It’s a tired piece of “wisdom” you hear from personal-finance gurus over and over: you need to invest in low-cost, passive index funds to get the highest return.

Too bad it’s completely false!

Today we’re going to look at how obsessing over fees can actually cost you tens of thousands of dollars. Then I’ll name a fund that could get you big gains and pays a dividend north of 6%. What’s more, this unusual fund, a closed-end fund (CEF), to be specific, gives you that steady cash payout while holding some of the biggest stocks out there—I’m talking about household tech names like Apple (NASDAQ:AAPL) and Amazon.com (NASDAQ:AMZN).

Confusing Fees With Performance

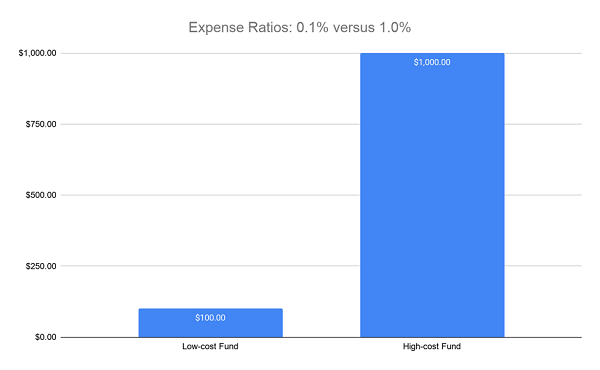

First off, though, our fee myth starts with a simple assumption: the lower the fees on a fund, the bigger your return. On its face, the myth makes sense. For instance, let’s say one fund has a 0.1% expense ratio and another has 1%. If you invest $100,000 in the first fund, the manager will take out $100 from your share of the fund’s portfolio to pay your fees; the second fund will take out $1,000, or 10 times as much.

A Scary, but Misleading Chart

But there’s a huge, unspoken assumption behind the chart above and the fee debate as a whole: that both of the funds you’re comparing are identical. And that’s rarely the case.

And even when it is the case, the differences in fees are often minuscule. Consider the SPDR S&P 500 ETF (NYSE:SPY), which tracks the S&P 500. It has a 0.095% expense ratio, meaning it’ll cost you $94.50 per $100,000 invested per year. The Vanguard S&P 500 ETF (NYSE:VOO), which also tracks the S&P 500, has a 0.03% expense ratio, meaning it’ll cost you $30 per $100,000 invested per year. That $64.50 savings per year is almost nothing on a $100,000 portfolio.

What’s worse, obsessing over fees leads you down a pennywise and pound-foolish road that ends up in a lot of money being left on the table. Like in the example we’ll get into now, where a $100,000 investment would have missed out on over $200,000 in profits.

Stock Selection—Not Fees—Is the Key

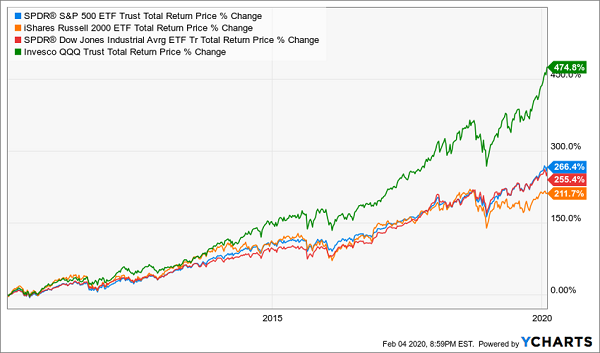

The real problem with index investing isn’t the tiny differences in expense ratios but the different indexes out there.

As you’re probably well aware, there is more than one stock index. While the S&P 500 tries to index the US stock market broadly, with a focus on mid-cap and large caps, there is also the large-cap–focused Dow Jones Industrial Average, the small-cap–focused Russell 2000 and the tech-focused Nasdaq 100. So if you chose to put your $100K into the S&P 500, you’d be biasing it toward bigger companies and more diversification across industries, but that comes at the cost of exposing your investment to sectors like materials, industrials and energy, which have been struggling for years.

