Market Indexes:

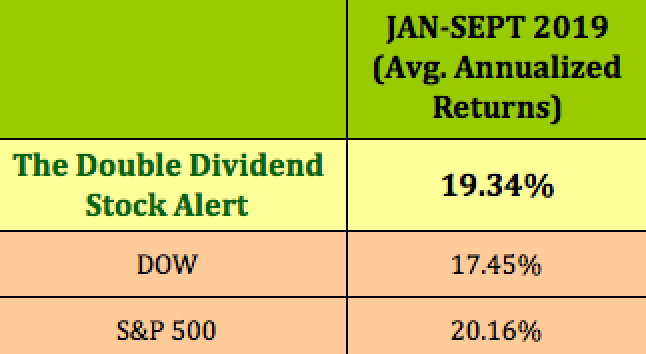

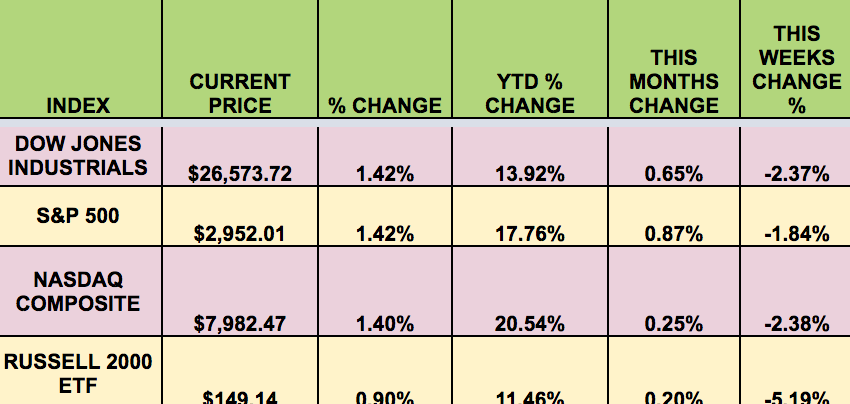

The market fell again, for the third straight week, with small caps falling the most, down -5.19%, followed by the NASDAQ, down -2.38%, the DOW, down -2.37%, and the S&P, down ~1.84%, as investors had renewed recession concerns over weakening US economic data, after September manufacturing activity fell to a more than 10-year low. In addition to pressures from the impeachment inquiry, the market now has an escalation of the trade war, with the US imposing $7.5B in tariffs against European goods. A rally on Friday occurred after a modest Sept. jobs report.

This Week’s Options Trades:

We added covered call and a put-selling trades for mega-cap banking stock JPMorgan Chase, (NYSE:JPM), to our Covered Calls Table and to our Cash Secured Puts Table this week.

There are several Covered Call trades with annualized yields above 25%, including TLT, FB, AAPL, and others. Our Cash Secured Puts table has put trades ranging up to nearly 50%.

Volatility:

The VIX fell 1% this week, after hitting over $21.00 on Wednesday, ending the week at $17.04.

High Dividend Stocks:

These high yield stocks go ex-dividend next week: LOAN, CIO, PMT, ARR.

Market Breadth:

Only 10 out of 30 DOW stocks rose this week, vs. 14 last week. 38% of the S&P 500 rose, vs. 42% last week.

