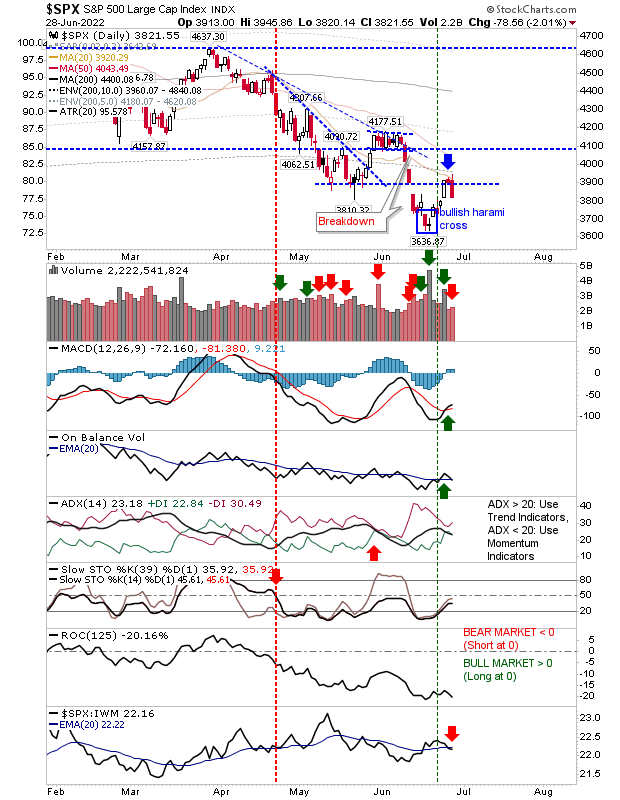

Yesterday's selling has started the retest of the June lows for the NASDAQ and Russell 2000 as the S&P gets rebuffed by its May low. One point of concern is that none of the indices were able to mark a new swing high. Nascent bullish technicals are also looking vulnerable to reversal.

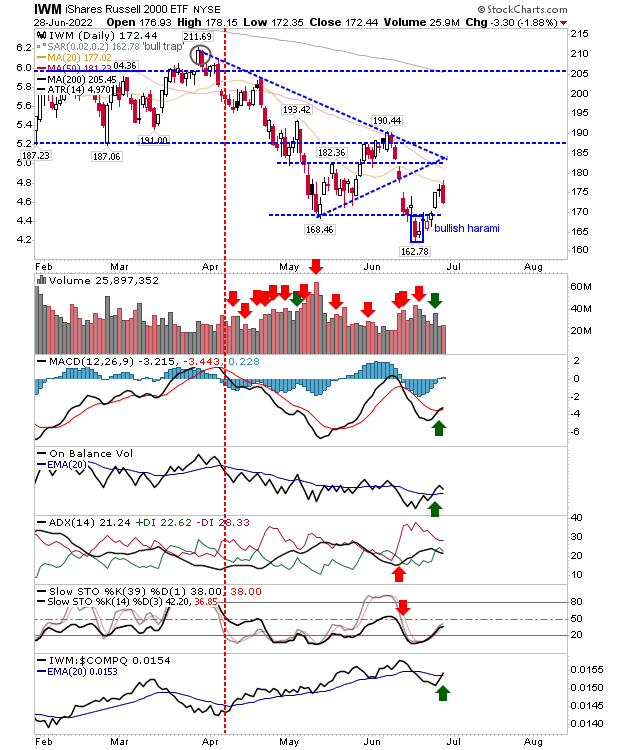

The index to watch is the Russell 2000. If there is to be a recovery then the Russell 2000 has to do the leg work. Key here is that the index retains its relative outperformance to the NASDAQ and S&P - even if it suffers selling, as is likely from here.

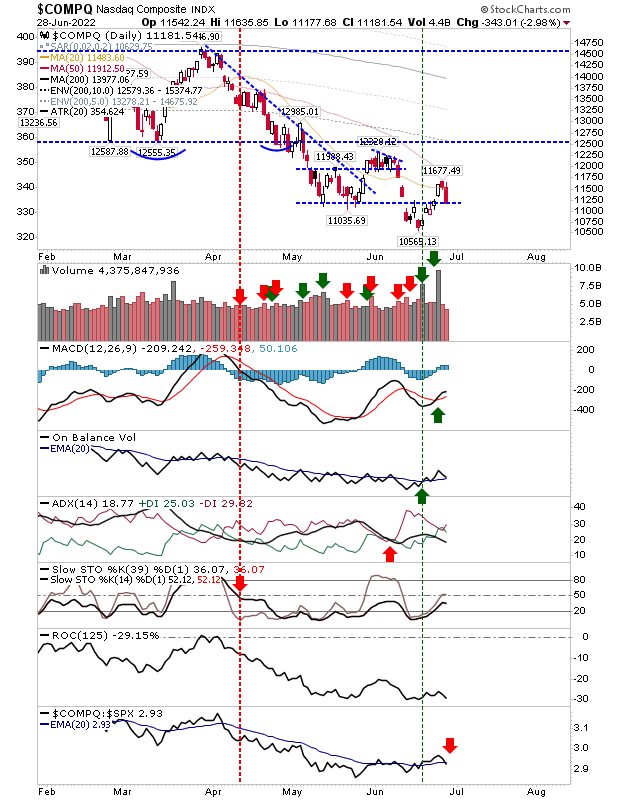

The NASDAQ fell just short of pushing into June swing low territory as the 20-day MA played as resistance. Of the three indices, it's the one caught in the middle, but the likelihood will be for losses to continue.

The doomsday clock is the S&P as the selling reversed off both the May low giving it little wiggle room as it works back towards from where it came. Shorts had a natural entry point today with risk defined by the 20-day MA, that it's going to be hard for buyers to step in front of this selling. A crumb of comfort is that the bullish harami cross is one of the better reversals and it will be interesting to see how it stands up here.

So bulls will be feeling the pressure after today, but as traders stress, investors should sit tight. There will be another low, be it above or below the June one, and this will offer another opportunity for investors to add to their positions.