The upcoming calendar has plenty of data in a holiday-shortened week. There could be OPEC or Black Friday news. In spite of this avalanche of information, I expect commentators to look for an organizing principle. In a week when many will be giving thanks, there will be scrutiny of the new market highs.

Many will ask: Are investors too complacent?

A Personal Message

It has been a very good year for WTWA and our followers. I have had a lot of help, so I have personal thanks for many.

- My original editor at Seeking Alpha who helped to develop this concept. She does not like to be named, but she knows who she is, and I think of her each week.

- The continuing support and help from the Seeking Alpha editorial team.

- Abnormal Returns – the gateway to the investment world and an early blogging colleague. Tadas has both guided me to great information and helped me to find many new friends.

- Sources that pick up and circulate my work, especially including Doug Short, Advisor Perspectives, Global Economic Intersection, and Investing.com.

- My friends on Twitter who provide pointers and help me reach new readers.

- The many great sources that I rely upon each week.

- And most of all – my readers. Without the comments, ideas, and encouragement, I could not tee it up each week.

I must not leave out Mrs. OldProf, who has given up many Saturdays and Friday nights while I was writing. I might take off next weekend or do an abbreviated column while enjoying the visit of her family.

Prior Theme Recap

In my last WTWA I predicted that media would focus on commodities, with special attention to the rebound potential. Instead, there was plenty of discussion of the Fed Minutes and the energy discussions were all pretty bearish. Even looking at the week’s history it might be hard to come up with a single theme.

By the end of the week, Melissa Lee and the Options Action traders were discussing some of the rebound action in commodities, with a focus on FCX (which I have been using as an example). But no excuses. Sometimes the theme is difficult to capture in advance.

Feel free to join in my exercise in thinking about the upcoming theme. We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

This Week’s Theme

There is plenty of economic data this week, mostly crammed into two days of releases. On Friday those who are working will be greeted with the results of the OPEC meeting and early releases about Black Friday sales. It is a very tough week for my “Guess the theme” challenge.

I am going to fudge the exercise just a bit this week by discussing “complacency.” This has been a frequent recent pundit theme and is certainly a candidate for a week where it could be confused with “giving thanks” for past gains and warnings to take profits. I will venture out onto that limb and suggest that the week will feature the question: Have investors become too complacent?

The basic argument for this viewpoint is twofold:

- The market is making new highs despite a long list of geopolitical concerns and “nosebleed valuations.” Is everyone blind? These sources colorfully describe investors as “sheeple” who have been sold a bill of goods. It will end badly.

- Low volatility is a sign of complacency. The low VIX and even the low St. Louis Financial Stress Index indicate danger. Beware!

The theme is worth a separate post, but let me highlight the most obvious responses:

- Those who choose to buy stocks are not ignorant of the list of worries or the crash warnings. They have the same information as the worriers, but they have reached a different conclusion. Check out Richard Bernstein’s list of fifty concerns that have kept people out of the market. It is a great list, perhaps helping people to understand the most difficult concept for investors – the Wall of Worry. It was a factor behind my Dow 20K forecast.

- Thinking about a group of people, or a market, as if it were an individual but be done with care. It may be a useful shorthand, but you cannot forget the underlying dynamic. Right now the market has been trading in a narrow range. That might represent an uneasy balance between those with sharply divergent viewpoints. The result might change rapidly with new evidence. Think of a tug-of-war, with two sides evenly matched. Do these men look complacent?

I emphasize risk control and have special methods for avoiding complacency. You should, too. More about that in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

The news last week was mostly good, even better than stock prices suggested.

