- The 2023 market rally is taking a breather after substantial advances on the popular indices

- Breadth has been thin throughout 2023 and remains so

- While cyclicals attract investor capital, the weak market participation throws sand in the gears of a sustained and strong trend

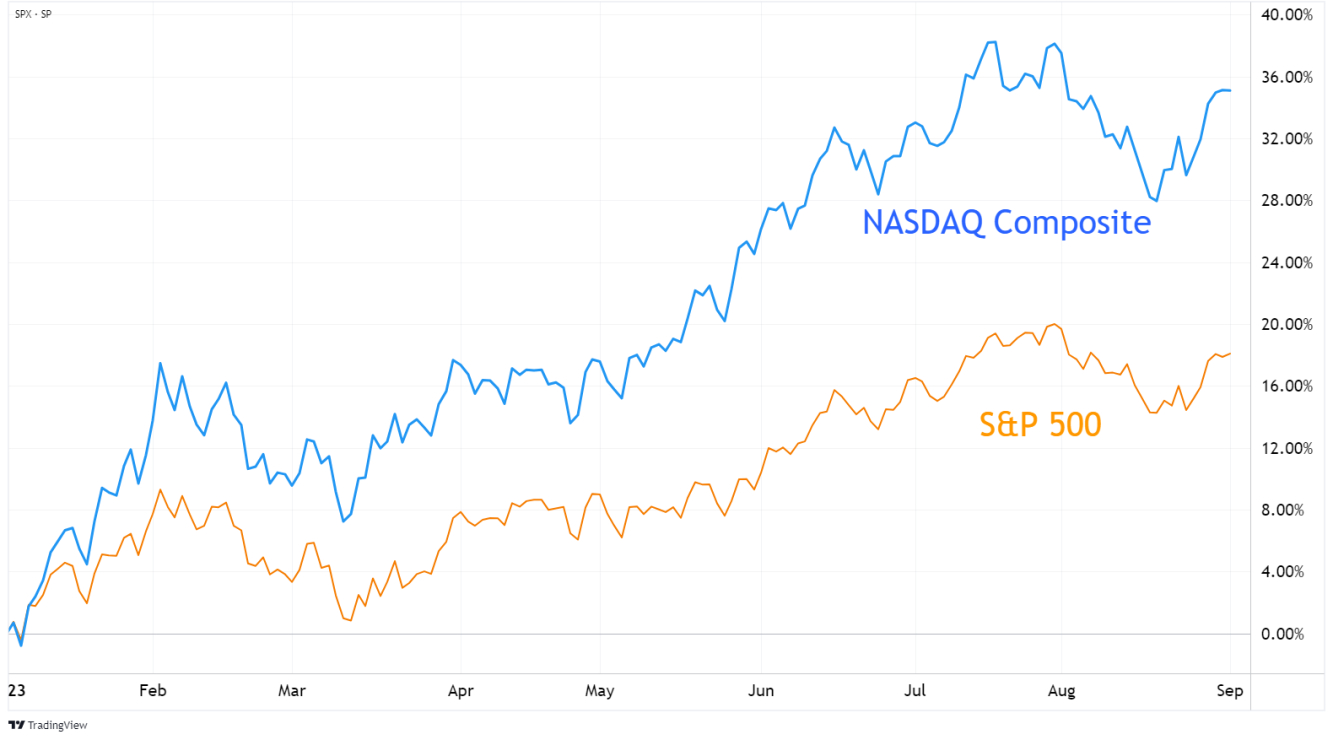

The impressive rallies of the NASDAQ Composite and S&P 500, YTD up 38% and 20%, respectively, look like they are just getting started.

