Iran joins in the OPEC jawboning

- The Aussie dropped -0.1% to 0.7620

- The DXY US dollar index was largely unchanged

- WTI oil was up 1.18% to 47.97 after Iran said it would attend the OPEC meeting

- Copper down 1.24% to 211.35 after big inventories gain

- South African rand loses 3% after Minister of Finance being investigated by police

- Economic data: New Zealand trade, Australai skilled vacancies, Australia construction work done

Earnings: A2 Milk Company Ltd (AX:A2M) Alumina Ltd (AX:AWC): APA Group (AX:APA), Ardent Leisure Group (AX:AAD), Bega Cheese Ltd (AX:BGA), Blackmores Ltd (AX:BKL), Boral Ltd. (AX:BLD), Isentia Group Ltd (AX:ISD), Link Administration Holdings Ltd (AX:LNK), Mcmillan Shakespeare Ltd (AX:MMS), Pact Group Holdings Ltd (AX:PGH), Qantas Airways Ltd (AX:QAN), Qube Holdings Ltd (AX:QUB), Sirtex Medical Ltd (AX:SRX), Spotless Fp (AX:SPO), Steadfast F (AX:SDF).

Markets continued to move higher overnight, but with minimal fanfare. The big news was that Iran said it would attend the upcoming OPEC meeting in September, which served to briefly rally WTI oil back above US$48. Some think that there is now some possibility that Iran will commit to a supply freeze deal.

But attendance does not mean they are ready to commit to a deal, and when Iraq and Saudi Arabia are producing at record levels, it is difficult to see Iran being happy to produce well below their potential. The need to see tangible benefits from the Detente with the Americans strongly argues for them pursuing as expansive an output strategy as possible. But by the same token, everyone in OPEC can benefit from upside jawboning of the oil price.

However, this jawboning looks like it is rapidly being reversed in the wake of the weekly US API inventories number, which saw crude oil inventories increase by 4.5 million barrels after declining by 1 million barrels last week. A similar figure in the EIA inventories report tomorrow could see WTI oil pull back to the US$45 handle.

In general most commodities had a good night with the materials sector being the best performer in the S&P 500. But copper prices plunged 1.2% after the London Metals Exchange reported a 4.7% increase in copper inventories.

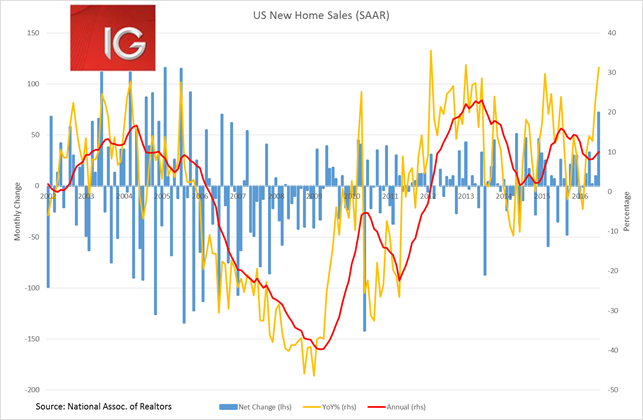

The DXY US dollar saw minor gains overnight helped along by the release of a huge increase in US new home sales data. US new home sales in July saw their biggest year-on-year growth since January 2013, increasing by 31.3%.

There is pretty clear evidence that the US housing market is doing very well, which is a positive for the investment contribution construction can add to GDP, but also for consumption from the associated wealth effect from rising house prices. But many US dollar traders are still holding out for Janet Yellen’s speech on Friday to see if she might indicate that a September rate hike is a possibility.

The big news in currencies overnight was the 3% drop in the South African rand (ZAR) after it was reported that the current Finance minister Pravin Gordhan had been ordered to report to the police. The ZAR saw a dramatic collapse in December when they removed the former Minister of Finance Nhlanhla Nene.

There are evidently concerns in the market that after the ruling ANC party has lost three major municipal elections in a month and that they may want to push out a respected and cautious finance minister again who is standing in the way of them opening the fiscal taps.

The ASX and most Asian markets are looking to edge slightly higher at the open after the solid performance in overnight markets. BHP’s ADR surged 3.3% overnight, while CBA’s gained 1%, both of which bodes well for the index today.