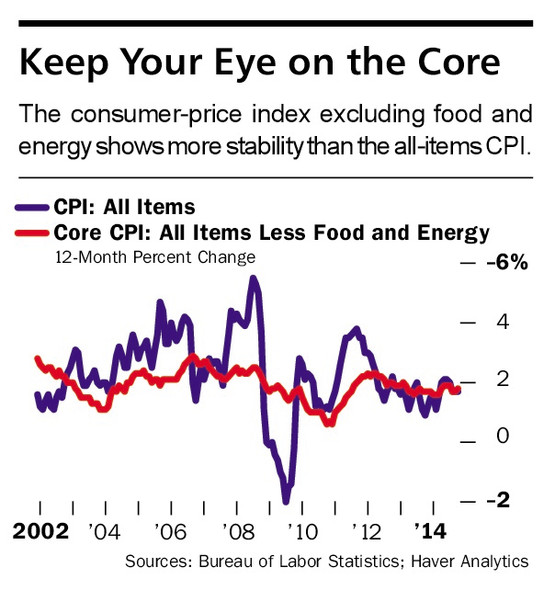

- Inflation remains low. The stubborn unwillingness of many investors to accept this conclusion is a big source of error – mostly from misreading the Fed and buying gold. Remember when many complained about using core inflation because food and energy were important? Now that energy prices are lowering the overall inflation rate many complainers have moved on to a new argument. Rex Nutting has a nice article explaining that “stuff” that we buy is getting cheaper while services are not. Barron’s shows that core inflation is better described as the trend, including this chart:

- The Philly Fed index was incredibly strong – a reading of 40.8 versus 20.7 in the prior month. It was the best reading since 1993. One of the reasons that I ignore this report and other regional Fed diffusion measures is that the market usually does not take the result seriously. No one understands what a diffusion index is (change over the prior month, not a level). The interpretation is always flawed. In this case the market did not really react and everyone rushed to explain that it was probably an outlier. To realize the flaw in this reasoning, suppose that it had been 25 instead of 40? Would that have made it credible? Or what if it was only 8? Would Rick Santelli be explaining the economic weakness behind the “big miss?”

- Building permits showed strength – the highest level since 2008. It is good, forward-looking news. (Calculated Risk) Steven Hansen at GEI focuses on the decline in the long-term trend.

- Chinese rate cut. The market celebrated, but the verdict is probably mixed. This is a story worth monitoring. It is probably good for our commodity theme from last week, but perhaps not for the overall US economy.

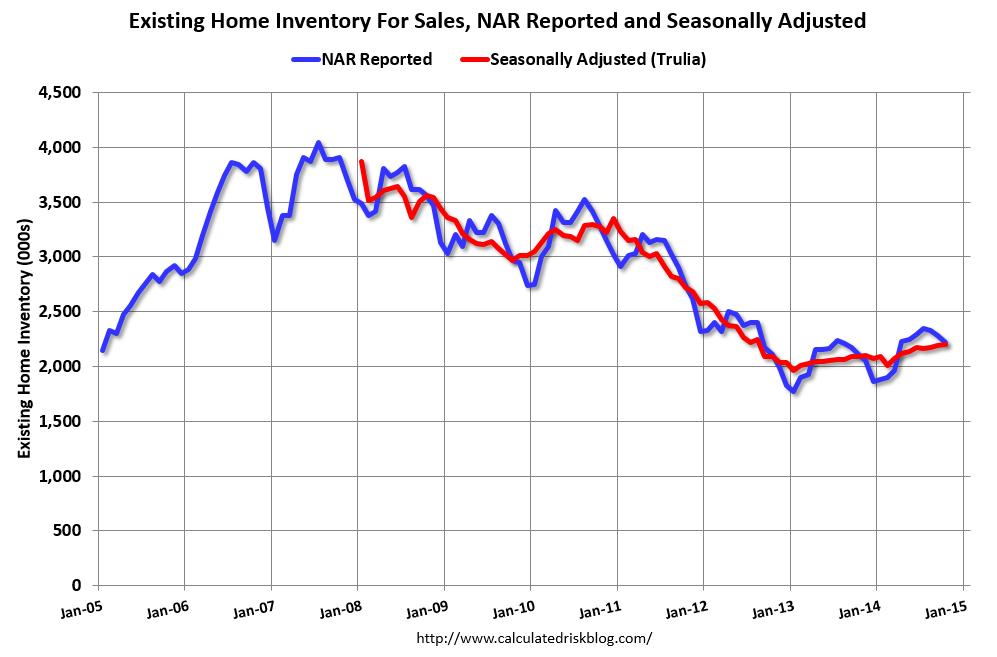

- Existing home sales were solid. The verdict is from Calculated Risk, our “go to source” on all things housing. The data involve inventories, seasonal adjustments, and plenty of noise from the sample. Read the full story to get a good explanation for the summary chart:

- Leading Economic Indicators beat expectations. The sharp increase is part of an overall picture of October strength for the US. New Deal Democrat’s summary of high frequency indicators covers the story well.