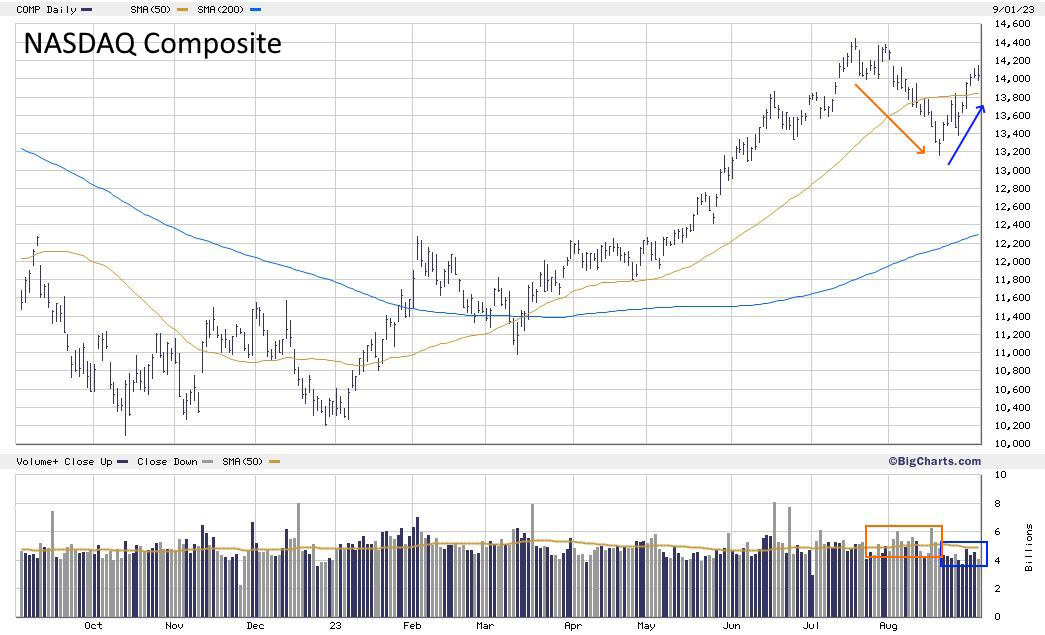

Of course, every rally requires a break, a breather for supply and demand to balance out again. When putting duration and %-extent of the NASDAQ rally in the historic context of all previous rallies since its inception, the odds of at least a temporary pullback had risen to above 4:1 in July.

Since July 19th, the index has pulled back roughly 9%, before staging a bounce on so-far muted volume.

