Wolf Richter penned a very interesting piece entitled: This Is When The Jobs “Recovery” Goes KABOOM:

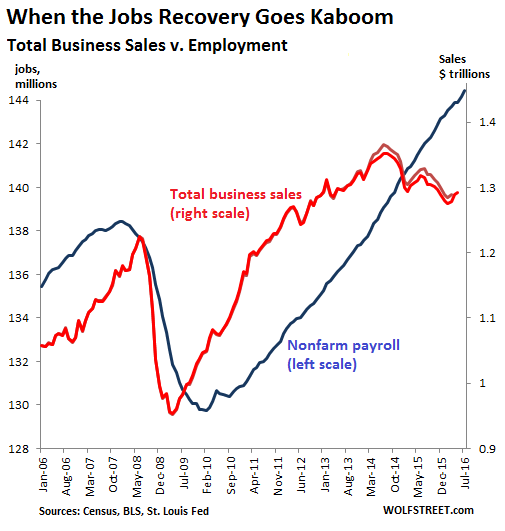

It will eventually impact the labor market. Here’s why: despite the hiring that companies have been doing, sales – the ultimate measure of “output” – have been heading south since mid-2014.

Total business sales, according to Census Bureau data, which include sales within the US by all companies, not just the largest in the S&P 500, peaked in July 2014 at $1.35 trillion. By May this year, the most recent data available, they’d dropped 4.4% to $1.29 trillion.

Despite sales cascading lower for a year-and-a-half, nonfarm employment from June 2014 through July 2016 has risen by 5.6 million jobs! And that’s what the productivity decline is also showing: the additional labor hours have been accompanied by a decline in sales!

The chart shows how jobs and total business sales are normally on the same wave length: When sales get hit, businesses cut their payrolls; when sales pick up, businesses hire. But since June 2014, a peculiar phenomenon has set in, with employment (blue line, left scale) rising and sales (red line, right scale) falling.

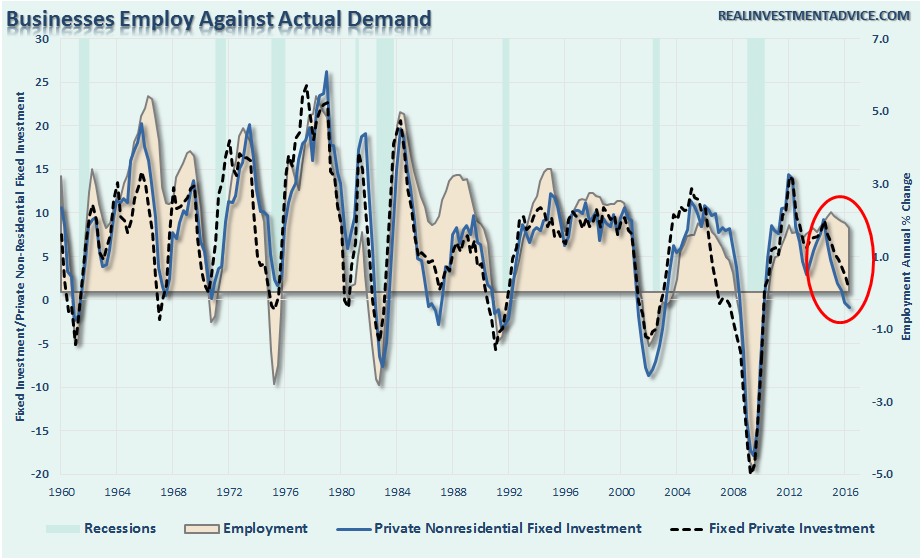

This also confirms my recent comments on business investment.

The +85k unadjusted number also confirms the trends of fixed and non-private residential investment. Businesses hire against the demand for their products and services. This is why, as shown in the chart below, the historical relationship between employment and fixed investment is extremely high….until now.

Business investment does not fall in isolation. Companies invest in buildings, property, plant, and equipment when consumer demand is strong and economic growth is strengthening. As investment is made to expand production, more employment is needed to meet that demand. The opposite occurs prior to recessionary onsets.

Currently, while the BEA continues to spew out record job numbers, due primarily to seasonal adjustments and other factors, a substantial number of business activity indicators are suggesting the data is being substantially overstated. Future negative revisions to the data should not be surprising.

If you step back and weave all of these points together from consumer credit, to employment to wages, savings and interest rates, the picture of rising recession risks clearly emerge.

With markets ignoring the data, the outcome for investors is likely not pretty.

As David Rosenberg stated just recently:

Okay, this really is one weird market.I am looking at the hedge fund proxy market positioning from the latest Commitments of Traders report from the Commodity Futures Trading Commission, and the results are startling. I’m quite sure I have not seen such levels of confidence on one hand, and cognitive dissonance on the other.