Stock bulls retraced over half of Friday's plunge, but does it count as a reversal? When I look at the volume, the weekly chart, and the credit markets, I have my doubts. Or will the Powell & Mnuchin testimony and Chicago PMI ride to the rescue, and provide a catalyst to reignite the bullish spirits? And will Thursday's non-farm payrolls surprise to the upside, as they did a month ago?

The Fed is contracting its balance sheet for a second week in the row, and unless they publicly open the spigots (or credibly signal they're about to do so), stocks look set to struggle in the short run. With the corona second wave fevers rising, will stocks ride unscathed through the rough patch ahead courtesy of more policy actions and all the money sitting on the sidelines being deployed? That's a recipe for quite some volatility regardless of whether Trump later on turns tough on China or not, if you ask me.

S&P 500 in the Medium- and Short-Run

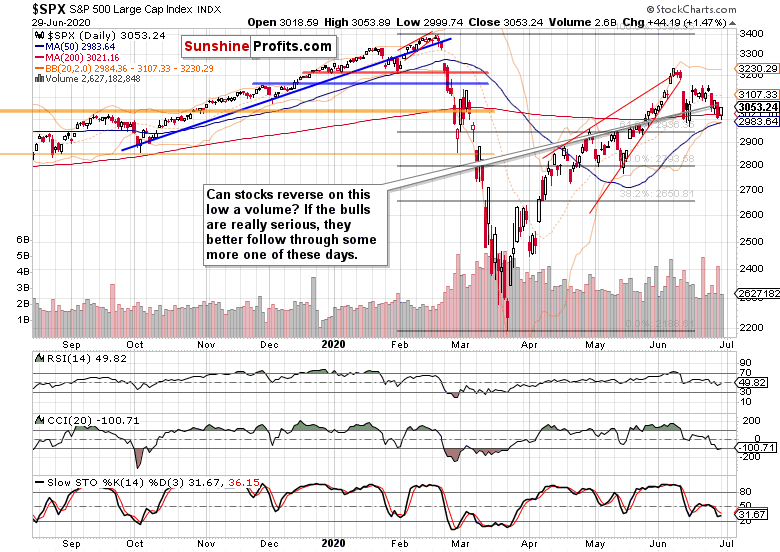

I’ll start with the daily chart perspective for the S&P 500 (charts courtesy of http://stockcharts.com ):

Monday's overnight trading opened with a bearish gap, which the bulls have closed still during the premarket session. Yet at the start of US trading, stocks again tumbled to the Asian opening lows. The bulls again countered, and repelled another selling wave just before the closing bell.

These were the overriding narratives battling it out earlier yesterday:

"(…) On one hand, we have these bearish factors and strengthening corona fears (risks of renewed lockdowns or disruptions to economic activity in general), on the other the uncertain effects of Q2 window dressing and generally rather positive seasonality going into Independence Day.

Given the prominence of each of the above factors, I see the bearish side as the one favored by the odds."

Couple that with this week's turbulences, and the potential for disappointments is high. That is, the downside risks appear disproportionate at this moment, relative to the upside.

That's certainly the message the daily volume is sending. Are the bulls strong enough to make up for yesterday's suspiciously low volume? Should they be earnest about this reversal, they better step in fast – and at higher prices as well, so as not to make yesterday a bull leg in a sideways-to-down trading range.

Before Monday's closing bell, I expressed my reservations in yesterday's intraday Stock Trading Alert. The quoted text is unchanged from yesterday's moment of publishing (12:11 PM EST), and the charts now feature the closing prices:

"(…) While stocks recovered from their opening dive below the 200-day moving average, let's do a quick check and put the move into perspectives."

That's this week's chart in progress, putting today's modest upswing into perspective. While the downside risks remains (I would highlight tomorrow's Powell testimony, Wednesday's ADP non-farm employment change, and especially Thursday's non-farm employment change – a cautious tone on corona recovery by Powell, or revealing the disconnect between the real economy and stocks by either of the remaining ones), the bulls haven't turned the tide yet – and the slowly but surely mounting corona fears on the ground aren't on their side.

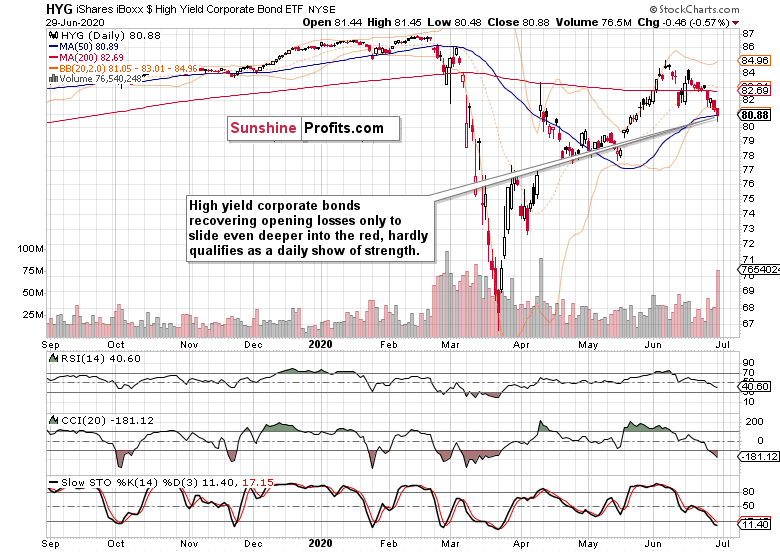

Credit market's key representative is lagging behind also today – and actually the moment it stopped declining, coincided with the intraday stock upswing. How sustainable is that unless junk corporate bonds turn around?