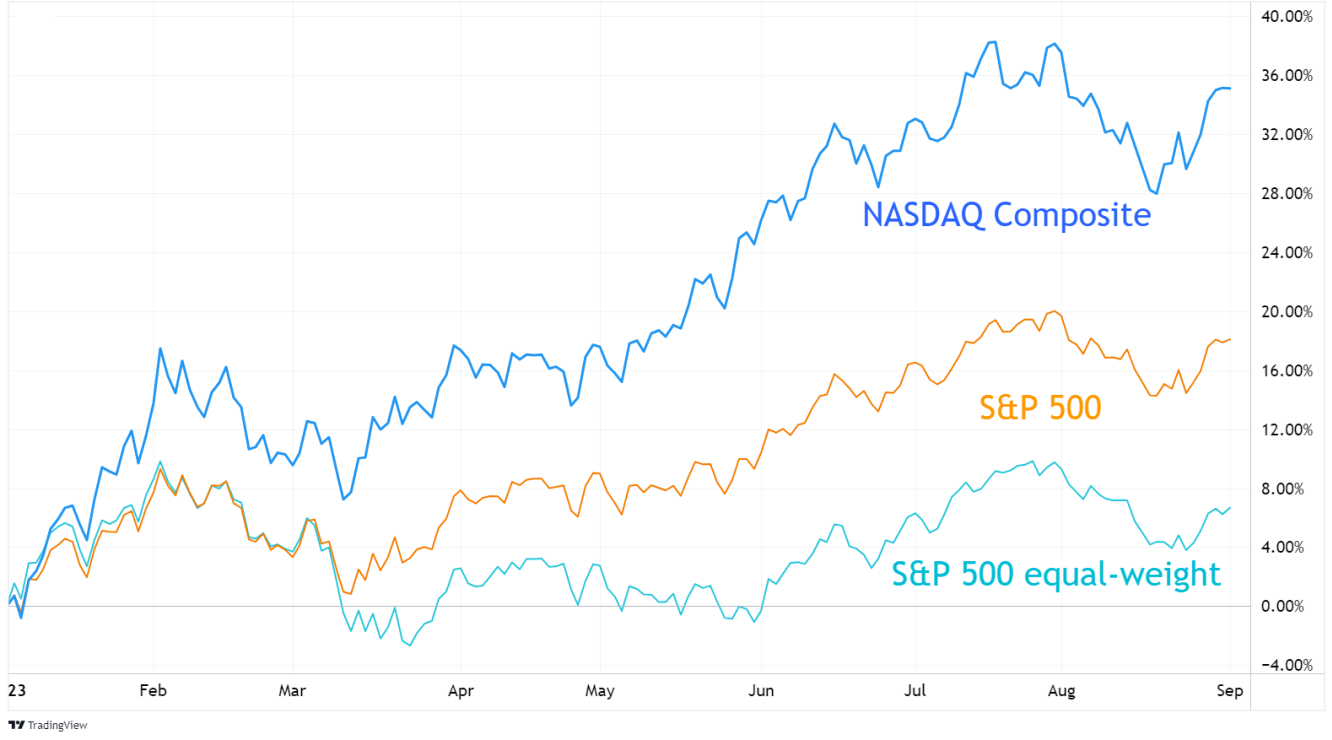

Despite the strong 2023 rally, which was a boon for passive index trackers in SPY and QQQ and dip-buyers in blue-chip stocks exposed to AI, the market advance has been thin. Very thin.

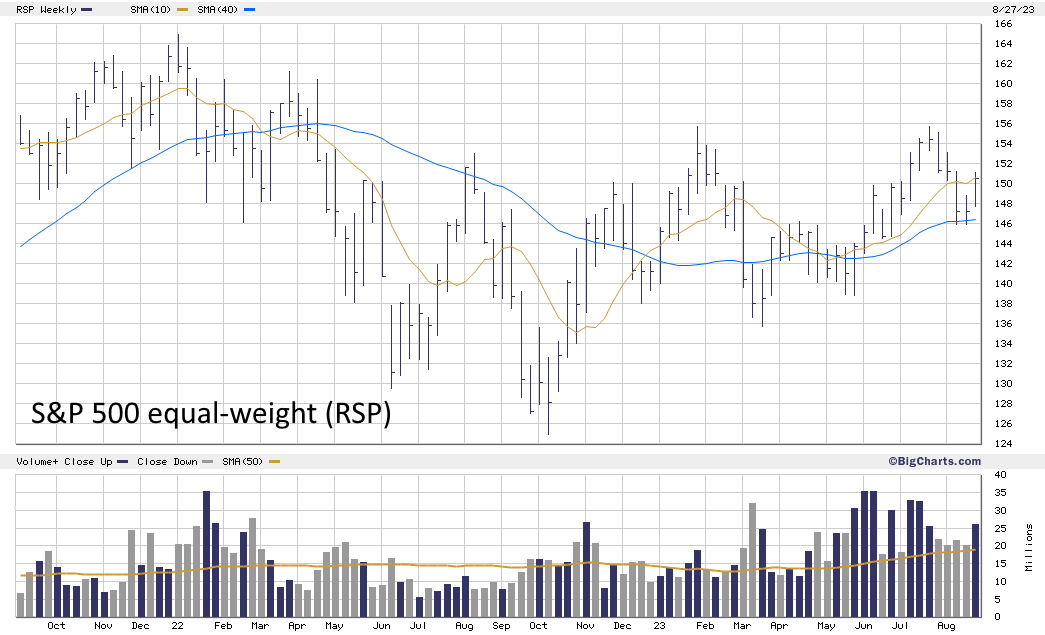

While the S&P 500 is up 20.19% YTD, its equal-weighted version RSP only managed to rally barely 10%.

In fact, the RSP has been trying to peg higher Highs in February and July 2023, but unsuccessfully so and has in effect been trading sideways and choppy since April 2022.

