Almost a full year after the election of Donald Trump to the White House, one of the key promises made to voters was the largest “tax cut” since Ronald Reagan was in office. As President Trump stated in Indiana yesterday:

“This is a revolutionary change, and the biggest winners will be middle-class workers as jobs start pouring into our country, as companies start competing for American labor, and as wages continue to grow. This will be the lowest top marginal income tax rate for small and mid-size businesses in more than 80 years.”

Here are the major points as summed up by BI.

Business tax changes:

- A 20% corporate tax rate. This is the first time Trump has publicly backed down from one of his earliest campaign promises: a 15% corporate tax rate. The budget math required for a 15% rate was too difficult, so the somewhat higher rate is the opening bid. The current statutory federal rate is 35%.

- A 25% rate for pass-through businesses. Instead of getting taxed at an individual rate for business profits, people who own their own business would pay at the pass-through rate. The plan also says it will consider rules to prevent “personal income” from being taxed at this rate. Mnuchin previously suggested there may be limitations on what types of businesses get this rate — it could apply only to goods producers and not service-oriented companies to prevent people from creating limited-liability corporations to store their assets and receive a lower rate.

- Elimination of some business deductions, industry-specific incentives, and more. There are few details, but the plan includes language regarding the “streamlining” of business tax breaks.

- A one-time repatriation tax. All overseas assets from US-owned companies would be considered repatriated and taxed at a one-time lower rate — this is designed to bring corporate profits back from overseas. Illiquid assets like real estate would be taxed at a lower rate than cash or cash equivalents, and the payments would be spread out over time. While there is no precise number in the plan, officials have indicated the rate could end up somewhere around 10%.

Personal tax changes:

- A bottom individual tax rate of 12%. The plan specifies three tax brackets, with the lowest rate being 12%. That would represent a slight bump in the bottom bracket, which is now 10%. People currently in the 15% marginal tax bracket would most likely be included here.

- A middle tax bracket of 25%. The incomes in this bracket aren’t specified.

- The top individual tax rate of 35%. The current top rate is 39.6%.

- The possibility of a fourth, higher bracket. Because of Trump’s insistence that taxes for the wealthiest Americans not decrease, the plan proposes the possibility of a fourth tax bracket at a rate higher than 35% if the tax-writing committees wish. “An additional top rate may apply to the highest-income taxpayers to ensure that the reformed tax code is at least as progressive as the existing tax code and does not shift the tax burden from high-income to lower- and middle-income taxpayers,” the plan reads.

- A larger standard deduction. To avoid raising taxes on those currently in the 10% tax bracket, the standard deduction for all taxes would increase to $12,000 for individuals (up from $6,350) and $24,000 for married couples (up from $12,700). These are slightly less than the doubled deductions expected and the idea this would save people money may be misleading.

- Eliminates most itemized deductions. The only deduction preserved explicitly in the plan is for charitable gifts and home-mortgage interest.

- Increases the size of the child tax credit. A pet project of Ivanka Trump, the proposal is to make the first $1,000 of the child tax credit refundable and increase the income level at which the credit would phase out.

- Vague promises on retirement savings and other deductions. Sections of the plan refer to retirement savings and other “provisions,” but details are sparse.

- Elimination of the state and local tax deduction. The so-called SALT deduction allows people to deduct what they pay in state and local taxes from their federal tax bill. Most of the people who take this deduction are wealthier Americans in Democratic states — about one-third of the beneficiaries are in New York, New Jersey, and California.

- Elimination of the estate tax. Called the “death tax” in the plan, this applies only to inherited assets totaling $5.49 million or more in 2017. Very few households pay the estate tax, but it has long been a target for Republicans.

Devil In The Details

As in always the case, there are some important points to remember. This is just a proposal. This will have to go through several drafts, negotiations, and tweaking before a final bill is voted on by the House. It will then go to Senate for changes and a vote. IF, and that is a big if, it is passed by the Senate the bill returns to the House where the bill will be reconciled before it is passed onto the President for his signature. The bill, as proposed today, will likely look very different by the time it is actually voted on.

However, as is always the case, the “devil is in the details.”

