Is it all fake?

Once again, we hear rumblings about the markets’ new all-time highs and whether or not they’re genuine.

There’s an argument being made that recent highs on the Dow Jones Industrial Average are unsustainable. The belief is that unless a new all-time high is also hit on the Dow Jones Transportation, there’s no reason for a continued breakout.

I think that’s bunk. As I’ll show you, there’s evidence to support the broader markets reaching new all-time highs -- again -- before year’s end.

And investors who play the trends behind these moves should profit handsomely.

Here’s The Situation:

- The last all-time high for the Dow was August 15 at 18,722.61.

- The last all-time high for the Transports was back in November 2014 at 9,310.22.

- Today the DJT is trading at 7,946.79. That means it’s more than 14.5% below that high set nearly two years ago.

Admittedly, that’s a lot of ground to cover before we see confirmation of the DJI’s continued uptrend.

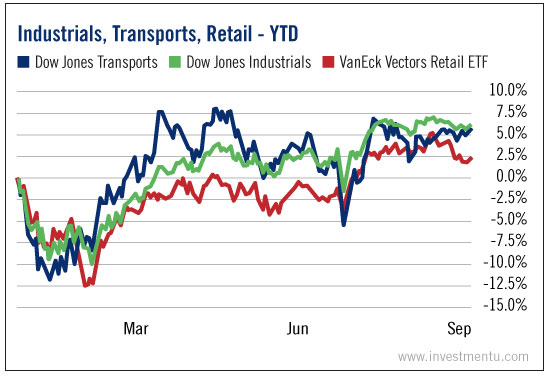

Year to date, Transports have lagged Industrials only slightly. Meanwhile, the retail sector - tracked below by the VanEck Vectors Retail ETF (NYSE:RTH) -- is struggling. (The retail and transport sectors are related since goods have to be shipped to stores.)

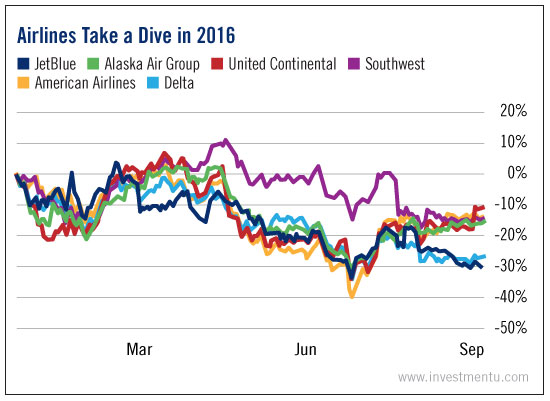

Now, of the 30 components of the Transports index, six are airlines. These got rattled following Brexit and Zika. But prior to that, they were already dealing with concerns over terrorism.

Because of all that negativity, every airline that’s a Dow Transports component is down double-digits in 2016.

The remainder of the DJT index is railroads, trucking companies, freight shippers and plus package shippers United Parcel Service (NYSE:UPS) and FedEx (NYSE:FDX). These businesses have all done pretty well this year.

But here’s the deal: Not only is retail heading toward its best period of the year -- what I call its Prime Period -- but so are Transports.

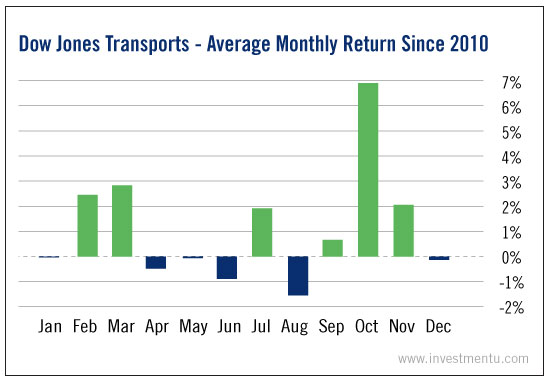

Take a look at this chart. It shows the average monthly performance of the Dow Transports of the past five years.

We see that September, October, November, February and March are the best months for the index. In fact, the Dow Transports haven’t fallen in October since 2009.

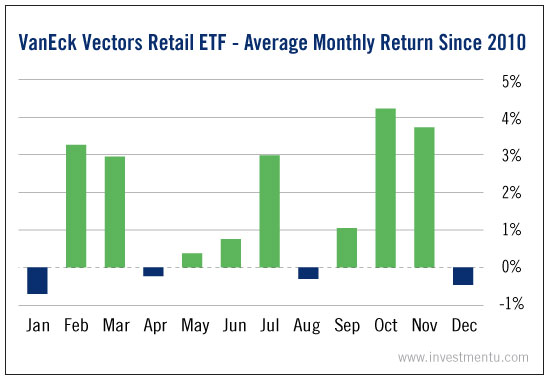

Now let’s take a look at the average monthly performance of the VanEck Vectors Retail ETF, which holds the largest retailers in the world. Its largest holding? Amazon.com (NASDAQ:AMZN).

We see a strikingly similar trend.

Both sectors -- Transports and Retail -- see their Prime Periods in October, with the momentum carrying over into November. Then we see a strong performance again in February and March.

It’s really no surprise. Both sectors are largely dependent on consumers. And consumer spending accounts for more than 70% of U.S. GDP. So when these markets enter their best periods of the year, it only makes sense that the broader markets will push higher.

Since 1993, the best month of the year for the S&P 500 is October. It’s the second-best month of the year for the Dow Industrials.

Here’s The Reality:

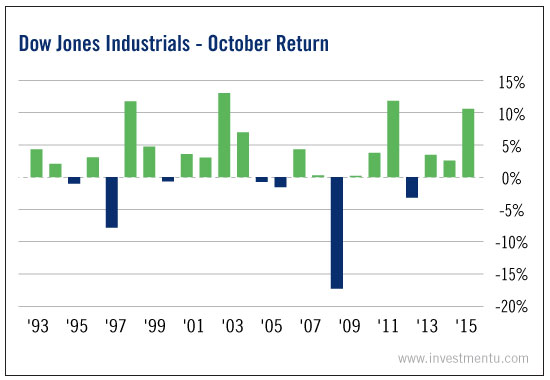

Despite all the negativity, gloom and auspiciousness that surrounds October for the broader markets, the Dow Jones Industrials have ended the month in the red only six times in the last 23 years.

Which brings us back to those concerns from the top of the article.

Is the Dow’s uptrend over? Will we not see any more highs in 2016?

Is it all fake?

These types of questions have nagged our bull market for seven years. And the same old excuses are trotted out every time. Bears say the market’s moves shouldn’t be trusted because of central bank monetary policy... our sluggish economic recovery... so forth and so on.

The financial crisis of 2008 hurt a lot of investors financially. But many more were broken psychologically. Dealing with two major market crashes in less than 10 years created widespread distrust of the markets.

In response to that volatility, I did something different. That’s where my Prime System ultimately came into being.

It’s a short-term focused, trend-based trading strategy.

I don’t spend my time fretting over the broader market’s demise. Instead, I focus only on where I can see consistent profits over a short period of time. I move from one sector to the next during each of their Prime Periods throughout the year.

Because the truth is: There’s always a bull market somewhere.

In October, it’s likely to be in those two key sectors, Retail and Transports. Historically, the trend is on our side.

And I wouldn’t be surprised if those sectors help push the broader markets to new all-time highs.

Good investing,