I don't write much about Canada but I have been watching this trend for quite some time. This analysis from BMO came across my desk (via Sober Look):

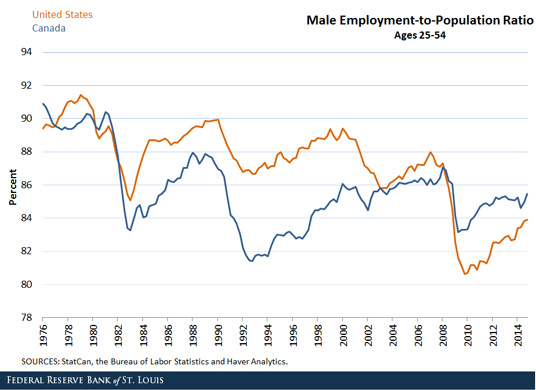

While some top-down macro analysts might dismiss the spread in job growth due to the cratering oil price, the divergence began in late 2013/early 2014, when oil prices were still relatively robust. This picture of falling labor demand is even more disturbing in light of analysis from David Andolfatto of the St. Louis Fed, who showed that Canadian labor participation rates are well above the US for the current economic cycle.

So what we have is a picture of slower labor demand (BMO analysis, first chart) and higher than usual labor supply (St. Louis Fed analysis).

Declining competitiveness

Despite what non-Canadians macro analysts think, Canada is not just one big oil producer. In past cycles, falling commodity prices would see the economies of the resource-rich West recede while the manufacturing base in Ontario and Quebec boom. Unfortunately, Canada may not see the same kind of offsetting rise in manufacturing employment as it had in past cycles.

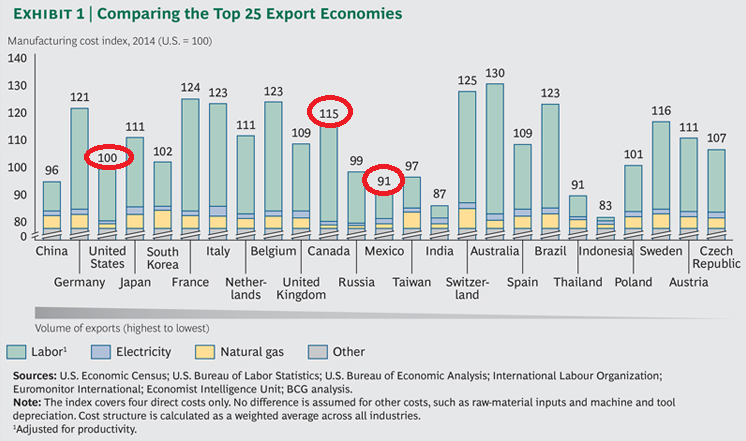

A 2014 Boston Consulting Group (BCG) study showed the manufacturing competitiveness of major exporting countries around the world. Canadian costs are higher than its NAFTA partners, the US and Mexico. In the past, where American manufacturing might have looked at locating plants in Central Canada because of its proximity to markets, educated labor force and costs, either staying home in America or moving to Mexico is a more compelling choice today.

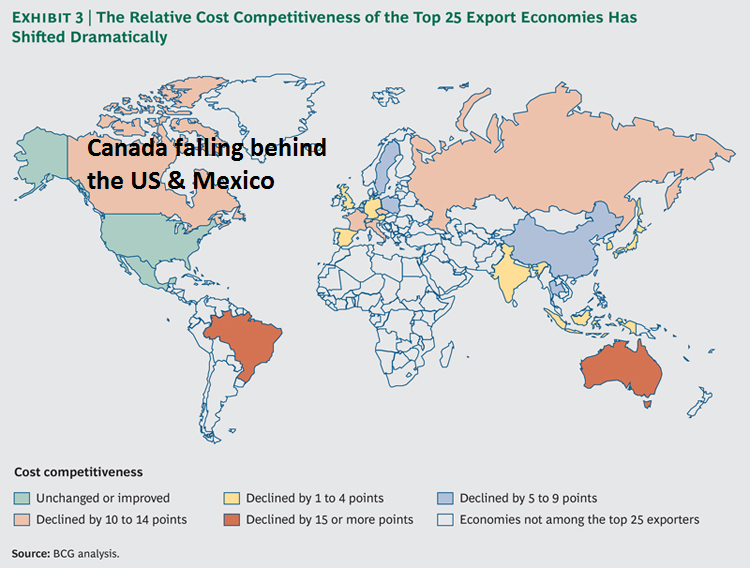

The BCG study also showed how manufacturing costs have shifted between 2004 and 2014. While American and Mexican manufacturing competitiveness has stayed the same or improved, Canadian competitiveness has declined.

Loonie bearish

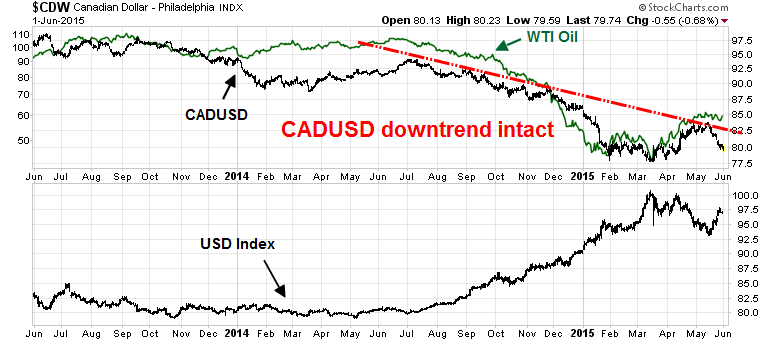

The bottom line is that all these long-term developments are bearish for the Canadian dollar, otherwise known as the loonie. The chart below depicts the CADUSD exchange rate (top panel, black), the WTI oil price (top panel, green) and the USD Index (bottom panel). While the loonie is thought of as a petro-currency and therefore highly correlated to oil prices, oil prices have stabilized recently while the loonie has fallen, possibly because of these differences in competitiveness.

There are several reasons to continue to be bearish on CADUSD:

- The Fed and BoC have divergent monetary policies, which are supportive of further USD strength and CAD weakness.

- Technically, the CADUSD remains in a downtrend and therefore the momentum trade is for further loonie weakness.

- The BCG analysis implies an equilibrium exchange rate of 0.72 to 0.78. The BCG study showed a Canadian cost of 115, compared to 100 for the USD and 91 for Mexico. That study was done when the CADUSD exchange rate was about 0.90. If all of the adjustment were to made through the exchange rate mechanism, CADUSD would have to fall to 0.78 to be competitive with American manufacturing and would have to fall to 0.72 to be competitive with Mexican manufacturing.

I have moved a fair amount of my liquid cash from CAD into USD in anticipation of a much lower loonie over the next few years. Given the propensity for markets to overshoot, I wouldn't be totally surprised to see the exchange rate trade with a 6-handle before it finally bottoms.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.