US consumer spending manages to excite

- The Aussie dollar gained +0.2% to 0.7576 as the USD pulled back somewhat

- The ASX SPI Futures are pointing to an 18 point rise at the open

- WTI oil dropped 1.4% as Iran said it wouldn’t commit to a supply freeze

- The S&P 500 gained 0.5% to 2180 with banking stocks rallying 1%

- Economic Releases: Australia ANZ Roy Morgan Weekly Consumer Confidence, Australia July Building Approvals

The DXY US Dollar index pared back all of yesterday’s gains as markets look to be steadily adjusting into a holding pattern as they await the non-farm payrolls report on Friday.

While a host of Fed officials are set to speak this week with Vice-Chairman Fischer speaking on Bloomberg at 8:30 pm AEST this evening, its unlikely markets will react too dramatically given the upcoming NFP risk event.

This will also be Fischer’s third public appearance in a week-and–a-half and he has been the primary driver of the hawkish fear in markets, but the marginal impact of any further jawboning from him this evening may have diminished, particularly in the lead up to the NFP.

US equity markets moved higher in the wake of the solid consumer spending reports with the S&P 500 closing up 0.5% at 2180. But the big gainers continue to be the banking stocks who are benefitting from rising rate expectations as they would see their net interest margins improve. The S&P 500 Banks Index rose over 1%.

But the fixed income market was less convinced about imminent rising rates as US treasuries rallied with yields dropping by 4-7 basis points across the board. While one of the major US treasury ETFs, iShares 20+ Year Treasury Bond (NYSE:TLT), gained 1.3%.

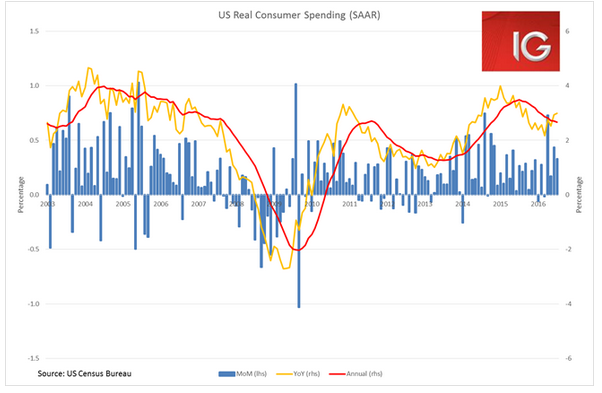

While nominal personal income and personal spending largely came in where the market consensus was positioned, real personal spending did surprise to the upside gaining 0.3% month-on-month. In year-on-year terms, real personal spending is growing at 3% - its strongest level since September 2015.

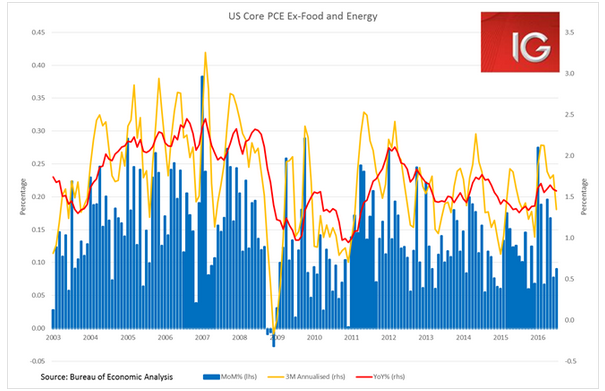

Although amidst all this hawkish jawboning of how close the US economy is to the Fed’s targets, PCE core inflation, which was also released overnight, continues to look like it is weakening again. PCE core inflation grew at 1.6% year-on-year for its fifth month in a row. While the PCE deflator saw its worst month-on-month growth since February, seeing no change from June to July.

The strong session in US equities overnight looks like it will be a boon for Asian markets today. Australian and Chinese markets (Mainland and HK) all look set to open higher.

While oil prices dropped over 1%, the rest of the commodities space caught a bit of a breather as the USD pared back most of its gains, which could be a help for materials today.

The solid performance of US financials could help out the under pressure Aussie banking sector. Although the pullback in the USD has not helped the key USD/JPY rate and the Nikkei looks like it may be the only market in the region to open down.