Both of these points remain valid also today. Stock bulls haven't made any progress as S&P 500 futures keep trading at around yesterday's closing prices, and junk corporate bonds during the remainder of the regular session dived again while stocks mostly rallied.

That increases the non-confirmation between the two – such a conclusion seems foregone. But let's do the heavy lifting and inspect the credit markets thoroughly next.

The Credit Markets’ Point of View

High yield corporate bonds (NYSE:HYG) keep trading below the Wednesday and Thursday intraday lows, and the bears kept the reins throughout yesterday's session too. The longer this lasts, the more dicey for the stock bulls.

But the investment grade corporate bonds to the longer-term Treasuries (LQD:IEI) ratio is already turning up, unlike the high yield corporate bonds to short-term Treasuries one (HYG:SHY). But does a two-day stabilization followed by a one-day upswing qualify as a turnaround?

Does it have the power and momentum characteristics of the mid-May plunge that came to a halt earlier than the one in HYG:SHY? Or, is it sending a signal of false strength along the lines of the early June S&P 500 plunge and subsequent recovery? Please note the bearish divergence HYG:SHY made then – while LQD:IEI powered higher, HYG:SHY made a lower high. I take that as a vote of no confidence.

The plain comparison between high yield to investment grade corporate bonds (HYG:LQD) also points to waning risk appetite. This is even more concerning when you look at the below chart.

Yesterday's S&P 500 bump looks like Thursday's one – but at least on that day, it was accompanied by higher values in the ratio. With the HYG:SHY yesterday plunging without end in sight, Monday's stock upswing becomes even more suspicious.

Yes, Treasuries are rallying, both the very short-term ones (SHY ETF) and 3-7 year ones (IEI ETF), unlike the riskier corporate bonds (it's only the LQD ETF that actually rose yesterday). I read that as a desire to park money and preference for corporate quality in times of elevated uncertainty and risks to the downside that make you think of summer 1968 as an idyll.

Or are stocks refusing to take a cue from HYG:SHY setting them up both for an explosive upside move as in the latter half of May? Unless the ratio rallies strongly in the nearest sessions, I'll continue to stick to these yesterday-written lines:

"(…) We might be at the doorstep of a challenge to the bull market assessment. The key supports to hold are the 200-day moving average (3020, and if you take the 50-week moving average, then 3010), the 61.8% Fibonacci retracement (2940) and the 50% Fibonacci retracement (2790) on the daily chart."

As I wrote on Friday, the corona recovery path & renewed fears of stifled economic activity, and election uncertainties, make for rougher trading over the summer. The elevated volatility surely reflects the potential for both upside and downside moves that can frustrate the bulls and bears alike – unless the Fed or Congress throw in more than their two cents.

From the Readers' Mailbag

Q: Today's trading shows small caps (NYSE:IWM) are leading the market and beaten down stocks are now rising dramatically once again while SPX and NDX stocks are lagging. It looks like sector rotation is going on. SPX and NDX stocks went up too much and investors are finding value in IWM stocks. This could be a sign that market is preparing to go down again just like at the last peak. But then IWM may lead the market to keep SPX and NDX from breaking down further and market may go sideways. $4T on the side line has to go somewhere and this may keep the market afloat. HYG went down while SPX went up today which is a negative which means risk-off sentiment is intact. This conflicts with IWM rally. So, I am not sure what to make of this. How do you see this?

A: Let's start with the situation in the now.

They say that one swallow doesn't make a summer. While on respectable volume, the Russell 2000 (IWM ETF) indeed outperformed the S&P 500 – but can it be said that we're on a doorstep of smallcaps leading higher? I don't think so, and as the corona fears intensify, smallcaps will be as vulnerable as consumer discretionaries (XLY) to any curtailment of economic activity – voluntary or not.

Let's examine the nearest historic parallel, which is the April-May consolidation. Back then, smallcaps broke down below the previous lows in a deceptive show of weakness. Is such a move unfolding currently? Not really. Applying the laws of logic, could it be that they're showing fake strength now? That's possible but far from certain. A more plausible explanation to me is their sideways consolidation while both indices remain under pressure and looking for short-term direction.

I ascribe more meaning to the credit markets' behavior – and their current challenges coupled with the fundamental outlook, make short-term downside in stocks more appropriate to the gloomier and gloomier headlines than not.

What would make me lean more bearish in the IWM interpretation? Should I see profit distribution in smallcaps while the S&P 500 (propped by its handful of heavyweight stocks) still marches higher, that would be it – because eventually, S&P 500 would roll over to the downside as well.

But we're not seeing smallcaps rolling over. Once they do, I can take away the more probable sideways consolidation hypothesis.

At the same time, I think that the smallcaps getting challenged soon is more probable than not. Take it as upping the ante on the current uncertainties, and interpreting them bearishly in the market place. Are yields rising? No, Treasury prices are rising, which questions the accuracy of stock market's interpretation of the recovery and its veracity.

Put/call ratio is again heading lower towards the more complacent readings. Advance-decline volume on NYSE is again deteriorating. The spread between junk and investment grade bonds is on the rise. All of these make for a volatile cocktail that is apt to ambush the bulls with or without an easily noticeable catalyst, and not too far down the road I think.

Summary

Summing up, Monday's upswing probably wasn't the game changer the bulls have been looking for. Low volume, weakening credit markets, plunging Treasury yields are stronger arguments than yesterday's improvement in the S&P 500 advance-decline line or Russell 2000 daily outperformance. The weekly chart's perspective remains little changed as well, and significant short-term risks persist amid the choppy trading (now with a downside bias). The medium-term examination keeps favoring the bears – just as the Fed on pause. Should the market get spooked by corona even more, that would be a cherry on the cake for the bears.