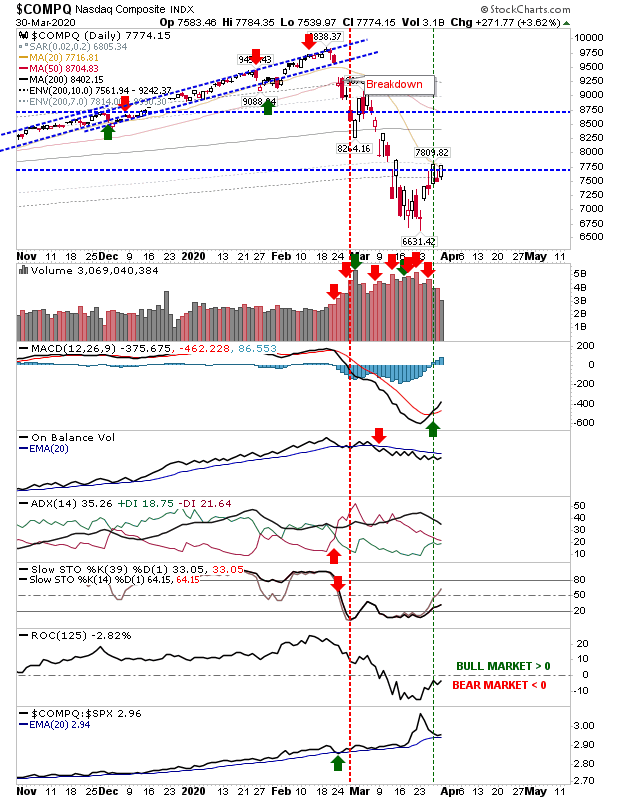

The NASDAQ likewise edged just beyond its 20-day MA with a continuous uptick in the MACD. On-Balance-Volume didn't improve much and other sectors are still bearish.

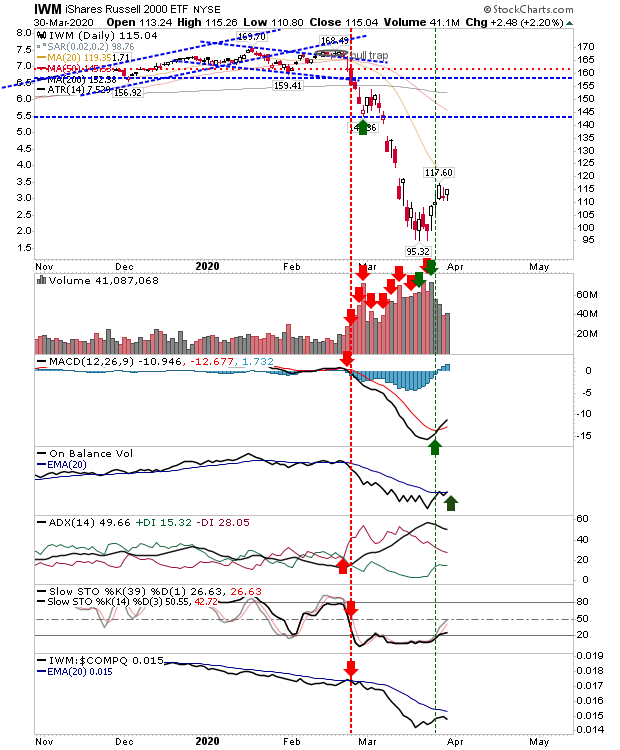

Small Caps (via iShares Russell 2000 ETF (NYSE:IWM)) have more ground to make up than other indices but like the S&P, it managed to see a return of an On-Balance-Volume 'buy' signal; so there are value hunters willing to buy into this hard sell-off. Where there was some loss was in relative performance against the NASDAQ.

Yesterday's gains, while positive, have put on hold the end point for this bounce. The bounce will offer others hope, and where there is hope there will be no end point low for this nascent bear market.