A recent BNN report indicated that the Bank of Canada is confused as to why Canadian exports aren't picking up:

Bank of Canada Governor Stephen Poloz called the persistent weakness in Canada’s non-energy exports “puzzling” in the central bank's latest assessment of the economy. And a former colleague of the central bank governor at Export Development Canada (EDC) is confused by the shortcoming in exports as well.

“We can attribute some of this. But a bunch of it we can’t,” Governor Stephen Poloz told reporters in the question and answer session that followed the Bank of Canada’s second rate cut of the year.

After crude oil and natural gas, Canada's largest exports to the U.S. include vehicles, machinery, and plastics.

Peter Hall, vice president and chief economist of Export Development Canada, says the lower loonie is only an effective stimulant to the export economy when it coincides with a groundswell of demand from our neighbours to the south. The problem, he explains, is that groundswell hasn’t materialized despite a bevy of strong U.S. economic indicators.

“They’ve got job growth. They’ve got real income growth. They’re confident again. They’ve reorganized their debts, and they have lower gas pump prices that are giving them $100 billion extra to spend. Put that all together. They should be spending. What are they doing? They’re saving at the moment. They’re as nervous as everybody else about the wiggles in the economy after six years of flat performance,” said Hall, who worked alongside Poloz at EDC for nine years.

Here is the reasoning. The Canadian economy is reasonably well diversified between the resource producing regions and the industrial heartland. When commodity prices boom, the resource provinces benefit and the CAD/USD exchange rate rises. When they retreat, the exchange rate falls, which makes the manufacturing centres more competitive, which raises exports to Canada’s largest trading partner, the United States.

This time, the BoC is puzzled as to why manufacturing exports aren't rising. In a separate report, the Globe and Mail quotes BoC governor Stephen Poloz as being puzzled:

Canada’s non-resource exports have “faltered” of late and remain “a puzzle that merits further study,” according to central bank Governor Stephen Poloz. One thing is clear, however: Canada’s share of U.S. goods imports has eroded over the past four decades. “Notably, the U.S. now imports roughly equal dollar amounts of goods from Mexico and Canada, versus 10 years ago when they brought in $1.70 (U.S.) from Canada for every $1 from Mexico,” Robert Kavcic, senior economist at BMO Nesbitt Burns, said in a note.

Canadian market share of US imports

Faltering competitiveness

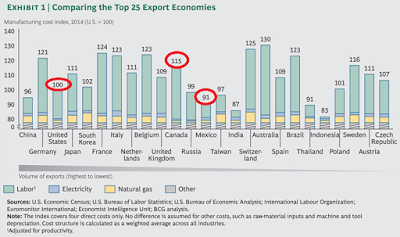

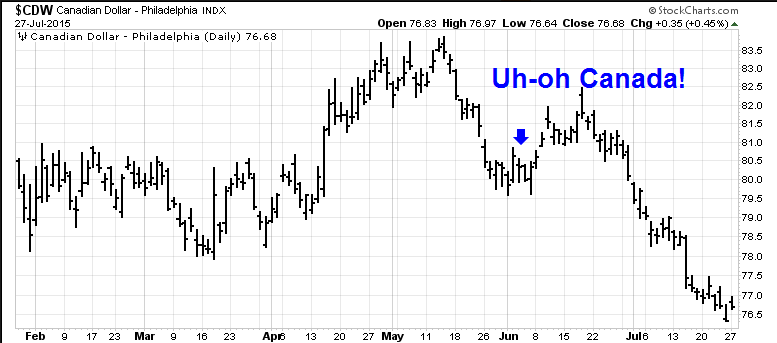

I addressed this issue in a post in early June (see Uh-oh Canada!). The competitiveness of Canadian manufacturing has markedly deteriorated between 2004 and 2014. A BCG study showed that the cost structure of Canadian manufacturing is behind that of its NAFTA partners, the US and Mexico. The Canadian dollar, or loonie, would have to fall to between 0.72 and 0.78 before it starts to become competitive with these other countries.

