There has been little mystery to what has worked this year, with the Technology sector within the S&P 500 up over 30% on the year and large-cap growth returning in the low 20% range, YTD.

This year, not so unusually, was the exact opposite of last year, where the Russell 2000 was up 22% in 2016, and the NASDAQ rose just 6%-7%.

Trinity is lucky to receive JP Morgan research, and we use some JP Morgan Funds, and are big fans of Jamie Dimon and Dr. David Kelly, JPM’s Global Strategist.

Dr. Kelly wrote this article a few weeks back and it is was good perspective.

*

This week, we're starting a new kind of post for readers, where each sector will be looked at in terms of its longer run earnings and revenue growth rates, as well as the sector’s top holdings and some sector ETFs will be used for comparative purposes and for some investment ideas.

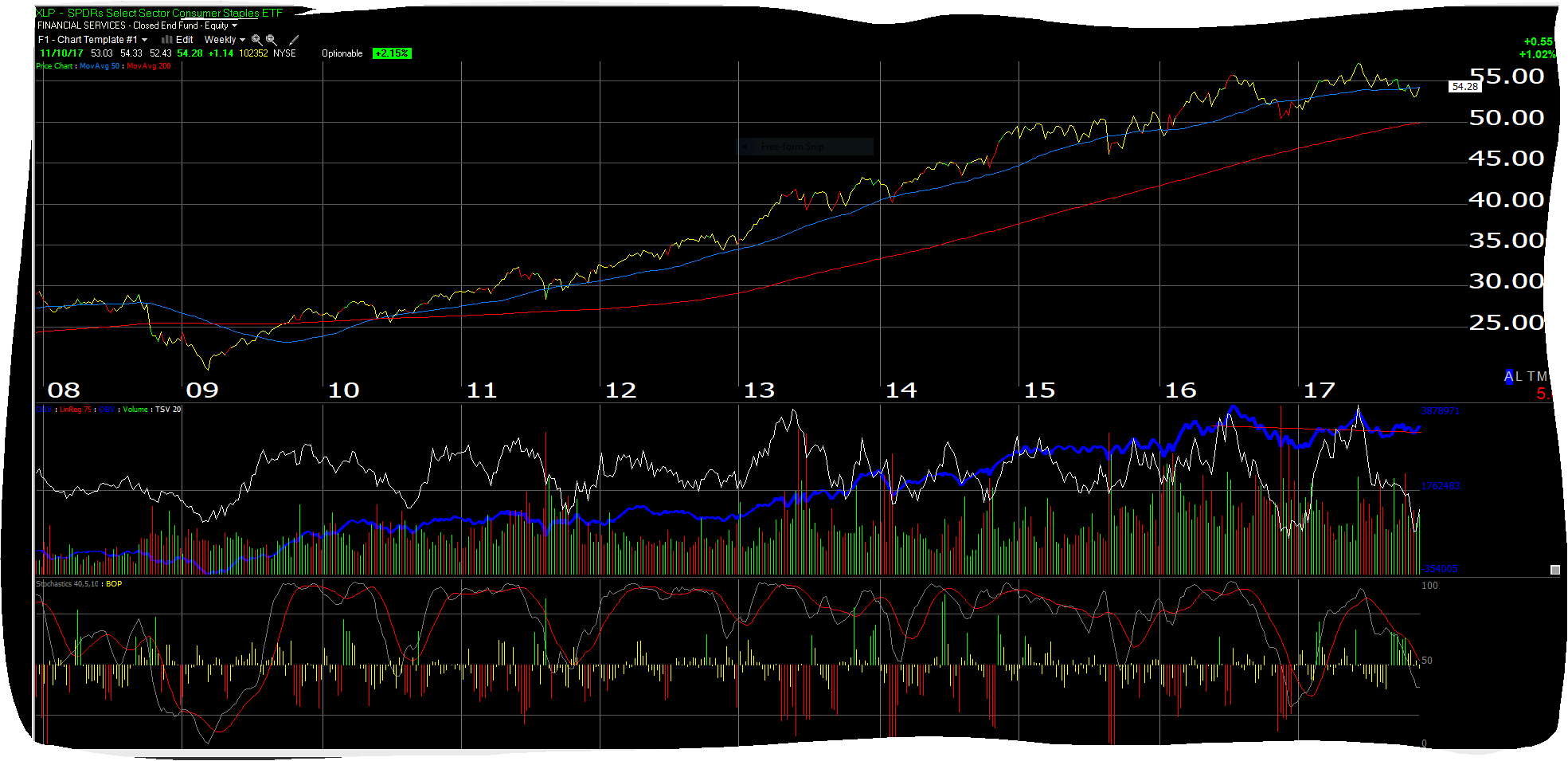

The Consumer Staples sector (via Consumer Staples Select Sector SPDR (NYSE:XLP)) will be the first shot at the analysis, since it’s a simple sector to analyze. Readers are welcome to chime in with your thoughts:

Looking quickly at the spreadsheet and the Consumer Staples earnings and revenue growth as a sector since 2012, readers can quickly see over the longer run, Staples gives investors 2%-2.5% revenue growth and 3%-5% earnings growth, which looks shabby relative to this year’s Technology sector earnings growth of 23% and revenue growth of 10%.

However, investors would have been happy to have Staples-like growth in periods like 2001-2002 and 2008-2009.

It is the stability and consistency of this sector’s earnings growth that should appeal to investors, particularly if rockier markets are expected.

What appeals to me about Staples today if you look at the XLP, is that a number of those stocks are being “disrupted” in the Darwinian or Schumpeterian nature that is the inevitable business cycle or business model disruption.

Nelson Peltz and Procter & Gamble (NYSE:PG) are expected to take $10 billion out of PG’s cost structure, Coke (NYSE:KO) has a new CEO, and Jim Quincey seems to be committed to reinvigorating growth at the beverage giant. What is scary is that – with the possible exception of tobacco – Amazon (NASDAQ:AMZN) could potentially lay waste to a number of those retailers, not tomorrow, but certainly over the next 10 years.