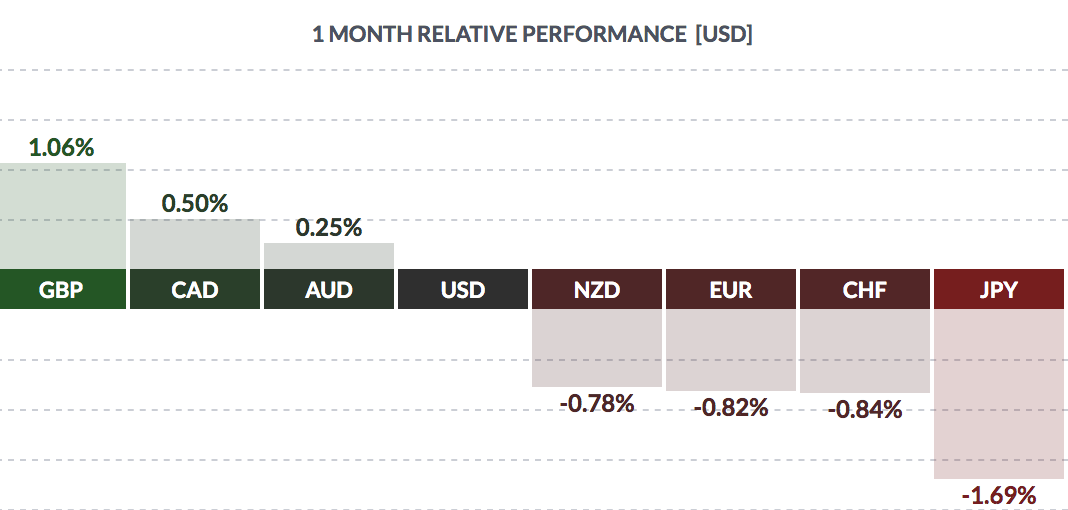

FOREX:

The U.S. dollar fell versus the pound, the Loonie, and the Aussie, but rose vs. the euro, the yen, the Swiss franc, and theNew Zealand dollar in September.

Economic Reports:

“U.S.job growth increased moderately in September, with the unemployment rate dropping to near a 50-year low of 3.5%, assuaging financial market concerns that the slowing economy was on the brink of a recession amid lingering trade tensions. Non-farm payrolls increased by 136,000 jobs last month, the government said. August data was revised to show 168,000 jobs created instead of the previously reported 130,000 positions.

The initial August job count was probably held back by a seasonal quirk related to students leaving their summer jobs and returning to school. Economists polled by Reuters had forecast payrolls would increase by 145,000 jobs in September.” (Reuters)

“Automatic Data Processing showed that a modest 135,000 jobs were created in September, another sign that hiring is slowing along with the broader U.S. economy. That missed the Econoday consensus forecast of 152,000 jobs. The average monthly job growth for the past three months also fell to 145,000 from 214,000 for the same time period last year.” (MarketWatch)

“U.S. manufacturing activity tumbled to a more than 10-year low in September as lingering trade tensions weighed on exports, further heightening financial market concerns of a sharp slowdown in economic growth in the third quarter. The survey from the Institute for Supply Management (ISM) on Tuesday came on the heels of data last week showing a moderation in consumer spending in August. The economy’s fading fortunes have been blamed on the White House’s 15-month trade war with China, which has sapped business confidence and undermined manufacturing.

The ISM said its index of national factory activity dropped 1.3 points to a reading of 47.8 last month, the lowest level since June 2009, when the recession was ending. A reading below 50 indicates contraction in the manufacturing sector, which accounts for about 11% of the U.S. economy. September’s reading marked the second straight month that the index broke below the 50 threshold.” (Reuters)

“Outlays for U.S. construction projects rose 0.1% in August at a seasonally adjusted annual rate of $1.29 trillion, the Commerce Department reported Tuesday. Economists polled by MarketWatch had expected a 0.4% gain. Activity has been weak but economists think housing may pick up as interest rates fall.” (MarketWatch)

“U.S. stocks fell sharply Thursday morning after a report on the U.S. services sector showed it growing at a slower pace than at any point since 2016, following a report on manufacturing earlier this week that showed it contracting for the second month in a row.The ISM’s index of the Services sector came in at 52.6% in September, down from 56.4% in August, and below economists expectations of 55.3%, according to a MarketWatch poll of economists.

Investors also were digesting news that the U.S. will impose some $7.5 billion in import duties on goods from the EU, including jetliners, Irish and Scotch whiskies, cheeses and hand tools, starting later this month, after the U.S.won WTO backing on Wednesday.” (MarketWatch)

Week Ahead Highlights:

With this week’s weak Sept. mfg. report pointing to trade as a major cause of the economic slowdown, the trade talks resuming in DC next week take on even more significance.

