As we’ve been arguing of late, a rate hike from the Federal Reserve must now be seen as a positive for risk assets, although this view really depends on the pace of potential appreciation in the USD.

Global systemic and economic risk assessment has been adopted as a key unofficial mandate for the US Central Bank, effectively making them an aggregator of global sentiment. In the Fed we take our cues for risk appetite and I genuinely feel that a December rate would be a statement that things are actually looking good.

Naturally, we will need to see stabilisation in Chinese economic indicators and the various equity markets, as China seems to be the pivotal story for so many central banks. For what it’s worth, I sit in the camp that Chinese equities are more attractive than they have been for months and, if I put my analyst hat on, I would be upgrading the China CSI 300 to ‘neutral’ from ‘underweight’. A very much sitting-on-the-fence call, but I just think that with the reduction in margin debt, an index trading on 12.4x forward earnings (relative to the year-to-date average of 14.8x) and a lowly 4% of companies above their 50-day moving average, sentiment has got a touch too bearish. This is in fitting with commentary from the Beige Book released over the weekend.

Despite these variables, it’s still worth looking at the insanely low volumes of CSI 300 futures traded on the futures exchange. Last week we saw an average of 16,761 contracts traded, which is amazing given this was closer to two million contracts four or five months ago. We know various futures players have migrated to the A50 Futures market with the exchange in Singapore, although volumes here are still much lower than the 20-day average. So it begs the question: How many hedge funds are actually left in China?

Volumes are also terrible in Australia and the real story is one of a buyers’ strike while Japan is offline amid a general confusion as to the macro environment in which we have to invest/trade in. As of midday, turnover was some 33% below the 30-day average for the same time. Market participants just can’t get a strong grip and this is quite easily seen in the daily chart where the ASX 200 seems perfectly happy oscillating in a range of 5200 to 5000, with the financial sector underpinning this moving in a range of 6000 to 5800.

We haven’t necessarily seen a strong contraction in the daily ranges and the average (true) range over the last five days is 92 points, some 33% above the year’s average. I guess this is a reflection of the strong conflict taking place between the bulls and the bears, and when we get this sort of disagreement you generally get volatility.

European markets look set to open on a slightly firmer footing, although we have started to see a stronger trend creeping in to sell S&P, Brent and copper futures. These markets could feasibly roll over on limited news, such is the trading environment, so it’s worth keeping an eye on price action here.

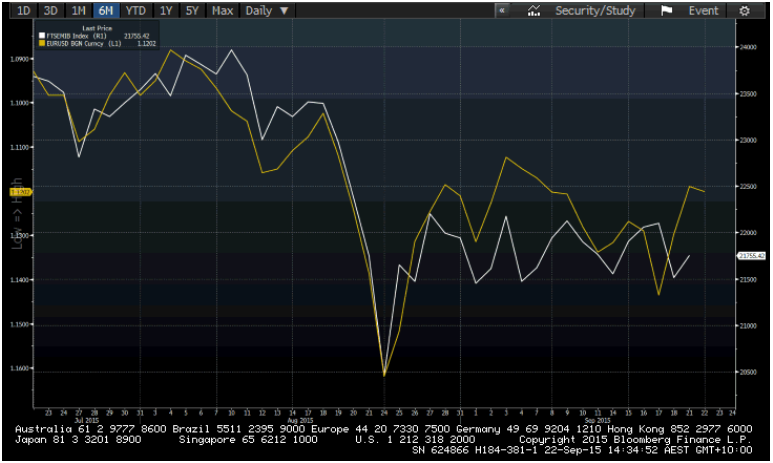

Specifically, the Italian MIB should really outperform if the EUR/USD fall still has legs, and so this market is firmly on the radar, especially with the fed funds future implying a 45% probability of a December hike from the Federal Reserve. Looking at EUR/USD on a four-hour chart, one can see the uptrend that started in early August has been broken. This is where behavioural analysis kicks in and a slight rally into the former uptrend (now seen at $1.1230) and subsequent rejection would suggest looking quite seriously at short positions for a move back into the $1.0800 to $1.1000 area. Interestingly, the inverse correlation between EUR/USD and the Italian equity market is perhaps the strongest of the European markets, with a 30-day rolling (inverse) correlation of 57%. Two weeks ago this percentage stood at 77% which was actually the largest inverse correlation since 2003!

Bloomberg chart showing the correlation between the MIB (white) and EUR/USD (I’ve flipped this to highlight the correlation):

There seems to be a growing belief that the European Central Bank will ease further this year, although we are just as likely to see its current QE program being extended into 2017. We have heard from a number of ECB officials regarding the need to do more (including the bank’s Chief Economist Peter Praet), so traders would be wise to listen to narrative this week from Jens Weidmann and Mario Draghi (in his quarterly hearing). In terms of further Fed speakers, the real treat for traders will be Janet Yellen, who gives a speech titled ‘inflation dynamics and monetary policy’ in the twilight period between the US close and Asia open on Friday morning (07:00 AEST).

What more can we possibly learn from Fed speakers given everything we have heard of late? It seems logical that we are going to have to see new information, and therefore assess upcoming China data and price action in its equity market. We will also keep an eye on any improvement in financial conditions from here, as well as any increase in implied probability for a December hike. Until then, expect this period of uncertainty to continue, along with a further schooling in the need to understand how to adapt portfolios to heightened volatility.

Ahead of the open we are calling the FTSE to open at 6106 -2, DAX 9964 +16, CAC 4586 +1, IBEX 9866 +10 and MIB 21729 -26.