Charts Speak For Themselves

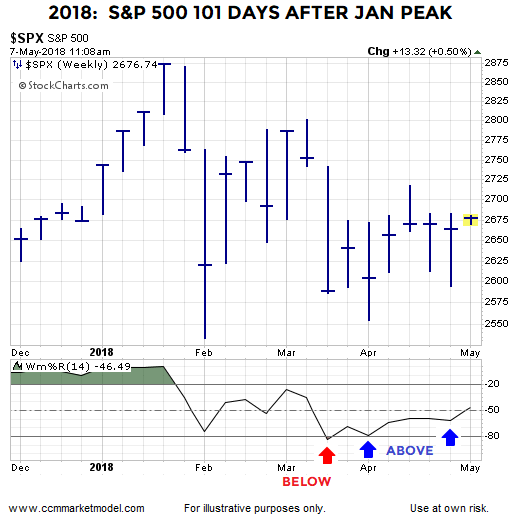

The S&P 500 peaked 101 days ago on January 26, 2018. Williams %R, which helps us track momentum, is shown at the bottom of each weekly chart below. The red arrow shows S&P 500 momentum reached "oversold" territory in March. During the subsequent drops (blue arrows), the bears were unable to push momentum back into oversold territory, which tells us to be open to better than expected outcomes in the weeks and months ahead.

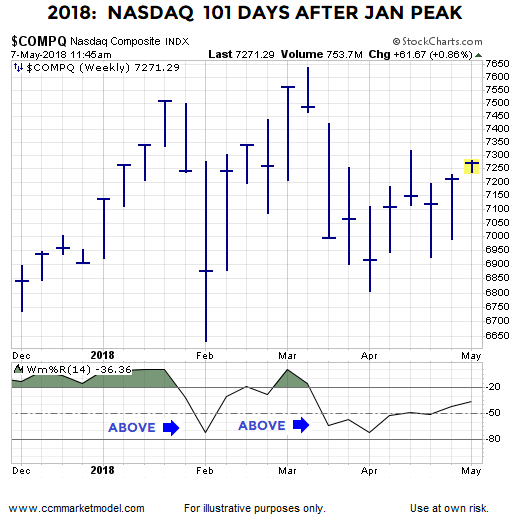

The Nasdaq Looks Even Better

Bullish momentum was so strong before the January 2018 peak that even after correcting/consolidating for 101 days, the NASDAQ has remained above oversold territory, which is a sign of strength.

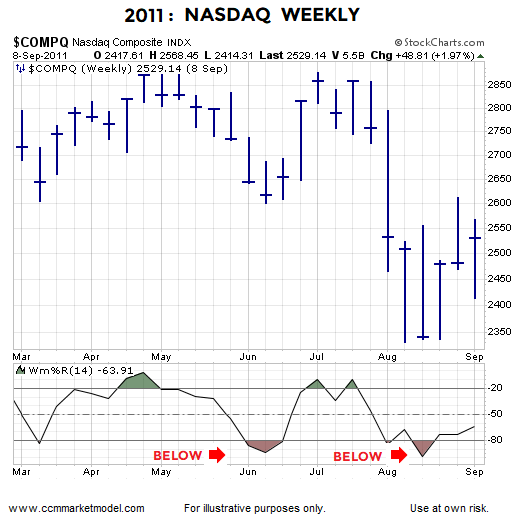

2011 Correction: Nasdaq

Compare and contrast the 2018 chart (above) to the 2011 chart (below). Notice how momentum was much weaker in 2011.

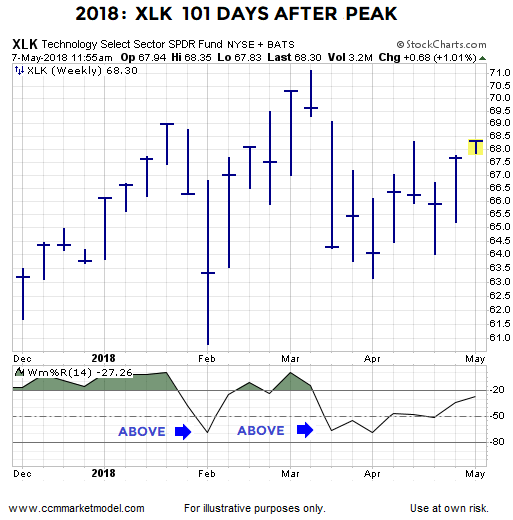

Tech Stocks In 2018

Like the NASDAQ, momentum in the technology sector (NYSE:XLK) has remained incredibly strong since markets peaked in January.