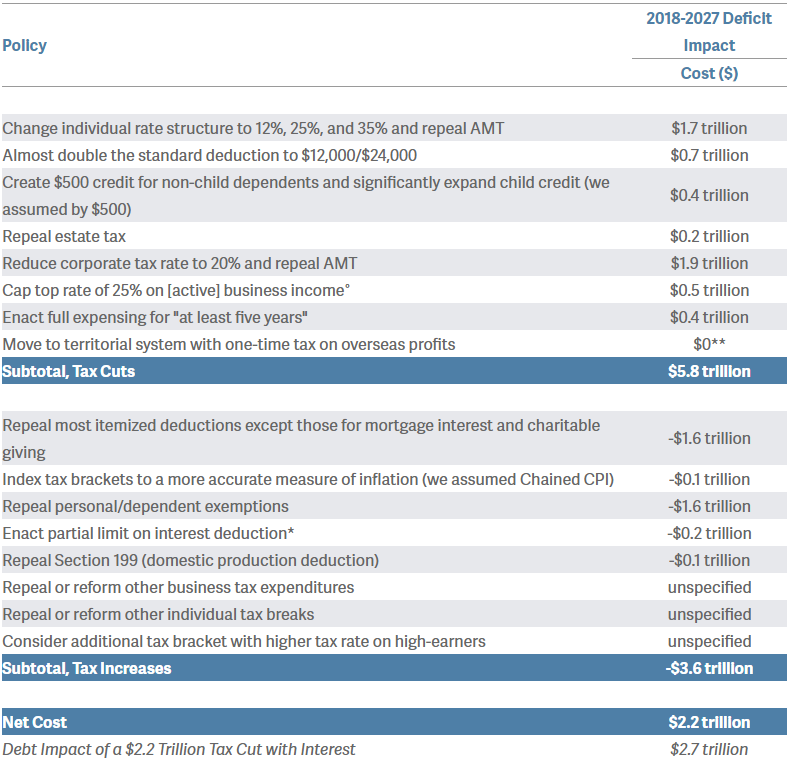

First, as the Committee for a Responsible Federal Budget lays out:

“Tax cuts shouldn’t be handed out like Halloween candy. To grow the economy, they must be paid for, and the details of this plan appear to come up $2 to 2.5 trillion short.

Deficit-financed tax cuts are a recipe for a short-term economic sugar high followed by sluggish long-term growth.

Without sufficient details on how or even if these tax cuts will be fully paid for, this outline is nothing more than a fiscal fantasy.

Tax reform remains one of the most important national objectives. Fiscally responsible tax reform would not only improve simplicity and fairness, but can actually grow the economy and help to improve the dangerous fiscal situation we face.

But the difference between tax reform that would grow the economy, and tax cuts that would grow the debt, cannot be made up for with wishful thinking or magical economic growth. And tax cuts certainly don’t pay for themselves.“

Furthermore, the CFRB picks up on a particularly important point that headlines have seemed to overlook:

“Making many assumptions about the plan – including that the brackets apply to the same income as the Trump campaign’s plan, that its 25 percent pass-through rate contains guardrails so it only applies to active business income, and that the limit on interest makes up about half the revenue lost from expensing – we estimate the plan has about $5.8 trillion over a decade of gross tax cuts and would cost $2.2 trillion on net through 2027. Given that it calls for only five years of expensing rather than permanent – a major budget gimmick – it also potentially sets the stage for an extenders package of over $1 trillion when expensing expires.”

No Budget, No Reform

But even before we can get to tax reform, the issue of the budget must be addressed first. As Congressman Kevin Brady, Chairman of the House Ways And Means Committee, stated during a recent interview on the “Lance Roberts Show:”

“No budget, no tax-reform.”

Without a budget for 2018, the tax bill cannot be passed using “reconciliation” which would only require a 51-vote majority versus the currently required 60-vote majority under Senate rules.

Passing a budget has been an impossible feat over the last 8-years with the government currently operating under another continuing resolution (“CR”) until December of this year. (That means spending remains at the same level as the previous budget, last passed in 2008, with an 8% baseline increase.)

The debate over the budget will be contentious enough with threats of a Government “shutdown” now an annual event. But some GOP members, however, have suggested combining another attempt at repealing Obamacare with the tax bill for 2018 reconciliation. This will make an already difficult undertaking even more complicated.

