Investing.com’s stocks of the week

Over the last couple of weeks, Michael Lebowitz, CFA and I have been discussing the extremely low levels of the volatility index and the positions we have added to client portfolios as a hedge against a sudden reversion. (See here.)

Michael did some additional work this past week into the VIX’s current situation.

The complacency in the equity markets, as measured by implied volatility (VIX), is at levels rarely seen. On its own, this is not breaking news, but it is very strange when contrasted with the palpable concerns over the coming election and more general market risks such as weak economic growth, extreme valuations, a corporate earnings recession and various geopolitical worries. We ended the previous article asking investors to consider employing equity insurance, which looks cheap in the context of the risky environment.

The VIX is an equity volatility index that uses put-and-call option pricing to calculate an implied level of future volatility. After researching specific VIX insurance strategies, we noticed something that caught our attention and further strengthens the case for adding VIX exposure.

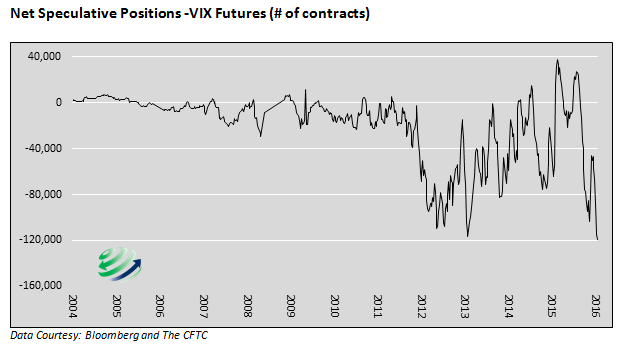

All futures and commodities exchanges release data on contract volumes and positioning. As you can see in the graph above, net speculative positions in the VIX futures contracts are at record levels of short exposure. In other words, speculators betting on a VIX decline outnumber those betting on an increase in volatility by the largest margin in at least twelve years. A normalization of this positioning could quickly occur -- and in a disorderly fashion due to the extreme positioning of speculative traders. If this were to happen, it would likely add to downside pressure on equity prices.

The current low level of implied volatility may be justified, and the political and economic environment that concern us may prove benign. However, given the potential for market-damaging events, the historically low price of insurance, the limited downside of the VIX and the massive net short VIX positions, we simply ask one question: What is the harm in acquiring some cheap insurance to protect against downside risk?

“Got Vix?”

Another Warning Sign

As stated above, I have been pointing out signs as of late that only tend to appear during late-stage economic expansions and generally precede the onset of a recession.

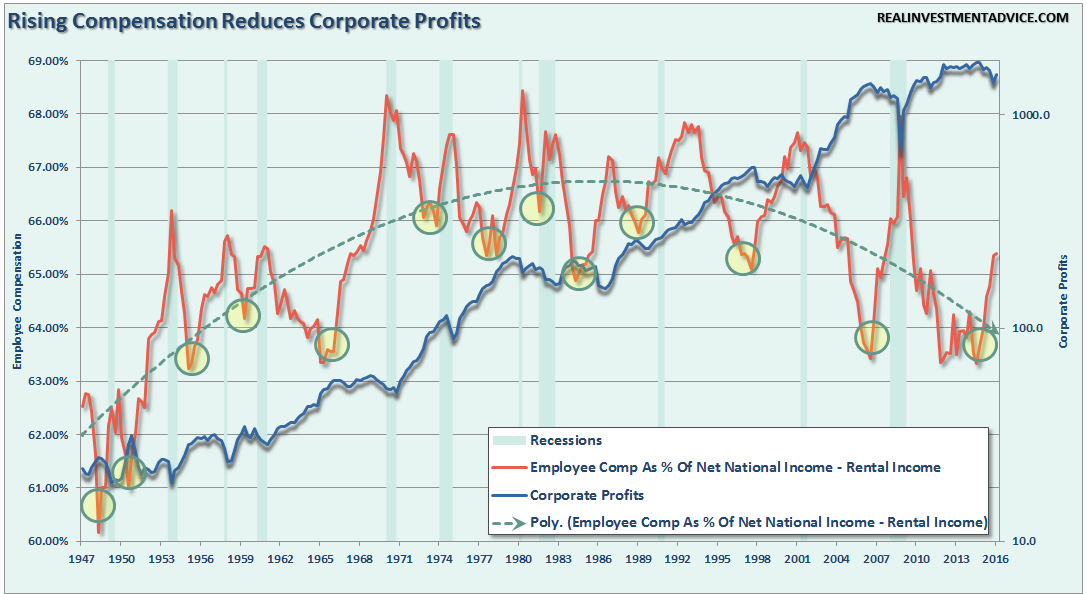

While there are many hopes of an end to the current “profits” recession, there is mounting evidence those hopes may once again be disappointed. One of the latest indications is rising employee compensation.

While rising employee compensation is good from the view that it should lead to rising consumption, it also reduces corporate profitability (wages reduce profits). Furthermore, this is especially problematic as rising compensation is being offset by soaring healthcare costs due to the Affordable Care Act.

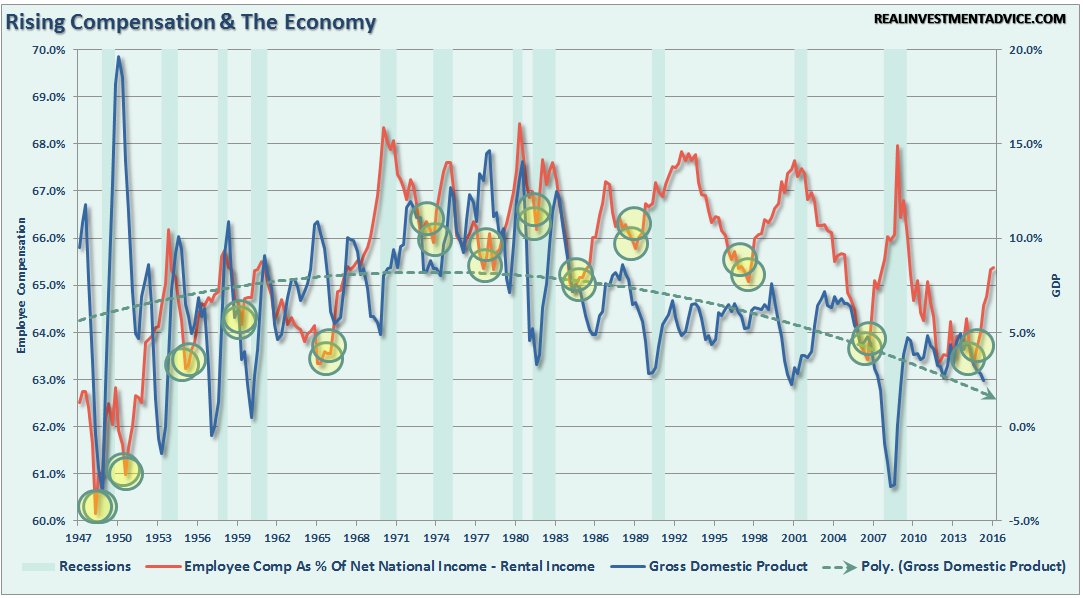

Like jobless claims, which hit historically low levels prior to recessions, rising employee compensation has also denoted turns in economic growth and has preceded the onset of recessionary economic drags.

It is worth noting that in both charts above, despite hopes of continued economic expansion, both employee compensation and economic growth have continued to trend lower since the 1980s. This declining growth trend has been compensated for by soaring levels of debt to sustain the current standard of living.

Of course, the question to ask is what happens when the “debt well” runs dry.