Since I wrote that blog post, CADUSD has fallen to below 0.78.

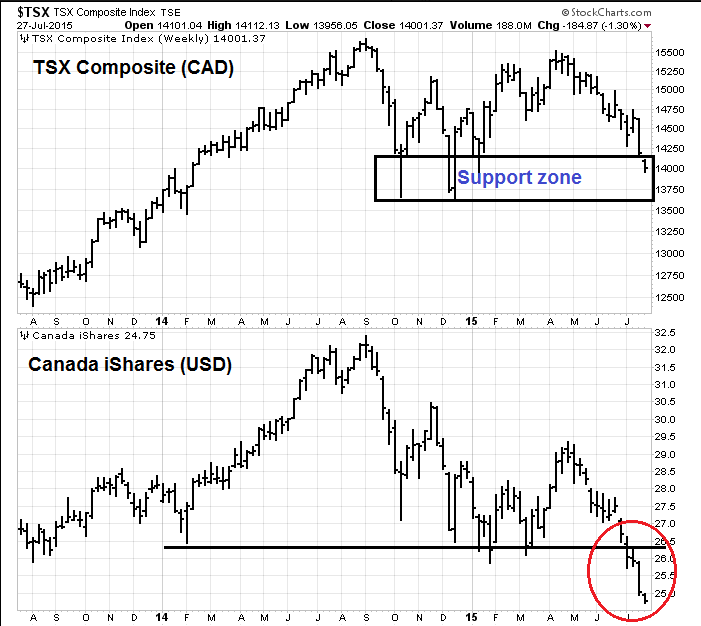

Canadian equities have fallen as well. The chart below depicts the S&P/TSX Composite (priced in CAD) in the top panel and the iShares MSCI Canada ETF (NYSE:EWC, priced in USD). The TSX is holding at a key support zone, but a look at the USD denominated ETF shows that it has violated support.

So, what now? Should you buy Canada?

Hollowed out manufacturing

If the question is whether you should buy the Canadian equity market, the answer is an emphatic no. In the past, the manufacturing heartland of Ontario and Quebec were populated by lots of manufacturers that would benefit from a falling exchange rate. So I took a look at the components of the TSX Composite to see what non-resource exporting companies might benefit from a falling loonie (note that this is only a list and does not constitute a recommendation to buy any of these stocks): What I came up with is a rather sad list:

- Amaya Gaming Group (Amaya Inc (TO:AYA)

- Avigilon Corp (TO:AVO)

- Bombardier Inc (TO:BBDb)

- BRP Inc (TO:DOO)

- Descarte Systems Group (TO:DSG)

- Enghouse Systems Ltd (TO:ESL)

- Gildan Activewear (TO:GIL)

- Intertain Group (TO:IT)

- Intertape Polymer Group (TO:ITP)

- Magna International (TO:MG)

- Martinrea International (TO:MRE)

- Open Text Company (TO:OTC)

I may have left out one or two, but this is an extremely small list and some of those stocks are not very liquid. The two large caps on that list are Bombardier (aircraft manufacturing) and Magna (auto parts). The rest are mainly software service providers with a global customer base. Is that all that’s left of Canadian manufacturing?

I deliberately left out companies that are unlikely to significantly benefit from a falling loonie because their costs are not in Canadian dollars, such as Thomson Reuters, whose operations are not really located in Canada, Restaurant Brands International, which operates Burger King and Tim Hortons, and Lululemon, which produces its products mainly in Asia.

The remainder of the TSX Composite are resource companies (energy and mining), REITs and financials and consumer products and retailers serving the Canadian market. Both of the latter are vulnerable should the Canadian economy roll over into recession as it seems to be doing,

Given current macro conditions, why on earth would anyone want to buy Canadian equities?

As for the loonie, I have estimated the equilibrium rate at between 0.72 and 0.78. However, we know that markets overshoot equilibrium. I would therefore be not surprised to see the loonie trade at 0.65 or even lower before the current adjustment period is over.

Even though I live here, my inner investor continues to prefer US over Canadian assets as much as possible.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.