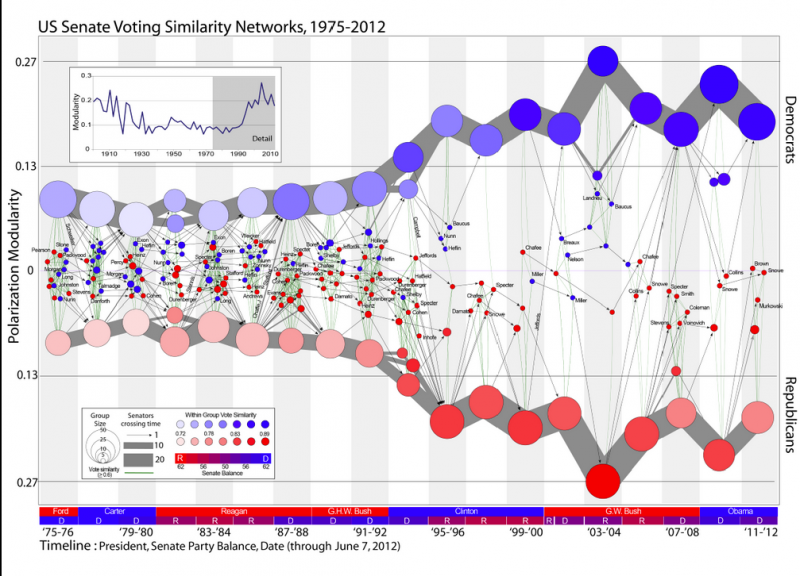

“The issue of tax reform is not going to be an easy one. With such a deeply partisan government the probability of passing tax reform as currently proposed is extremely slim. Furthermore, while I do expect that some version of tax reform will eventually get passed, it will likely take much longer than most expect. The chart below shows the current chasm leading to the difficulty of getting anything accomplished in Washington.”

Already, Democrats are aligning to push back against the proposed legislation:

“If this framework is all about the middle class, then Trump tower is middle-class housing,” – Senator Ron Wyden (D)

“This would cost anywhere from 5 to 7 TRILLION dollars and they have no credible plan to pay for it… If they don’t pay for it, they’ll balloon the deficit and debt….” – Senator Chuck Schumer (D)

And most importantly:

“Tax reform is going to make health care look like a piece of cake,” – Retiring Sen. Bob Corker.

This is why there hasn’t been a major piece of tax legislation enacted since Ronald Reagan was in office.

Economic Outcomes Likely Disappointing

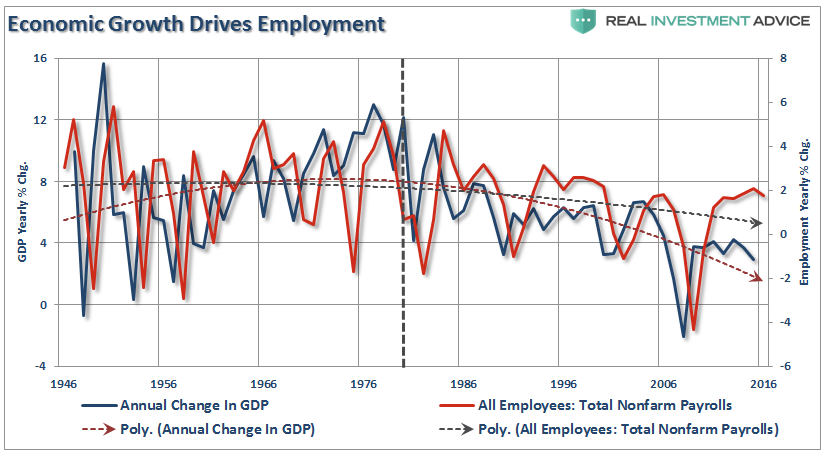

Do not misunderstand me. Tax rates CAN make a difference in the short run particularly when coming out of a recession as it frees up capital for productive investment at a time when recovering economic growth and pent-up demand require it.

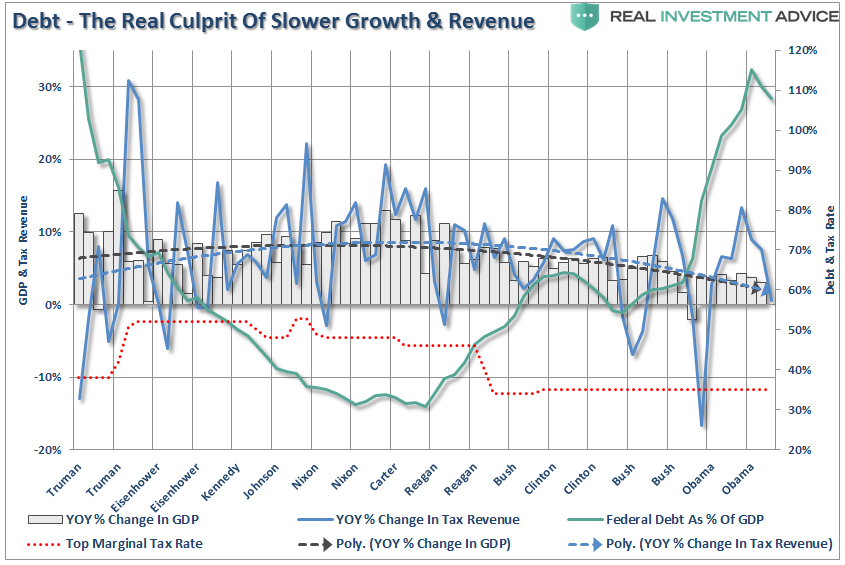

However, in the long run, it is the direction and trend of economic growth that drives employment. The reason I say “direction and trend” is because, as you will see by the vertical blue dashed line, beginning in 1980, both the direction and trend of economic growth in the United States changed for the worse.