- Q3 earnings beat estimates handily. Q4 is also looking good. There are various ways of calculating the change. Brian Gilmartin cites Thomson Reuters data as showing the Q3 growth rate as 11.2%. (He carefully examines some of the big outliers). FactSet reports that 77% of the S&P 500 companies have beaten earnings estimates (best since Q210). In a refreshing change from recent quarters, 59% beat revenue estimates. (But please note that more Dow 30 companies reported declines in European sales).

The Bad

There was not very much bad news. Readers are invited to nominate ideas in the comments, but remember that we are focusing on recent developments, not a list of continuing macro concerns.

- Politics. The rhetoric escalated again. The Keystone pipeline bill failed by one vote in the Senate (with the parties agreeing that a 60% super-majority would be required). This legislation will pass next year, possibly with enough support to override a veto. The President advanced his immigration via Executive Order plan in spite of GOP warnings. I am not scoring this as “bad” because of the merits of the specific policies. As investors, the key aspect for us is a government shutdown or questions about the debt ceiling. We are not yet at that point, but it bears watching.

- Q1 Job Gains. I have insisted that we should monitor the actual count of job changes from the state employment agencies and compare it with the estimates from various sources. The “official” BLS report is an estimate, based upon surveys and modeling. The true count is part of the Business Employment Dynamics series. It is ignored because it is “old news.” It should be used to measure the accuracy of those doing the estimates. This week’s release showed that Q1 net job gains were only 397K, about 200K less than the BLS series. Last year the BLS estimate as a bit too low. The early returns this year are different.

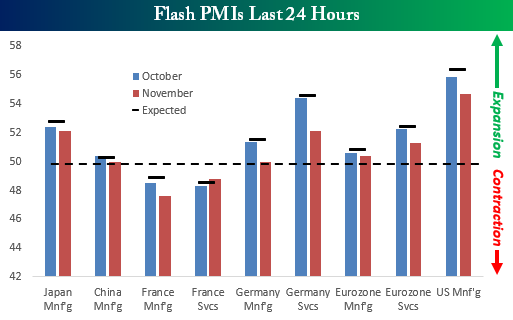

- Markit Flash PMI for Europe was only 51.4. This is the lowest in 16 months, and is consistent with growth of only 0.1 to -.2%. (MarketWatch) Scott Grannis takes the contrary side. Bespoke has the story with both analysis and one of their great charts.

- Industrial production disappointed. There was a slight decrease instead of the expected increase in the October report.

Noteworthy

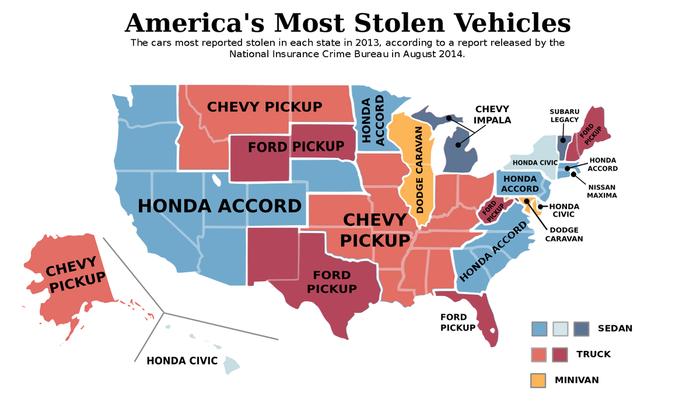

The most stolen car in my state is the Dodge Caravan? Check out your own state and the reason behind the unlikely results.