This massive divergence is due to the mega-cap bias of the S&P 500, the SPY, the NASDAQ Composite and the QQQ.

The top 10% of the S&P 500 explains 56.4% of its movement. For the QQQ, the top 10% explain 48.6%. These are staggering numbers, that warranted even a rare QQQ ETF rebalancing in July.

Of course, the “Magnificent Seven” stocks of Tesla (NASDAQ:TSLA), Apple (NASDAQ:AAPL), Amazon.com (NASDAQ:AMZN), Nvidia (NVDA), Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL), also termed the “MegaCap-8” including Netflix (NASDAQ:NFLX) by Yardeni Research, are largely the drivers of this massive divergence.

Broader market action, and segments not affected by the influence of the mentioned mega-cap stocks, show few to no signs of confirming the rally on NASDAQ or S&P 500.

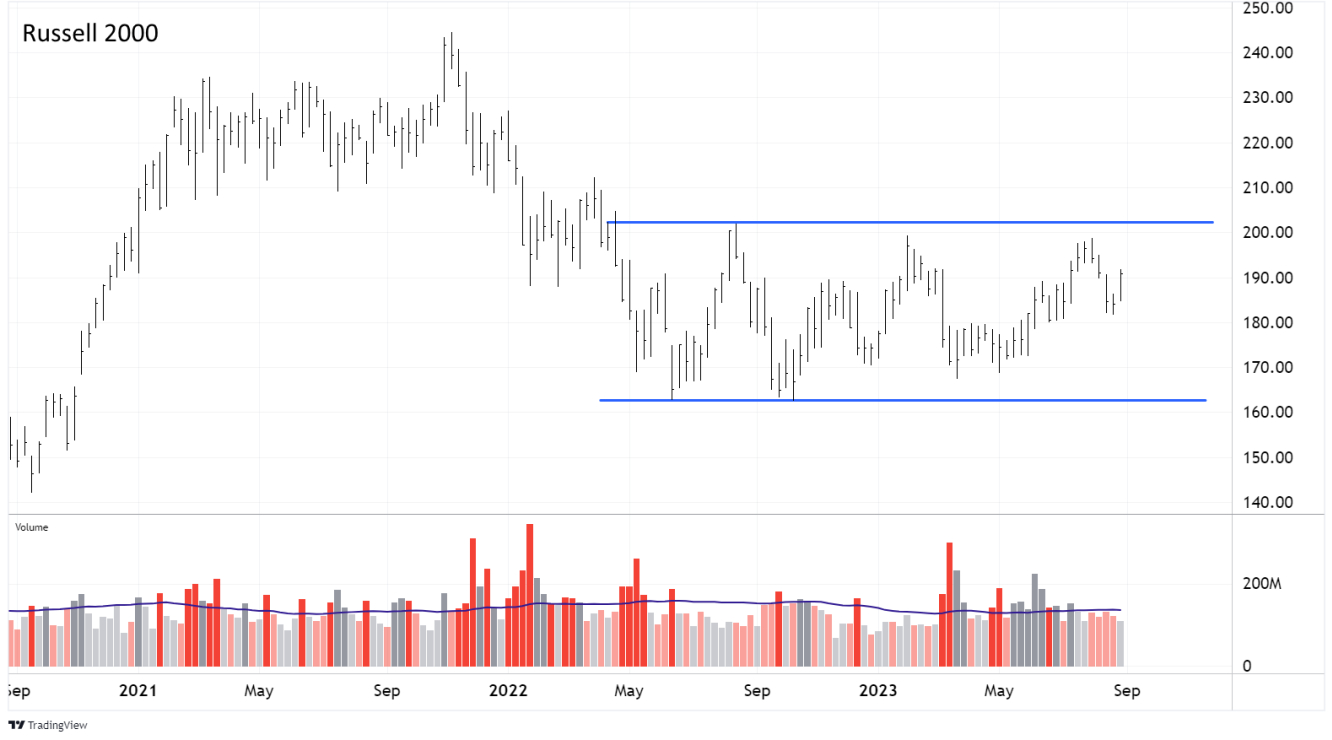

The Russell 2000, reflective of 2000 mid-and small-cap stocks, has been range-bound since April 2022, just like RSP.

