Recently, President Obama made his last state visit to Asia.

The trip had two official purposes for the president. First, to attend the G20 summit in China. Then Obama went down to Laos to pitch the Trans-Pacific Partnership (TPP).

The massive trade agreement would involve 12 countries and hundreds of American businesses. It seeks to boost American exports, ensure fair commercial practices and protect American labor.

But the deal has an uncertain future. Despite bipartisan support from Congress and the White House, both Hillary Clinton and Donald Trump oppose the TPP.

The fate of the trade agreement is anyone’s guess. However, some TPP-supporting companies could see significant changes in their stock prices if the agreement passes (or fails). This creates an opportunity for investors who are optimistic about the fate of the TPP.

It also creates a short-play opportunity for those who are pessimistic about the future of the deal.

Let’s look at three companies whose bottom lines could be affected.

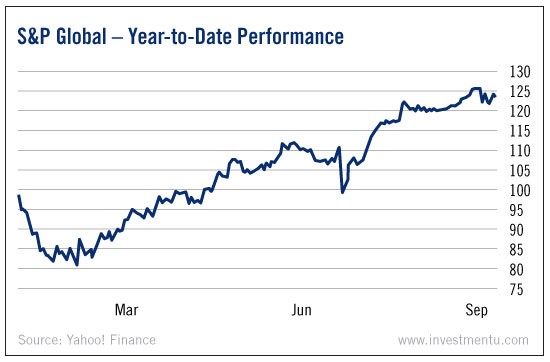

S&P Global

One vocal TPP-supporting industry is financial services. As such, the folks who maintain your favorite stock market indexes are big fans of the deal.

S&P Global Inc (NYSE:SPGI) compiles the S&P 500 and the Dow Jones Industrial Average. Before this year, it was known as McGraw Hill Financial. The company has spent more than $1 million lobbying individually for the TPP. It’s also a member of the Securities Industry and Financial Markets Association, another big part of the pro-TPP business coalition.

If the deal passes, it will be good news for S&P Global shareholders. The stock has already risen by almost 27% this year.

The gains will likely continue if S&P Global gets its way on the TPP. On the other hand, if the deal is shot down by the next president, the stock may lose some of its upward momentum. A TPP-related pullback would create a potential shorting opportunity.

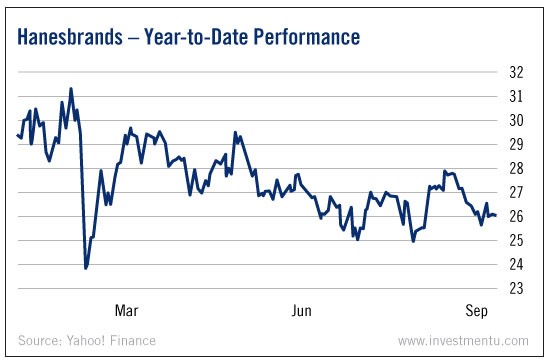

Hanesbrands

A former division of Sara Lee Corporation, Hanesbrands Inc (NYSE:HBI) was spun off into its own publicly traded company in 2006. Since then, it has enjoyed considerable success in the apparel industry, thanks in part to its supply chain strategy.

As of late, the retailer has been building lots of factories in Vietnam, another TPP signatory country. It has invested more than $50 million in Vietnamese manufacturing, and it has spent millions lobbying for the trade agreement. As such, Hanesbrands is another major TPP stakeholder.

The passage of the deal could provide some much-needed momentum to Hanesbrands stock. Its shares have had a bumpy year.

On the other hand, if the TPP fails, it could potentially cause a sell-off in this volatile investment. Long and short plays on Hanesbrands both have the potential to make big returns. It depends on the deal’s future.

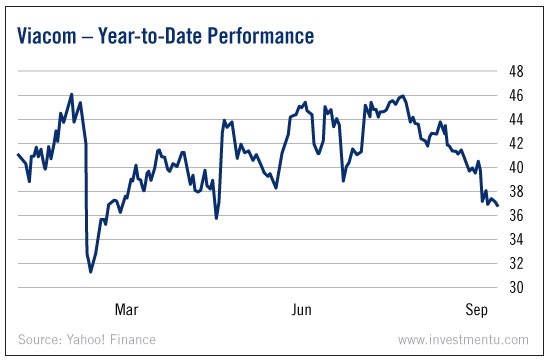

Viacom

Viacom Inc (NASDAQ:VIA) is one of the biggest media conglomerates in the world. Throughout the 2000s and 2010s, it has become one of the loudest advocates for online intellectual property rights.

IP is one of the biggest concerns of the TPP (it has a whole chapter on the subject). Viacom is one of the world’s biggest IP watchdogs, and it has also independently funded pro-TPP campaigns. When you put these things together, it becomes clear that Viacom has a lot riding on the deal.

Viacom is another stock that could use a boost from a TPP ratification. Its stock price has gone through some sharp rises and falls in the last year. If the deal is vetoed, the current sell-off may continue. That could be quite profitable for investors who short the stock.

Whatever your opinion of the TPP, we can all agree on one thing...

Its passage or failure will have huge economic effects in the United States and beyond.

There’s a chance that Obama and the current Congress will be able to ratify it this year. But it’s just as likely that the agreement will stall until it’s on the next president’s desk.

If ratified, the deal could create a buying opportunity for the companies that support it. If not, it could be a shorting opportunity. It’s just another case where we’ll just have to wait and see what Washington decides.