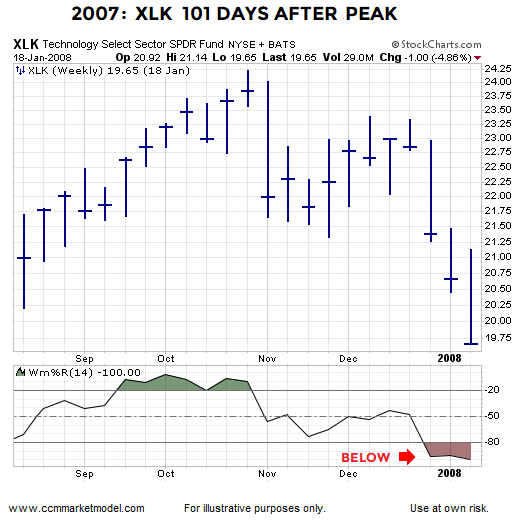

Tech Stocks In 2007

Compare and contrast the 2018 chart (above) to the 2007 chart (below). Notice how momentum in the technology sector was much weaker in late 2007/early 2008.

S&P 500'S Long-Term Outlook

In November 2016 bullish setups on the chart of the S&P 500 turned out to be helpful. This week's video revisits that analysis to see if the long-term bullish conclusions have been negated during the recent stock market correction.

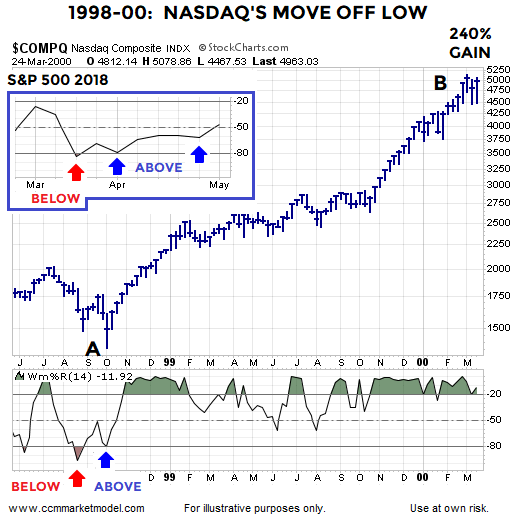

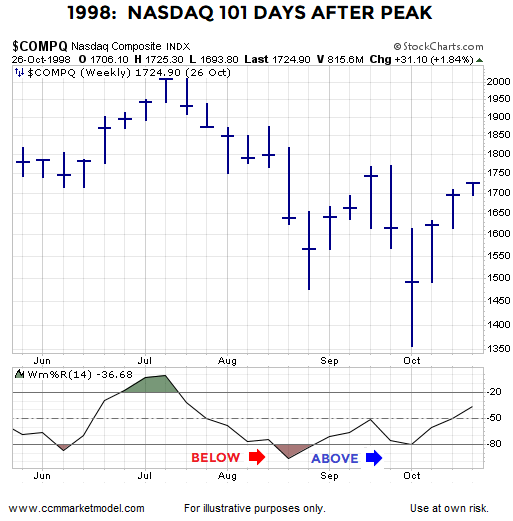

Momentum Failure In 1998

When the bears had control of the short-term trends in 1998, they were unable to push bearish momentum back into oversold territory in late September/early October; this is known as a momentum failure (see blue arrow below). The momentum failure said "be open to better than expected outcomes in the weeks and months ahead".

According to StockCharts.com:

The failure to move back into overbought or oversold territory signals a change in momentum that can foreshadow a significant price move.

What Happened After The Momentum Failure?

After the bears failed to push momentum back into oversold territory in 1998 (blue arrow bottom of image), the NASDAQ found its footing and tacked on 240%. The box in the upper left hand corned of the image shows a similar situation on the present day weekly chart of the S&P 500, telling us to keep an open mind about better than expected outcomes in the weeks and months ahead.