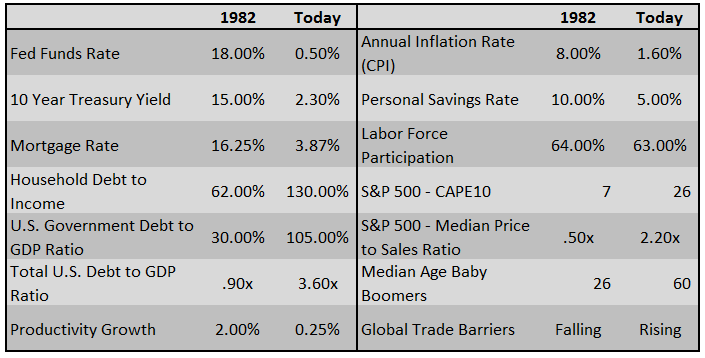

Furthermore, as I noted previously, Reagan’s tax cuts were timely due to the economic, fiscal, and valuation backdrop which is diametrically opposed to the situation today.

“Importantly, as has been stated, the proposed tax cut by President-elect Trump will be the largest since Ronald Reagan. However, in order to make valid assumptions on the potential impact of the tax cut on the economy, earnings and the markets, we need to review the differences between the Reagan and Trump eras.My colleague, Michael Lebowitz, recently penned the following on this exact issue.

‘Many investors are suddenly comparing Trump’s economic policy proposals to those of Ronald Reagan. For those that deem that bullish, we remind you that the economic environment and potential growth of 1982 was vastly different than it is today. Consider the following table:’”

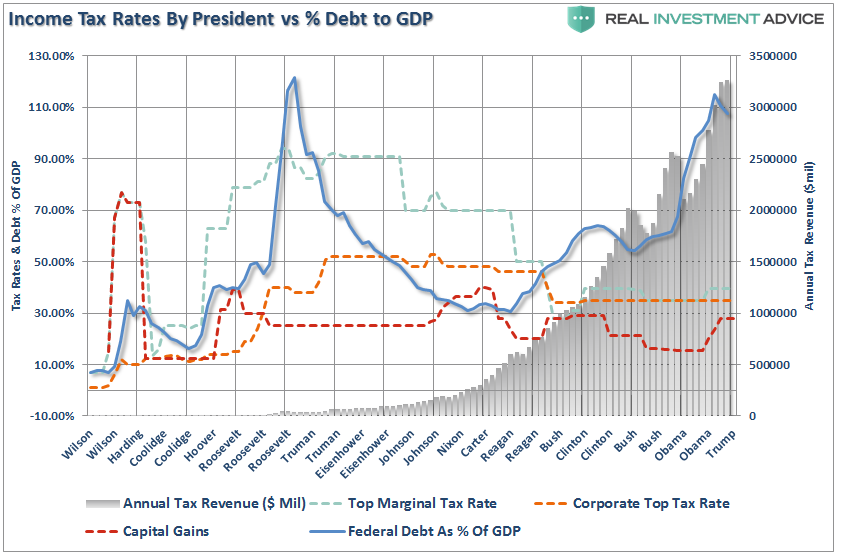

The differences between today’s economic and market environment could not be starker. The tailwinds provided by initial deregulation, consumer leveraging and declining interest rates and inflation provided huge tailwinds for corporate profitability growth. The chart below shows the ramp up in government debt since Reagan versus subsequent economic growth and tax rates.

Of course, as noted, rising debt levels are the real impediment to longer-term increases in economic growth. When 75% of your current Federal Budget goes to entitlements and debt service, there is little left over for the expansion of the economic growth.