The Ugly

Ebola stock scams. The SEC has suspended trading in four small companies making “unverified claims.” Also beware of calls concerning private companies. (Reuters).

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. No award this week. Nominations welcome!

Quant Corner

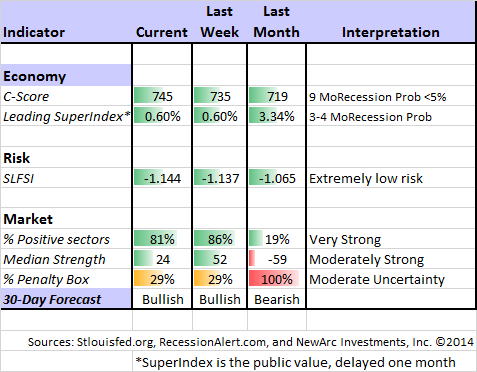

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (three years after their recession call), you should be reading this carefully. This week there is (yet another) change in the ECRI story. See also his regular updates to the “Big Four” economic indicators important for official recession dating.

Georg Vrba: has developed an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. Georg’s BCI index also shows no recession in sight. Georg continues to develop new tools for market analysis and timing. Some investors will be interested in his recommendations for dynamic asset allocation of Vanguard funds. Georg has a new method for TIAA-CREF asset allocation. I am following his results and methods with great interest.

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting market indicators.

This week Dwaine has updated one of his timing approaches in Fingerprints of a short-term market top. It is a nuanced report, but you can check it out without charge. You should read it in full. Here is a key conclusion:

The SP-500 is on a tear. Normally such rapid advances coming from rare, deep, oversold levels and rare great-trough buying signals signify new bull-mark sequences with multi-month gains. However some intermediate corrections are likely on the way up. For now, some short-term breadth momentum has faded, but there are no immediate signs of an intermediate market-top forming. But this situation could change rapidly.

Stay tuned!

We are fans of The Bonddad Blog. Last week we highlighted Hale Stewart’s concerns about the global economy. His colleague, New Deal Democrat, has also been a recent skeptic about economic prospects. This week saw something of a change in his viewpoint – sparked by building permits! This is an indicator that I also favor. NDD helped to identify this as something that the ECRI (probably unwisely) dropped from their WLI series. His conclusion:

This doesn’t mean the economy finally achieves lift-off in 2015. But it pretty much takes contraction of the table for the US economy.

Paul Kasriel has a wonkish analysis of US and European monetary and fiscal policy. One reason that I read GEI is their embrace of a wide range of viewpoints. No matter what you think, you will find this piece stimulating. Here is the conclusion:

The point is that in both the U.S. and the eurozone, there has been fiscal austerity in recent years. Yet, U.S. aggregate domestic demand has been considerably stronger than that of the eurozone. The tale of the two economies is that in one, the U.S., the Fed pursued a QE policy, resulting in the better of times. In the other, the eurozone, the ECB eschewed a QE policy, resulting in the worst of times.

The Week Ahead

There is a lot of data packed into three days of a holiday-shortened week.

The “A List” includes the following:

- Initial jobless claims (W). The best concurrent news on employment trends, with emphasis on job losses.

- Consumer confidence (T). Conference Board version. Another high in store?

- Michigan sentiment (W). Also making new, post-recession highs. CXO Advisory has a nice report showing that this indicator does not lead the stock market. It is a coincident or lagging indicator. I agree. There are few true leading indicators. Most of what we see just fills in the current economic picture.

- Personal income and spending (W). An important economic series.

- PCE prices (W). The Fed’s favorite inflation indicator.

The “B List” includes the following:

- Durable goods (W). Possible rebound from weak September?

- Chicago PMI (W). Assumes a greater interest as an indicator for the national ISM index when released before an extra-long weekend.

- Pending home sales (W). Everything in housing is important, but this has less direct impact than new sales.

- Case-Shiller home prices (T). September data and a lagging average of 20 cities.

