Yesterday was another day for sellers to pressure weak-hand longs into dumping their positions. Despite the sizable losses, most of the indices have yet to reach an oversold condition. However, there is a shift in relative performance between the indices.

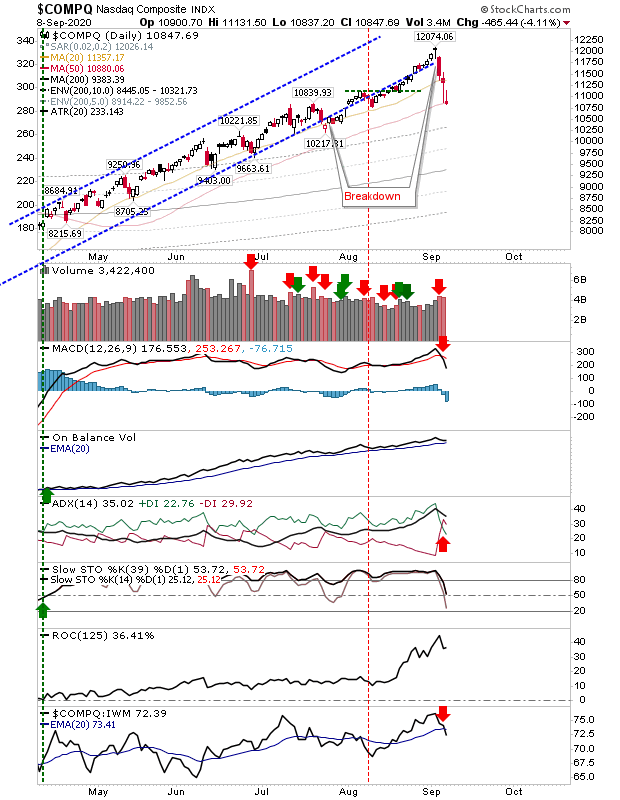

Losing out is the NASDAQ. It started the day at its 20-day MA but then gapped down to its 50-day MA. If the latter fails to hold then it's a long way to its 200-day MA. Stochastics are just about net bullish but it's looking likely this level won't hold. There are also 'sell' triggers in the MACD and -DI/+DI to consider.

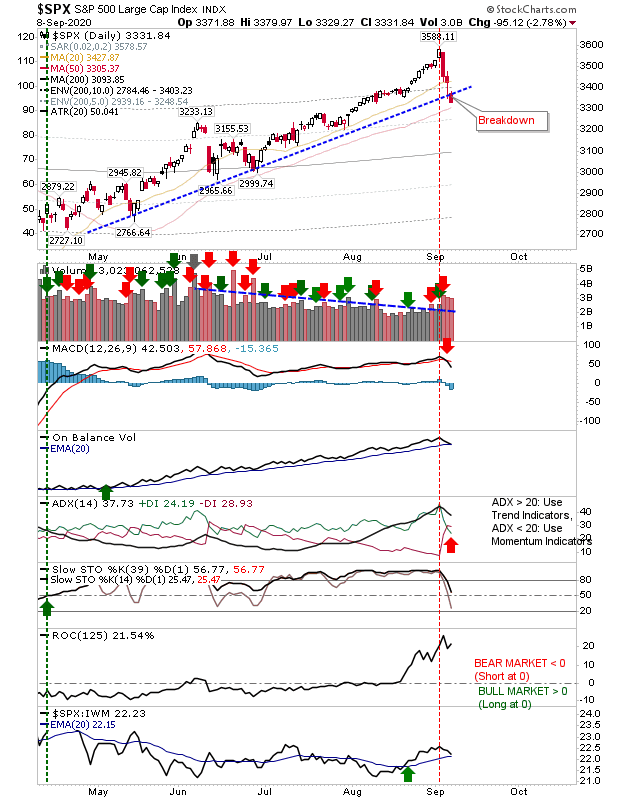

Next there is the S&P. It broke below its rising trendline from May on its way to test in the 50-day MA. Technically, there is also a 'sell' trigger in the MACD and -DI/+DI. The index is still outperforming Small Caps so there is still a chance for a recovery and a possible 'bear trap' if there is a close above the rising trendline.

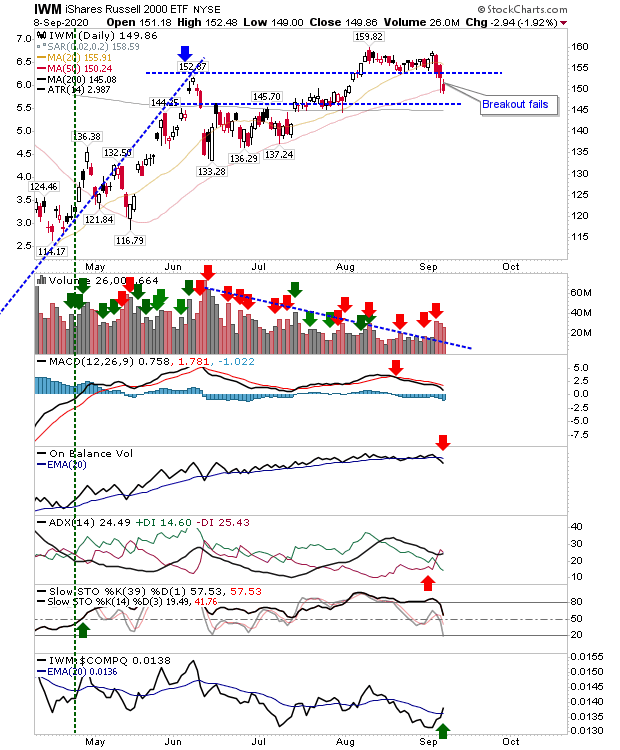

Small Caps (via IWM) was a bit of a mixed bag. The breakout lacked the impetus to follow through and yesterday's action effectively killed it.

However, the relative performance of the index is better than both Large Cap and Tech indices, so it's not seeing the same level of profit taking as the aforementioned indices. Tuesday's close left the index close to its 50-day MA with the 200-day MA not far below. The uptick in selling volume is a slight concern but it remains well down on the volumes of April-June. There are 'sell' triggers for the MACD, On-Balance-Volume and ADX to consider but if there is an index positioned to recover it's probably the Russell 2000.

With the markets having suffered three sizable sell-off days we are now in a position to consider what will happen when buyers next return. Bulls will not want to see a double top, which is a distinct possibility now that existing holders will be kicking themselves for not exiting sooner.

The loss of the breakout in the Russell 2000 is disappointing but not hugely damaging, with a trading range the most likely outcome from this. Again, until markets are oversold we can't consider a cash scenario.