With the release of the Consumer Price Index (CPI) report yesterday showing an inflation increase of 5.4% compared to the expected 3.8%, we should pay close attention to investments that keep inflation in mind.

Though we have recently talked about food commodities and agricultural tech as potential hedges against inflation, precious metals such as gold (SPDR® Gold Shares (NYSE:GLD) and silver (iShares Silver Trust (NYSE:SLV)) remain the go-to investment.

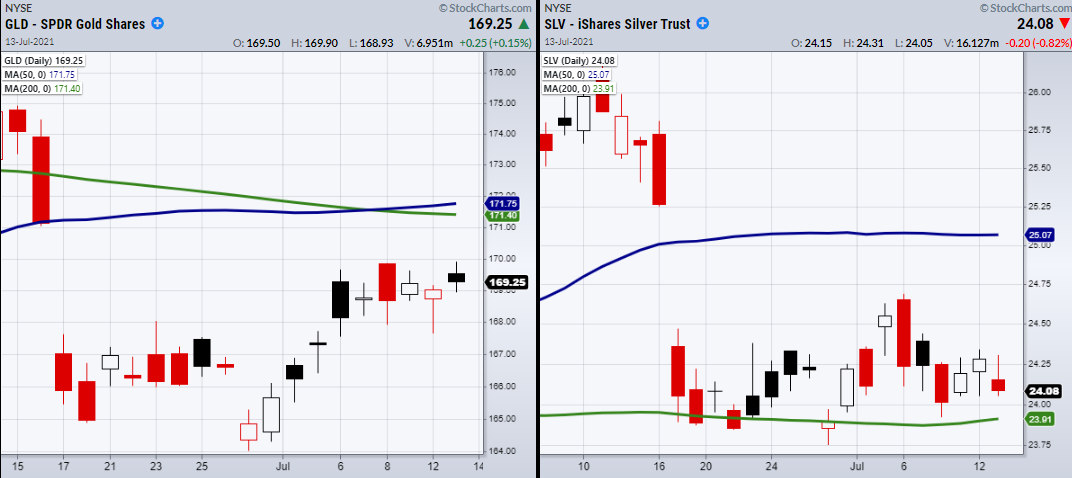

However, prices of gold and silver have yet to take off. Therefore, we can look for price action to confirm if precious metals are ready to push higher.

From a technical standpoint, gold (GLD) recently had a golden cross. This means the 50-Day moving average has crossed over the 200-DMA.

While this is a bullish sign, next we can watch for the price to clear the 200-DMA for 2 consecutive days around $171.40.

When watching for phase changes over or under major moving averages it helps to wait for a second day to confirm price action can hold. Although there is no perfect trading rule, waiting the second day greatly increases the chances the 3rd day will hold.

On the other hand, silver (SLV) has been trending sideways for roughly a month and needs to clear resistance at $24.70 created from its recent high on 7/06.

Silver’s 50 day moving average sits overhead at $25.07. Whether you initiate a position over the recent consolidation or wait a bit longer for a confirmed phase change, the point is that the metals have yet to reflect real inflation.

And their time could be coming real soon.

ETF Summary

S&P 500 (SPY) 427 support area.

Russell 2000 (IWM) Needs to clear highs at 234.50 area. Minor support 217.85

Dow (DIA) 351.09 high to clear.

NASDAQ (NASDAQ:QQQ) Doji Day. (Day where open price and closing price are close together.) Shows indecision.

KRE (Regional Banks) If cannot get over 63.63 today, next support area at 61.24.

SMH (Semiconductors) 245 main support area. 262.50 resistance.

IYT (Transportation) 251.78 support.

IBB (Biotechnology) 159 support area. 165.79 resistance.

XRT (Retail) 99.24 main resistance.

Junk Bonds (JNK) 109.57 support needs to hold.

XLU (Utilities) Holding over the 10-DMA with main support at 63.

SLV (Silver) Trading sideways. Resistance at 24.69.

VBK (Small Cap Growth ETF) 293 resistance. 280. Support.

TLT (iShares 20+ Year Treasuries) Next support area the 50-DMA at 141.

USD (Dollar) 91.40 support area. 93.44 resistance.

DBA (Agriculture) 17.54 support. Siting in resistance around 18.02

GLD (Gold Trust) Watching to fill gap at 171.03.

UNG (Natural Gas) 13.32 minor resistance area.

TAN (Solar Energy) Held over the 200-DMA at 88.06.

USO (US Oil Fund) 48.22 recent support.

XME (S&P Metals and Mining) 44.42 resistance level.