- FHFA home prices (T). September data and a limited sample of homes.

Most of the speech making will be on hold for the holiday. The big news might come from Thursday’s OPEC meeting. We will also have the expected “flash bulletins” about Black Friday shopping. This could lead to some action in Friday’s slow and abbreviated trading.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix continued the profitable bullish posture for another week. There is excellent breadth among the strongest sectors. Ratings have gotten a bit lower, but are still quite solid in many sectors. Felix does not anticipate tops and bottoms, but responds pretty quickly when there is evidence of a change. The penalty box can be triggered by extremely high volatility and volume. It is similar to a trading stop, but not based only on price. There has been quite a bit of shifting at the top, so we have done some trading. You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com.

Traders might also be interested in Goldman’s top ideas for 2015.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. The recent “actionable investment advice” is summarized here.

Whenever there is a market decline, we are bombarded with “explanations” and predictions of disaster. To keep perspective I wrote a section recently covering these three points:

- What is not happening;

- Factors most often linked to major market moves; and

- The best strategy for the current market.

If you missed this section from a few weeks ago, I urge you to check out the Investor Section of the earlier WTWA.

Taking advantage of what the market is giving you is always a good strategy.

Other Advice

Here is our collection of great investor advice for this week:

Stock Ideas.

- David Tepper’s holdings (via Josh Brown). Josh also points to Dataroma, which lets you explore the filings of other big-name fund managers.

- The top 50 stocks held by hedge funds (Business Insider).

- More dividend stocks from the hard-working and prolific Chuck Carnevale.

Interpreting Information. Morgan Housel covers many Stupid Things Finance People Say. You will see plenty of familiar silliness and also have a good laugh from this article. Here are some of my own favorites from his list:

“He predicted the market crash in 2008.”

He also predicted a crash in 2006, 2004, 2003, 2001, 1998, 1997, 1995, 1992, 1989, 1984, 1971…

“More buyers than sellers.”

This is the equivalent of saying someone has more mothers than fathers. There’s one buyer and one seller for every trade. Every single one.

“Stocks suffer their biggest drop since September.”

You know September was only six weeks ago, right?

“We’re cautiously optimistic.”

You’re also an oxymoron.

Market Outlook

There are plenty of stories about bubbles and crashes and what the Fed has done wrong. Those who focus on corporate earnings and use P/E ratios more recent than the Taft Administration have a more positive outlook. This is especially true if your concept of an appropriate multiple is adjusted for interest rates and/or inflation. If this viewpoint is correct, there is plenty of market upside left, especially if the economic cycle continues for another two years.

Bryan Rich has a “rational case” for stocks rising 45% by the end of 2015. Here is part of the argument:

The P/E on next year’s S&P 500 earnings estimate is just 16.8, in line with the long-term average (16). But we are not just in a low-interest-rate environment, we are in the mother of all low-interest-rate environments (ZERO). With that, when the 10-year yield runs on the low side, historically, the P/E on the S&P 500 runs closer to 20, if not north of it. A P/E at 20 on next year’s earnings consensus estimate from Wall Street would put the S&P 500 at 2,600.

Final Thought

It is vital to avoid complacency, asking what would change your mind. My sense is that most of those using the “C word” never ask about what might convince them to reach a different conclusion.

In July I did an extensive analysis of the potential for a mid-course correction. This included a list of things to watch for as downside risk. In later posts I highlighted the potential for upside surprises.

The key word here is “surprise.” There is no investment edge from repeating what you read in the morning paper. Here was my list – still worth watching:

- Geo-political that is not on the current radar – a true black swan.

- An increase in the PCE index that was not accompanied by strong economic growth.

- Wage increases that were not accompanied by strong economic growth.

- Declining profit margins that were not accompanied by strong economic growth and increased revenues.

- An increase in the chances for a business cycle peak (the official definition of a recession). Remote at this point.

- An increase in financial stress to our trigger point. Remote at this point.

If you have a good list of concerns to monitor you may count yourself as vigilant, not complacent.