A bounce for Asia, but can it hold?

Asian markets look set for a bounce today, but its sustainability is still an open question. Gains in US equities overnight, supported by moves in commodities and stability in Chinese equity markets yesterday, are pointing to a positive session for the S&P/ASX 200.

As usual, however, all bets will be off when we see 12.30 AEDT roll around with the open of the Chinese cash market. The big unknown today is whether we have seen a sustainable bounce in Chinese equities and whether yesterday’s gains can be held onto. Some sense of stability does seem to have been wrestled into the Chinese yuan this week, but the Chinese equity markets have been more immune to muscular shows of state intervention.

Some stability has taken hold of the Chinese equity markets. A group of 28 companies listed on China’s tech and small-cap focused (N:CNXT) index, calling themselves the C28, vowed to “take real action to stabilize the market”. The ChiNext surged 5.6% on the news - the most in two months. But, given it is the most volatile of all the Chinese equity markets, it may struggle to hold this momentum. Nonetheless, ChiNext gains, cheaper valuations and probably some state buying helped the Shanghai Composite see a 2% gain and push back above that key psychological level of 3000. The People’s Bank of China (PBoC) does look to have reined in the onshore and offshore Chinese yuan for the moment, so the big unknown today will be whether Chinese equity markets can hold onto their gains.

The Chinese equity markets do look to have helped commodities overnight. The Qingdao Iron ore price jumped 1.8% back, over the US$40 mark, while aluminum climbed 1.6% and nickel gained 3% on the London Metal Exchange. Oil also saw steady overnight gains with WTI and Brent both gaining over 2% and pushing into the US$31 handle. All of this bodes well for the materials and energy sectors on the ASX. The materials sector on the FTSE 100 was the best performer overnight, with Anglo American (L:AAL) gaining 13.6%, BHP Billiton (N:BHP) up 6% and Rio Tinto (N:RIO) up 3.1%.

Positive news from China and in the commodities complex could well push the Aussie dollar back above the US$0.70 mark today. If this bounce proves sustainable, the Aussie dollar moving into the US$0.71-0.72 level in the near term. With volatility going down, the safe haven in the Japanese yen is decreasing. The USD/JPY gained 0.3% and had moved into the 118 handle, if volatility continues to go down globally moves into the 120-121 level also look reasonable.

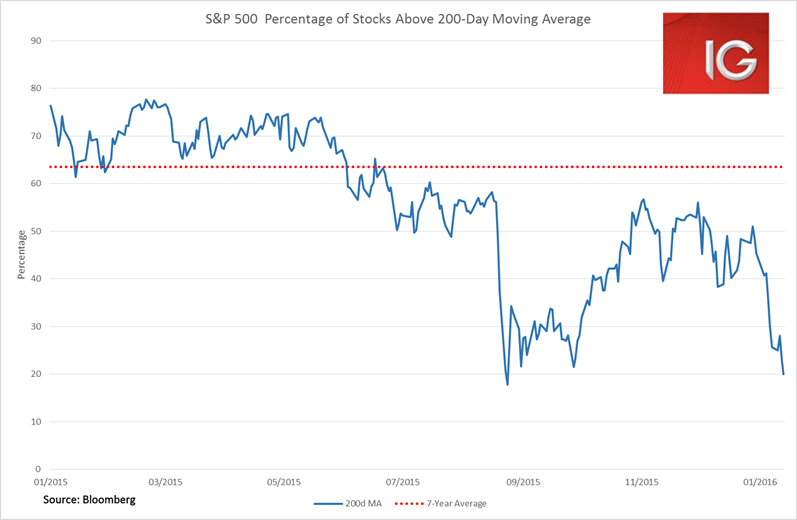

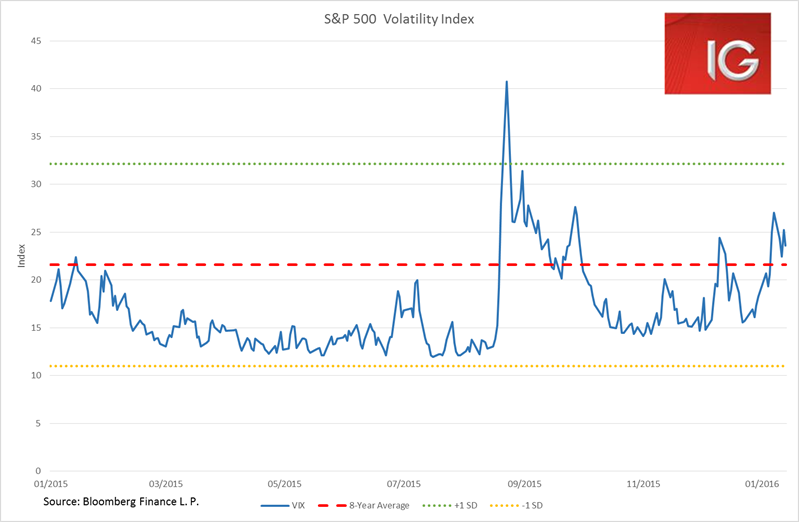

A strong bounce in US stock overnight is also likely to further buoy the Asian markets today. The VIX dropped from 25.2 to 23.6, but remained elevated above its 8-year average of 21.6. The S&P 500 had reached highly oversold territory, dropping to its lowest levels seen since September, while the percentage of companies above their 200-day moving average had dropped to 20% - the lowest level seen since 25 August. Dovish comments from Fed members Bullard overnight and Evans the day before also helped market sentiment. JPMorgan Chase & Co (N:JPM) saw its stock rally 3.2% after beating earnings estimates and lowering its surcharge as a global, systemically important bank. But energy, healthcare and tech stocks were the main drivers behind the S&P 500’s 1.7% gain.