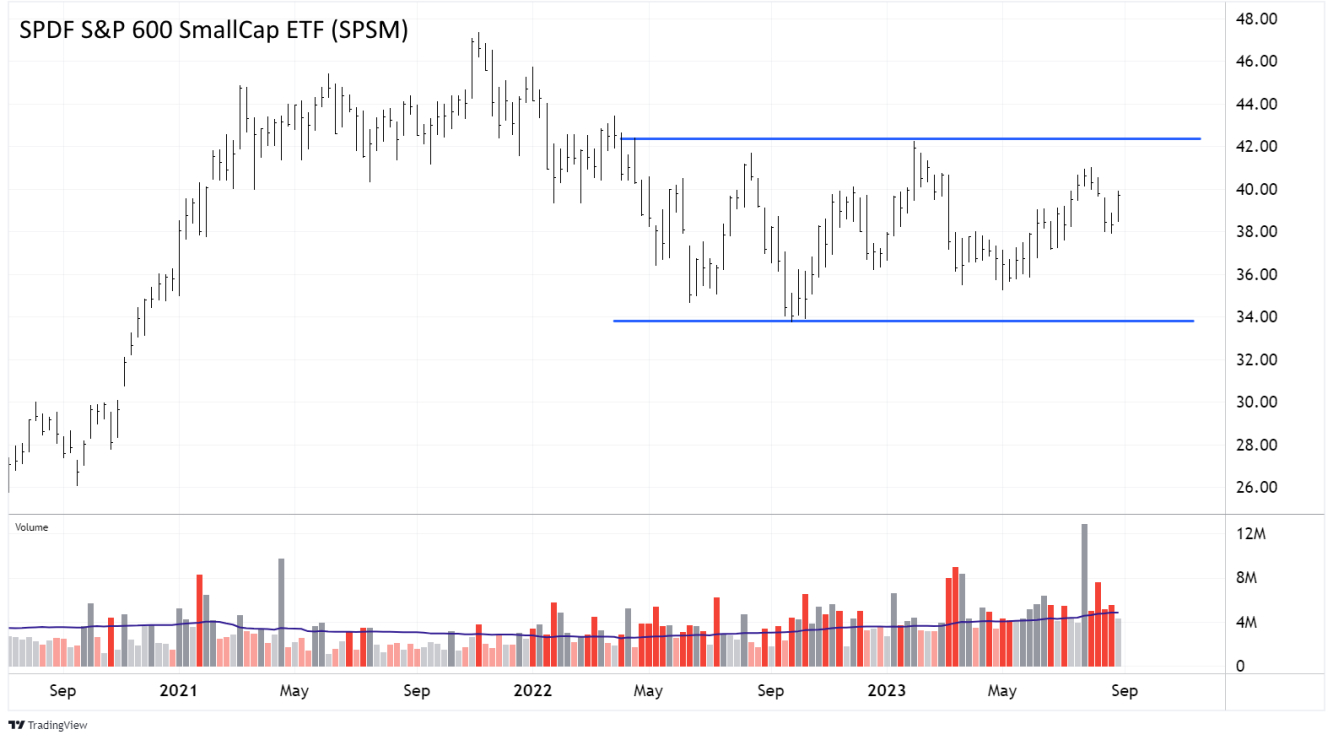

A similar picture is given by the SPDR® Portfolio S&P 600 Small Cap ETF (NYSE:SPSM) Small Cap ETF (SPSM).