However, if you’d decided to focus your $100K on, say, technology, with the Nasdaq 100 Index, you’d have set yourself up for far bigger profits.

The Index You Choose Matters

Over the last decade, the Nasdaq 100–tracking Invesco QQQ Trust (NASDAQ:QQQ) has beaten the S&P 500 (in blue) by 208.4 percentage points, That means an index investor who put $100,000 in QQQ instead of SPY earned a profit of $474,800 in a decade or $208,400 more than the S&P 500 index investor. Similarly, the conservative Dow Jones investor and the small-cap risk-taker lost out to the S&P 500 indexer by thousands of dollars.

The bottom line: indexing is not a passive choice, no matter what the finance gurus tell you, and choosing one index over another means making a conscious decision about what part of the market will win over another. Focusing on expense ratios is a red herring: focusing on the stocks poised to win is what really matters.

Tech’s Biggest Gains Are Still Ahead

Let’s keep our focus on tech, because after the breathtaking decade the sector has had, worrywarts say it can’t last, and tech stocks need to come back to earth. But these fears are unfounded because, quite simply, tech is leading the world.

More consumers are buying through Amazon (NASDAQ:AMZN), which is building its own delivery system to displace FedEx (NYSE:FDX) and United Parcel Service (NYSE:UPS). Apple and Alphabet (GOOG, NASDAQ:GOOGL) are dominating the smartphone world, and Facebook (NASDAQ:FB), despite its controversies, is still where a third of the planet socializes, and social media site’s user count keeps rising. And Netflix (NASDAQ:NFLX) may be increasingly pressured as other companies get into the streaming game, but this just proves that legacy players need to become tech companies to survive.

That’s just the bull case for FAANG stocks, but the rest of the tech world is becoming even more important both in the US and around the world.

And this is why tech’s big rise is only getting started, especially as these companies not only produce earnings but grow those earnings at a higher rate than blue chip stocks while also growing revenues.

This Tech-Focused Closed-End Fund Pays You 6.3%

You could get into this market with QQQ, but there’s another option that’s both safer and provides a big income stream: a 6.3% dividend yield, so your $100,000 will get you $525 per month in dividends.

Its name is the Nuveen Nasdaq 100 Dynamic Overwrite Fund (NASDAQ:QQQX), and it invests in the Nasdaq 100 index with a twist: it also sells call options, a kind of insurance on its portfolio, and passes the income from those options to investors. This makes it both a tech play and an income play. And unlike many funds like it, QQQX doesn’t trade at a premium to its portfolio value, so you’ll be getting what you pay for.

QQQX is just one of many closed-end funds that get you exposure to a great index and a big income stream. But there are many more that go beyond that and crush their indexes by massive margins. And index investors who have ignored them have been giving up bigger returns for years.

Forget ETFs: These 5 Funds Boast Huge 8% Dividends—and 20% Upside!

QQQX is just the start, because I’ve got 5 actively managed CEFs waiting for you right here that all throw off even bigger dividends—I’m talking a massive 8% average payout here. Some of these red-hot buys even send dividend cash your way monthly!

And you don’t have to bet the farm on just one sector, either: these 5 funds hold top investments from across the economy, including healthcare stocks, leading blue chips, corporate bonds, real estate investment trusts (REITs) and rock-steady (and tax-advantaged) municipal bonds, too.

The best part is that you don’t have to give up price upside to start tapping these huge payouts. Because unlike QQQX, these 5 amazing CEFs trade at deep discounts to the value of the stocks, bonds and REITs in their portfolios.

How big are these discounts?

Altogether, I’m forecasting 20%+ price upside for these 5 funds in the next 12 months, on both the strength of their carefully crafted portfolios and their discounts “snapping shut” and reverting back to normal levels.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."