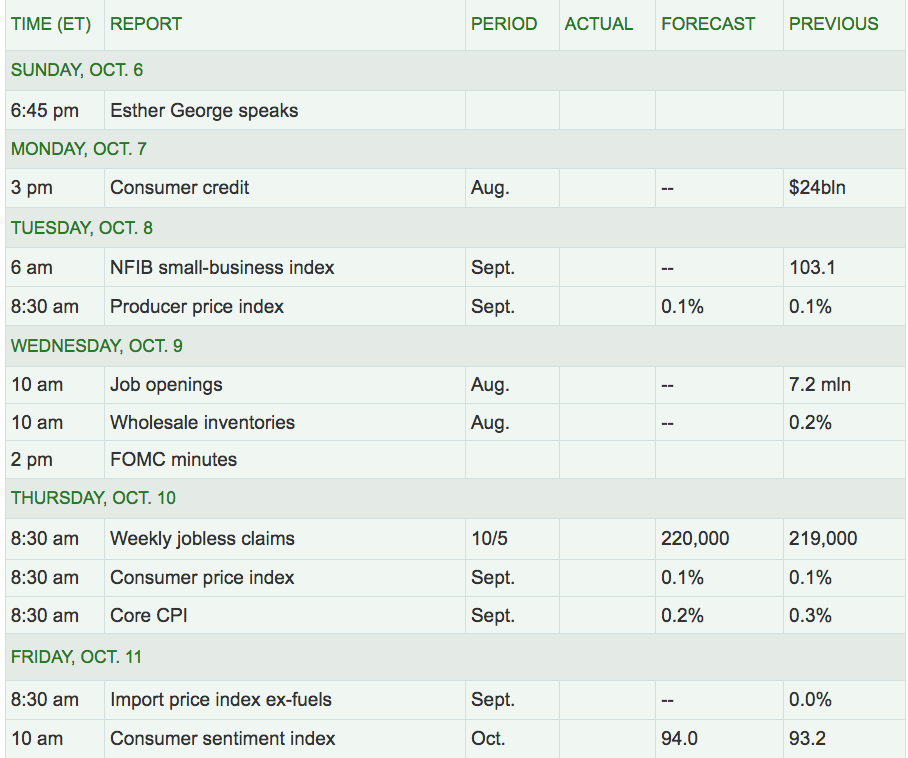

Next Week’s US Economic Reports:

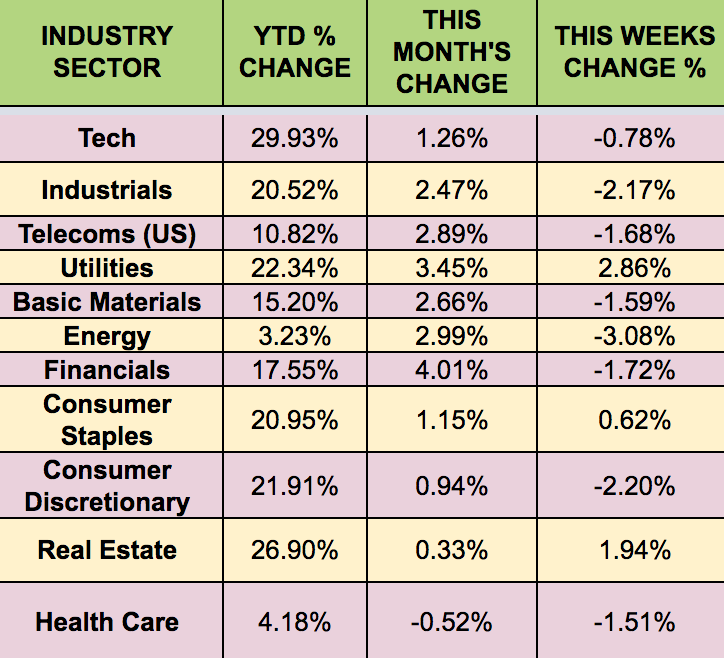

Sectors:

Defensive Utilities and Real Estate sectors led this week with Energy stocks lagging.

