During the bull run of the past decade, technology stocks have led Wall Street higher. Although they were among those shares that initially dropped during the COVID-19 triggered selloff in February and March, most technology stocks have had remarkable comebacks since hitting 52-week lows in late March.

So it comes as no surprise that there are dozens of technology exchange-traded funds (ETFs) in the US, not including leveraged ETFs or inverse ETFs. Below, we'll take a closer look at where the tech sector is headed and consider two funds for investment in robotics, artificial intelligence (AI) and autonomous technology.

Next Generation Tech Influencers

The technology sector encompasses many high-growth businesses. A large number of stocks with which investors worldwide are familiar are listed on the NASDAQ stock exchange. The NASDAQ 100 index tracks the 100 largest non-financial stocks listed on the NASDAQ exchange.

The index includes tech giants like Adobe (NASDAQ:ADBE), Google parent company Alphabet (NASDAQ:GOOGL), (NASDAQ:GOOG), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Facebook (NASDAQ:FB), Intel (NASDAQ:INTC) and Microsoft (NASDAQ:MSFT), among others. Especially over the past decade, these companies have had a substantial influence on our lives, becoming household names.

Yet, there are also new and more established companies in emerging fields such as AI, robotics and big data. This decade is likely to witness "intelligent" machines becoming a growing part of personal and professional lives.

Meanwhile, the collection and analysis of data are playing an ever-expanding role in business. The Internet of Things (IoT), 5G and mobile devices will likely contribute to the transformation of societies worldwide.

With all that in mind, here are two ETFs on our radar:

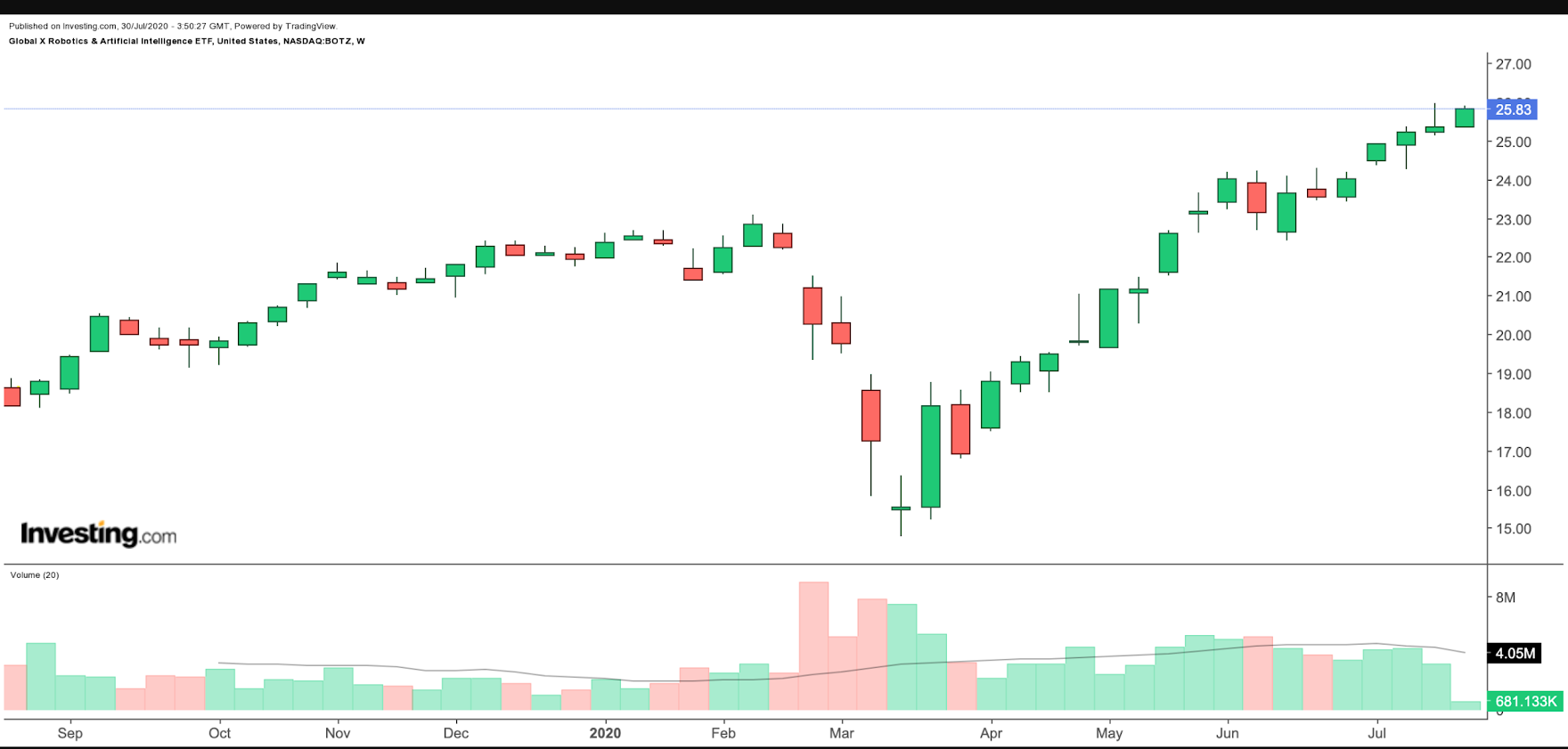

1. Global X Robotics & Artificial Intelligence ETF

- Current Price: $ 25.83

- 52-Week Range: $14.77 - $25.98

- Dividend Yield: 0.25%

- Expense Ratio: 0.68% per year, or $68 on a $10,000 investment

The Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ) invests in companies that could stand to benefit from increased adoption and utilization of robotics and AI. Such businesses may include those involved with industrial robotics and automation, non-industrial robots and autonomous vehicles. The fund tracks the INDXX Global Robotics & Artificial Intelligence Thematic Index.

BOTZ currently includes 31 holdings. The top ten make up approximately 65% of total net assets, which stand close to $1.6 billion. BOTZ's top five companies are ABB (NYSE:ABB), Intuitive Surgical (NASDAQ:ISRG), NVIDIA (NASDAQ:NVDA), Fanuc (OTC:FANUY) and Keyence (OTC:KYCCF).

Launched in September 2016, the fund provides significant exposure to non-US markets, too. Year-to-date (YTD), BOTZ is up about 17%. On July 27, it hit an all-time high. In case of short-term profit-taking in the fund, long-term investors may consider buying the dips, especially if the price goes toward $22.50.

2. ARK Autonomous Technology & Robotics ETF

- Current Price: $53.76

- 52-Week Range: $26.19 - $54.85

- Dividend Yield: N/A

- Expense Ratio: 0.75 % per year, or $75 on a $10,000 investment

The ARK Autonomous Technology & Robotics ETF (NYSE:ARKQ) is comprised of companies that may develop, produce or enable autonomous transportation, robotics and automation, 3D printing, energy storage and space exploration.

ARKQ currently includes 38 holdings. The top ten account for approximately 55% of total net assets, close to $320 million.

ARKQ's top five companies are Tesla (NASDAQ:TSLA), 2U (NASDAQ:TWOU), Xilinx, (NASDAQ:XLNX), Materialise (NASDAQ:MTLS) and Stratasys (NASDAQ:SSYS).

YTD, the fund is up over 44%. Like BOTZ, ARKQ also hit an all-time high earlier in July. However, it is important to note that Tesla’s weighting within this ETF is 10.17%. Therefore daily moves in TSLA shares affect the price of ARKQ.

In case of a price decline toward the $50- or even $45-level, long-term investors may find better value in the fund.

Bottom Line

Exchange-traded funds typically allow low-cost, efficient exposure to targeted markets and sectors, such as technology. While areas such as artificial intelligence, robotics and big data are still in nascent stages, those who believe in their potential for disruptive innovation may consider conducting further research and investing in these companies and ETFs.