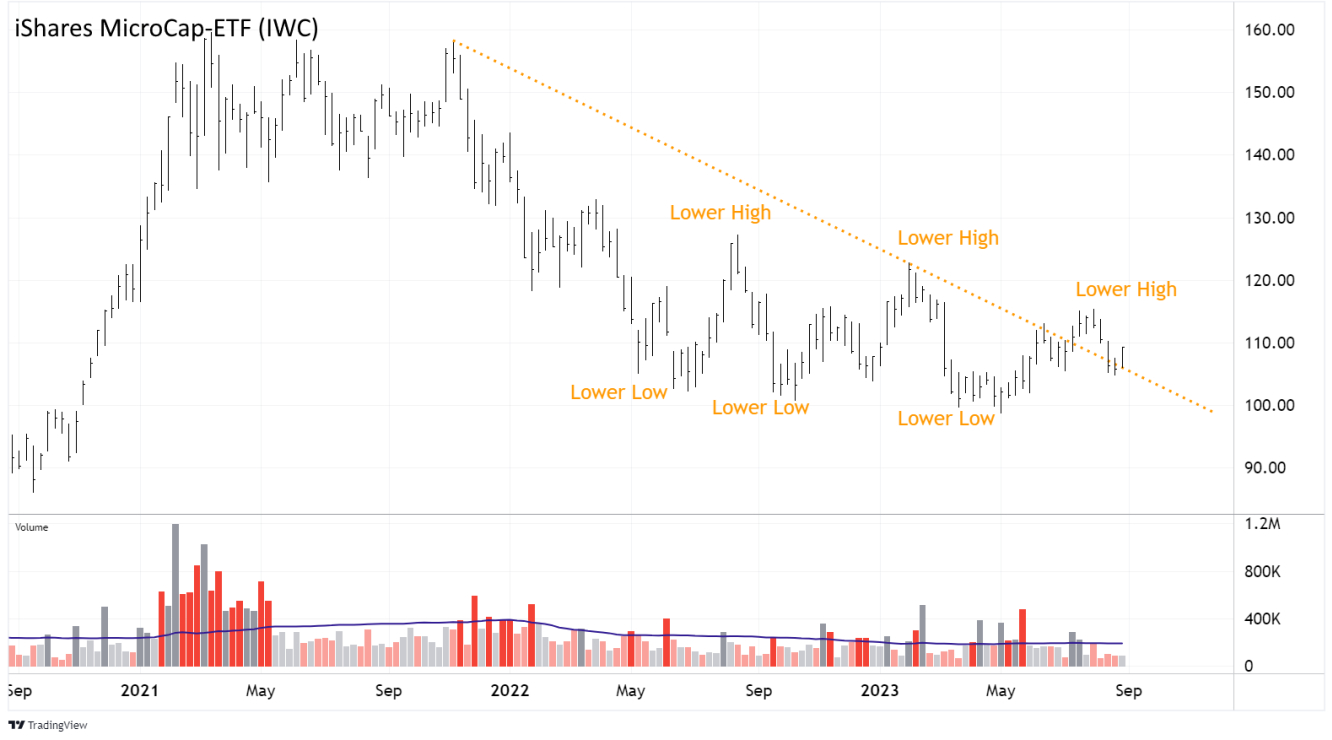

Microcaps, for example reflected by 1500 micro-cap stocks in the iShares MicroCap ETF (IWC), have been outright in a down-trend since late 2021. The ETF is currently attempting to break through the trend line, however a similar attempt in February 2023 has been unsuccessful.

Plotting out advancing minus declining (A/D) issues from the two main exchanges of NASDAQ and NYSE yields an indication of how stocks are moving as a group. Looking from that perspective, we can see that though the NASDAQ Composite has been leading the 2023 rally, it has in fact been witnessing a continuously decreasing amount of stocks advancing along with it.

This is not only observable for the whole of 2023, but since early 2021. Concomitantly, the NYSE A/D line is sloping up, largely driven by value investors buying up cyclical stocks from the groups of construction/engineering, capital goods and energy - all indications of an aging trend in the sector rotation model.

As the eminent Bob Farrell stated in his famous 10 market rules, “Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.”

Mid-, small- and micro-caps by and large represent the “risk-on” segments of the market and primary focus of stock pickers. Only broad markets will show emergence of these segments. A lack of fundamentally strong stocks from the risk-on segment of the market, such as we’re seeing now, cannot prime the market to become more than the hefty bounce in liquid large-caps that it already is.