The world market’s attention is shifting from fear of the unknown to an attempt to evaluate the cost and try to look forward. The daily new cases looks more and more stable, allowing hope that there will be no further restrictions. The next stage is to assess the impact of quarantine on the economy and timing how long the damage will persist. This turns markets to China as it leads the coronavirus curve for a month or two before the EU and US.

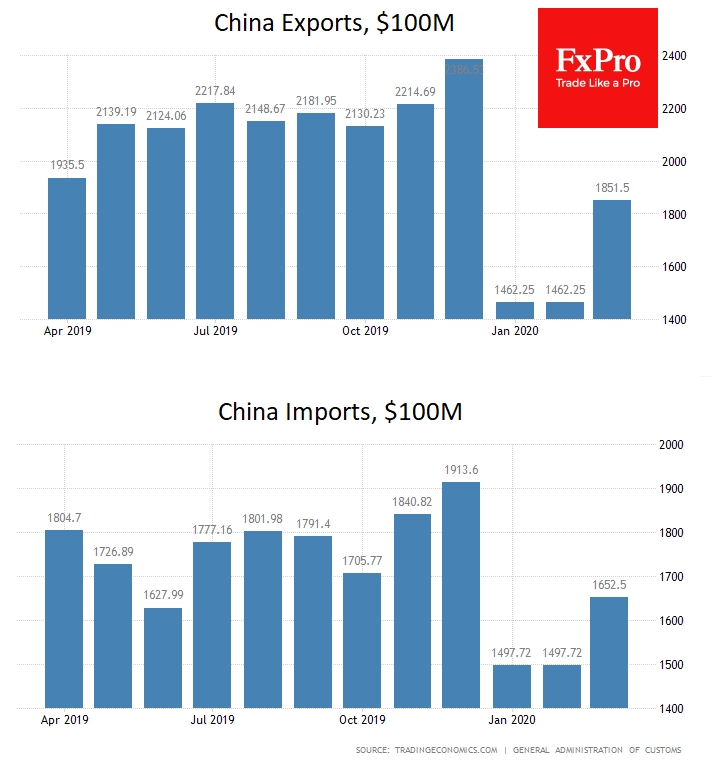

China’s foreign trade data, published earlier today, gave market participants a breath of relief. Exports from China fell by 6.6% YoY in March, well below the expected collapse of 14%. Imports declined by 0.9% YoY, sharply better than expected collapse by 9.5%.

The sharp improvement was further evidence of a V-shaped recovery after the February collapse and confirmed the trends outlined in PMI surveys. It seems that China’s growth rate has almost fully recovered. A return to gross economic performance on the pre-crisis trajectory is unlikely in the foreseeable future. However, the ability of businesses to get back to work is in itself, an important signal.

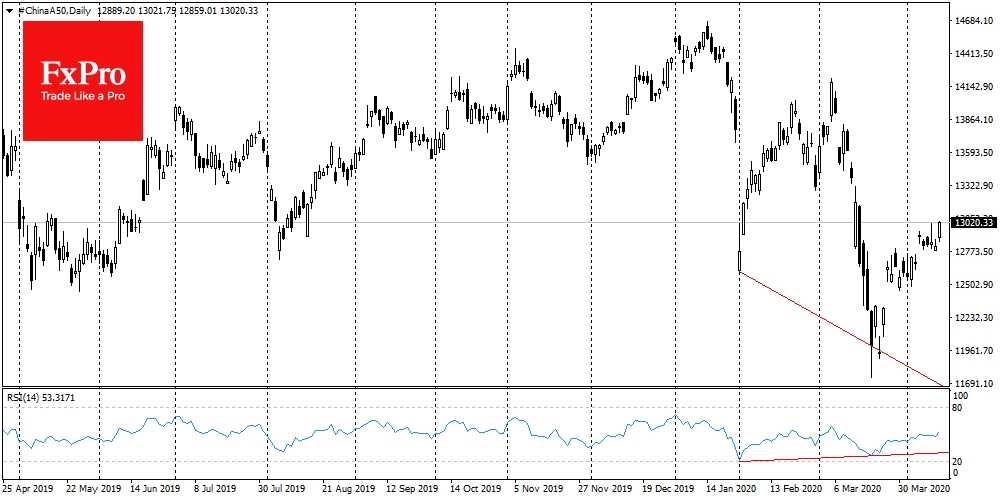

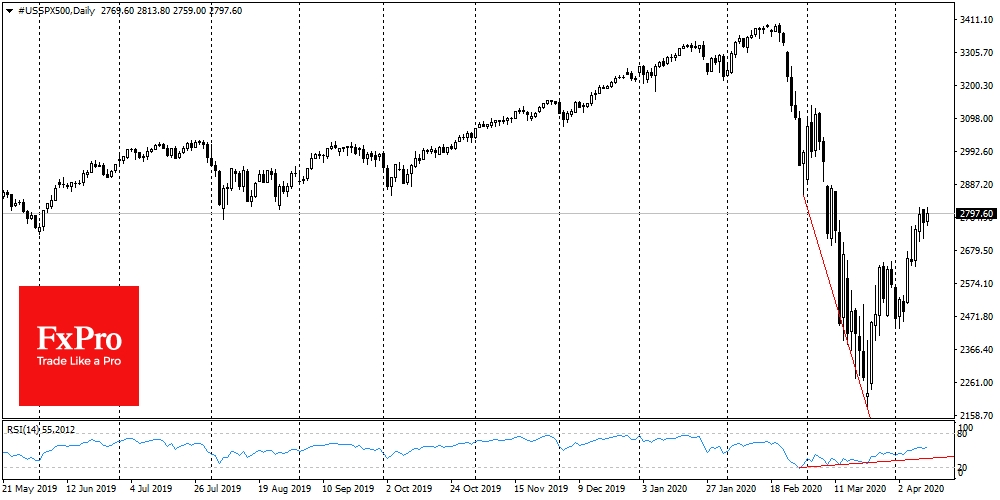

The published data caused growth in Chinese markets, raising China A50 to monthly highs. Japan’s Nikkei 225 has also been at its highest level since March 11, as well as futures on the S&P 500

However, China’s experience may prove to be far from an accurate forecast for the rest of the world. Many countries in Europe have been wholly quarantined, while it was just some regions in China. In light of this, it is reasonable for EU officials to expect that the region’s economy will suffer the most from quarantine compared to others.

It is also worth watching out for the British and US service sectors. They account for about 75% of the GDP there, and expected to get the hardest hit because of the pandemic. The open question is, will they recover so quickly? The markets may start getting their first estimates this week, along with the data and early quarterly reports and company forecasts.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Time To Assess The Damage

Published 04/14/2020, 04:56 AM

Time To Assess The Damage

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.