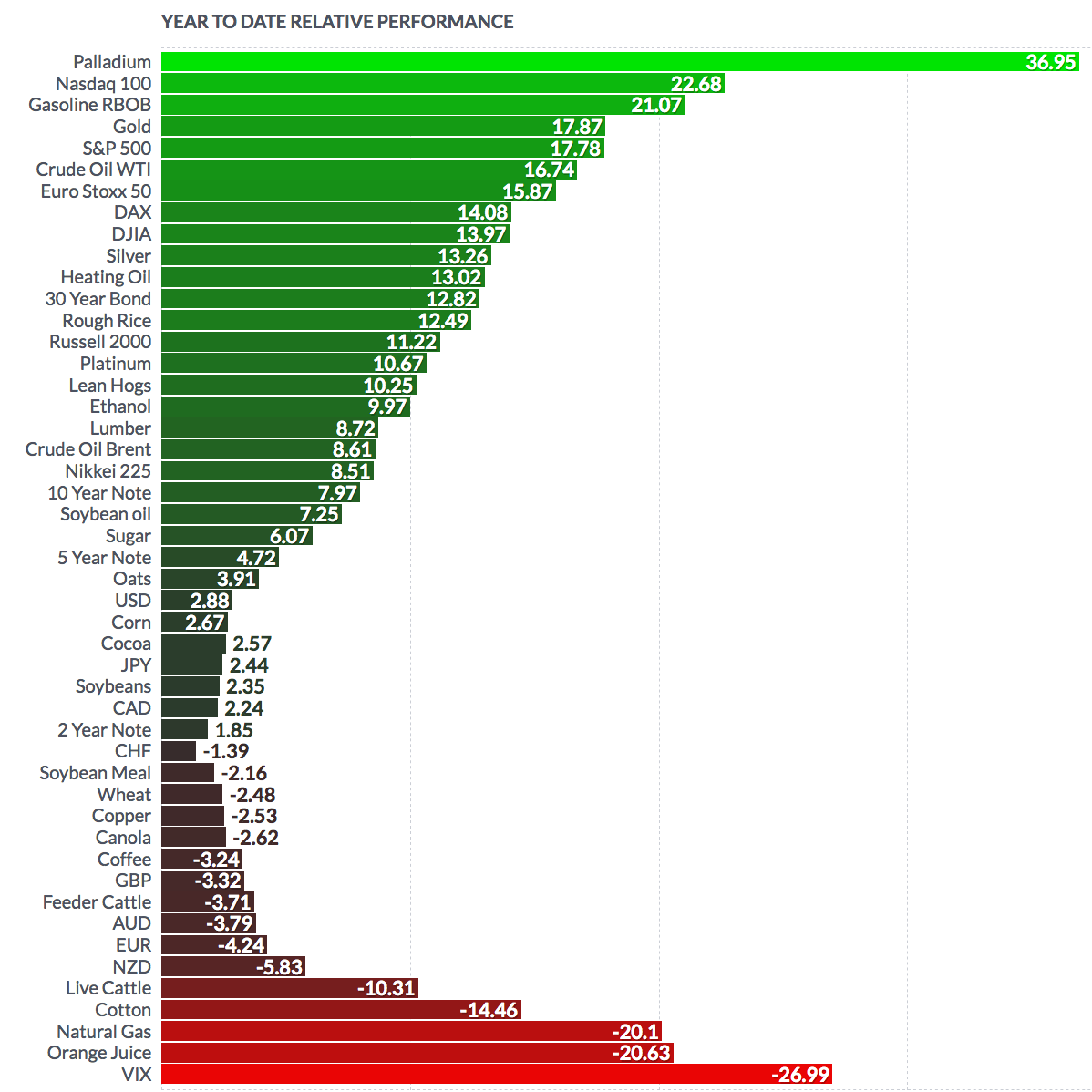

Futures:

WTI Crude has risen 16.74 in 2019, while Natural Gas has fallen 20.1%.