Forex Market Overview

As the future of Brexit is beginning to look more bearable, the pound was able to enjoy one of its most positive weeks in a long time. Reports from the Bank of England also stoked trader optimism about the pound.

Japan particularly enjoyed a productive week, watching the yen outperform almost every other currency. With the minutes from the Bank of Japan expected to be released later this week, we’ll have to see whether this trend continues or reverts back to normal.

Elsewhere in the forex world, both the United States and Canadian dollars experienced weeks marked by a series of ups and downs. This week, traders will be paying close attention to a speech from Fed chairman Jerome Powell as well as developing trade tensions with China.

In fact, it seems trade tensions with China have become a bit of a theme in the forex trading world, directly affecting both the Australian dollar and the Kiwi as well. Stay tuned to upcoming trade reports as well as the announcement of possible new tariffs.

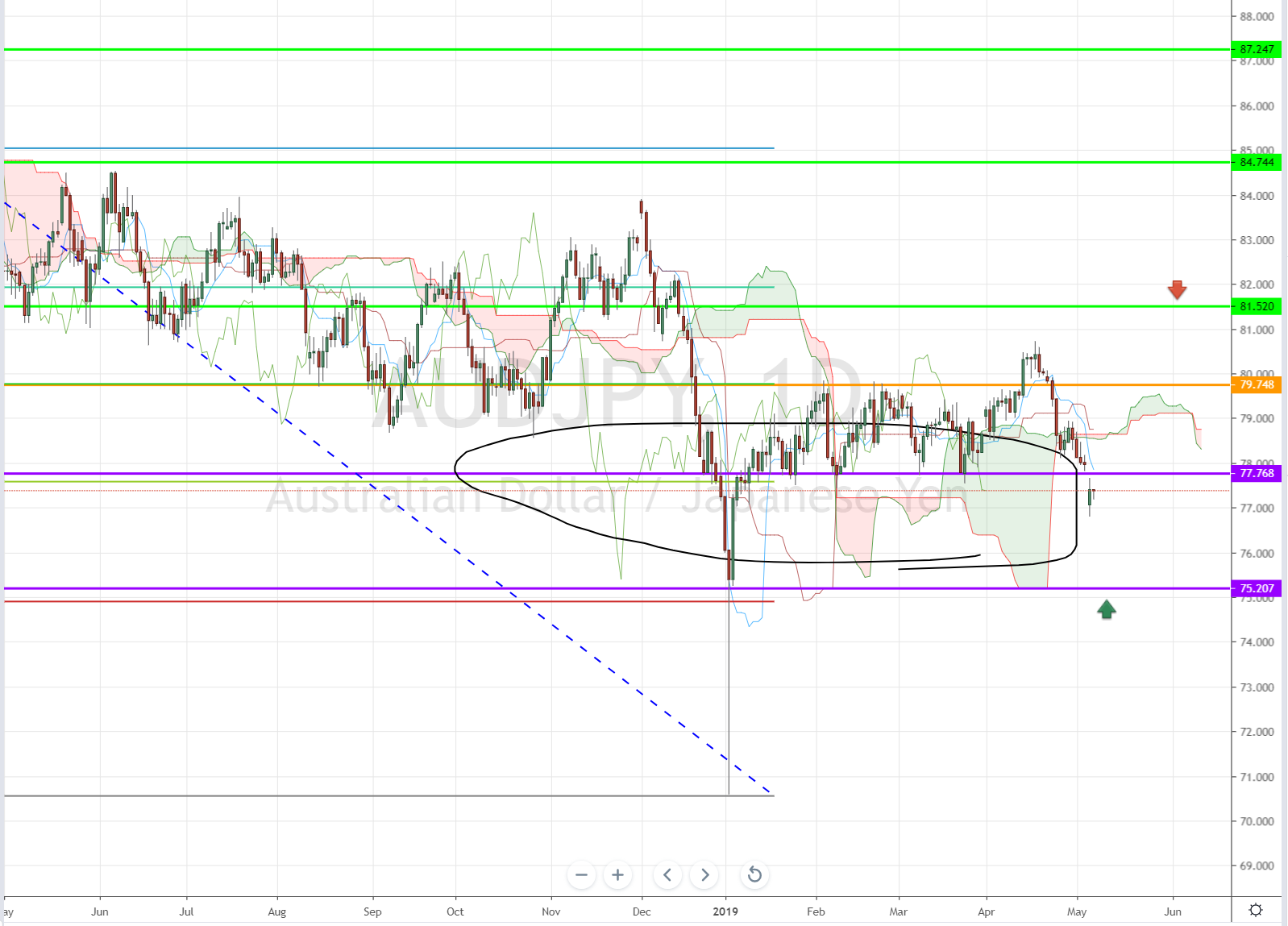

Taking a Closer Look at AUD/JPY

As the Aussie got weaker and the JPY got stronger, it made the pair a perfect bait for the bears on the forex dance floor. The AUD/JPY pair broke below the daily Ichimoku Cloud last week and confirmed a break below the key support level of 77.68 on Monday. However, it then corrected some of the losses. t

t

The future cloud appears bearish and we could see further drops towards 75.20. That could bring an end to the current bearish sentiment provided the China tensions slows down.

Crypto Market Overview

One of the biggest crypto stories to open up this week was Fidelity’s decision to introduce crypto trading services within the next few weeks. Fidelity is just one of many major banks that has recently begun exploring the world of crypto, which has helped promote the industry as a whole.

Bitcoin enjoyed another productive week, starting the week around $5,300 and eventually breaking the $5,800 mark for the first time since last November. As we have come to expect by now, most other major cryptocurrencies were also able to rally in response.

Other positive news for the industry came in from Europe, as MasterCard began seeking approval for the use of a crypto debit card. The card can be used anywhere that MasterCard is accepted and make it easier to use cryptocurrency while shopping. If the crypto MasterCard project is a success, we can expect to see similar cards pop up elsewhere around the world as well.

Stock Market Overview

Last week was a sluggish week for both the DOW and the S&P 500, with both major indexes ending the week right around where they started. Both indexes also opened with major drops on Monday, something that likely can be attributed to ongoing trade issues with China. Depending on how these disputes play out, you can expect to see quite a bit of movement in the near future.

Other tensions relating to global oil prices and ongoing issues with Iran may also be felt throughout the stock market. On the bright side, the US jobs report for April was considered better than expected, giving stock traders a reason to be excited. Wage growth has also been moving in a positive direction, alongside a relatively limited level of inflation.

The release of corporate earnings reports from last week caused a few up and down movements within the market, but prices generally remained unaffected. The important things for traders to watch this week include the speech from Jerome Powell, developing tariff agreements with China, and several small reports.