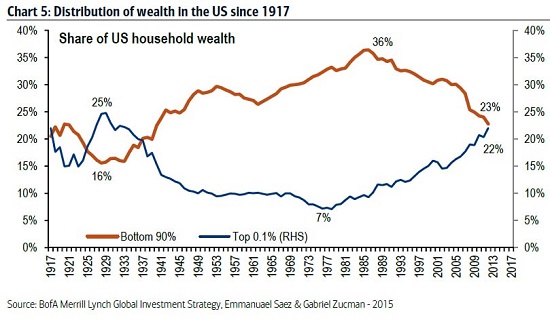

The tailwinds enjoyed by Reagan are now headwinds for Trump as the economic “boom” of the 80’s and 90’s was really not much more than a debt-driven illusion that has now come home to roost. (More discussion on this problem here, here and here)

Tax Cuts Don’t Reduce The Deficit

Senator Pat Toomey, a Pennsylvania Republican who sits on the finance committee, said he was confident that a growing economy would pay for the tax cuts and that the plan was fiscally responsible.

“This tax plan will be deficit reducing,”

The belief that tax cuts will eventually become revenue neutral due to expanded economic growth is a fallacy. As the CRFB noted:

“Given today’s record-high levels of national debt, the country cannot afford a deficit-financed tax cut. Tax reform that adds to the debt is likely to slow, rather than improve, long-term economic growth.”

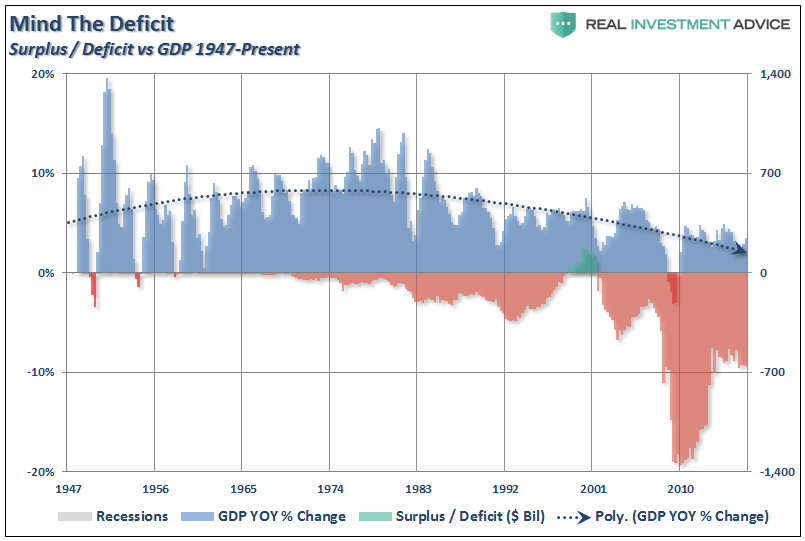

The problem with the claims that tax cuts reduce the deficit is that there is NO evidence to support the claim. The increases in deficit spending to supplant weaker economic growth has been apparent with larger deficits leading to further weakness in economic growth. In fact, ever since Reagan first lowered taxes in the ’80’s both GDP growth and the deficit have only headed in one direction – lower.

As noted above, there are massive differences between the economic and debt related backdrops between the early 80’s and today.

The true burden on taxpayers is government spending, because the debt requires future interest payments out of future taxes. As debt levels, and subsequently deficits, increase, economic growth is burdened by the diversion of revenue from productive investments into debt service.

While lowering corporate tax rates will certainly help businesses potentially increase their bottom line earnings, there is a high probability that it will not “trickle down” to middle-class America.

While I am certainly hopeful for meaningful changes in tax reform, deregulation and a move back towards a middle-right political agenda, from an investment standpoint there are many economic challenges that are not policy driven.

- Demographics

- Structural employment shifts

- Technological innovations

- Globalization

- Financialization

- Global debt

These challenges will continue to weigh on economic growth, wages and standards of living into the foreseeable future. As a result, incremental tax and policy changes will have a more muted effect on the economy as well.

As Mike concluded in his missive:

“As investors, we must understand the popular narrative and respect it as it is a formidable short-term force driving the market. That said, we also must understand whether there is logic and truth behind the narrative. In the late 1990’s, investors bought into the new economy narrative. By 2002, the market reminded them that the narrative was born of greed not reality. Similarly, in the early to mid-2000’s real estate investors were lead to believe that real-estate prices never decline.

The bottom line is that one should respect the narrative and its ability to propel the market higher.“

Will “Trumponomics” change the course of the U.S. economy? I certainly hope so. Unfortunately, there is no evidence that such has ever been the case.

As investors, we must understand the difference between a “narrative-driven” advance and one driven by strengthening fundamentals. The first is short-term and leads to bad outcomes. The other isn’t, and doesn’t.

Full text of Tax Reform plan below.