Conclusion: Consumer Staples is a great sector in which to play defense for clients. Coke is currently client’s largest Staples component, since the stock looks to be nearing a break of its 20-year trading range. The new CEO could be the catalyst.

Coke has an Investor Day this Thursday, November 16th, and with new CEO Jim Quincey being on the job for about 6 months now, and the re-franchising and divestiture of the bottling operations now complete, a “leaner, meaner” Coke should be able to leverage even slightly faster revenue growth, and case volume growth, and drive better returns for shareholders.

- Consumer Staples is anywhere between 7%-9% of the S&P 500 by market cap weight. Staples market cap weight within the S&P 500 has actually shrunk a little in 2017, which isn’t unusual when growth is robust.

- The sector generates 3%-5% earnings growth over the longer run, but its stability and consistency are key for investors.

- The S&P 500 will generate 10%-11% earnings growth in 2017, and expectations are for about the same level of earnings growth for the S&P 500 in 2018.

- The XLP is up 6.5% year to date as of November 10, 2017, versus the S&P 500’s 15%-16%.

- Looking at the last substantial correction for the S&P 500, from July 1, 2015, through February 29th, 2016, the XLP rose 10.6% while the S&P 500 fell 5.5%-6% for that time frame.

This is our first pass at this type of sector analysis, and it will likely take a few months to get through the 11 S&P 500 sectors and then update the sectors with different ETFs for comparison purposes for readers.

This will be an ongoing process to help fill in the periods when S&P 500 earnings seem to be discounted by the market and there is very little new to add.

A trade below $50 for the XLP on heavy volume would be readers' sell-stop.

Staples have their place in client portfolios. This year the sector would have been a drag on performance, but that won't always be the case.

Disclosure: Long AMZN, KO, XLP;JPM is clients' 2nd largest financial stock/ weight behind Schwab.