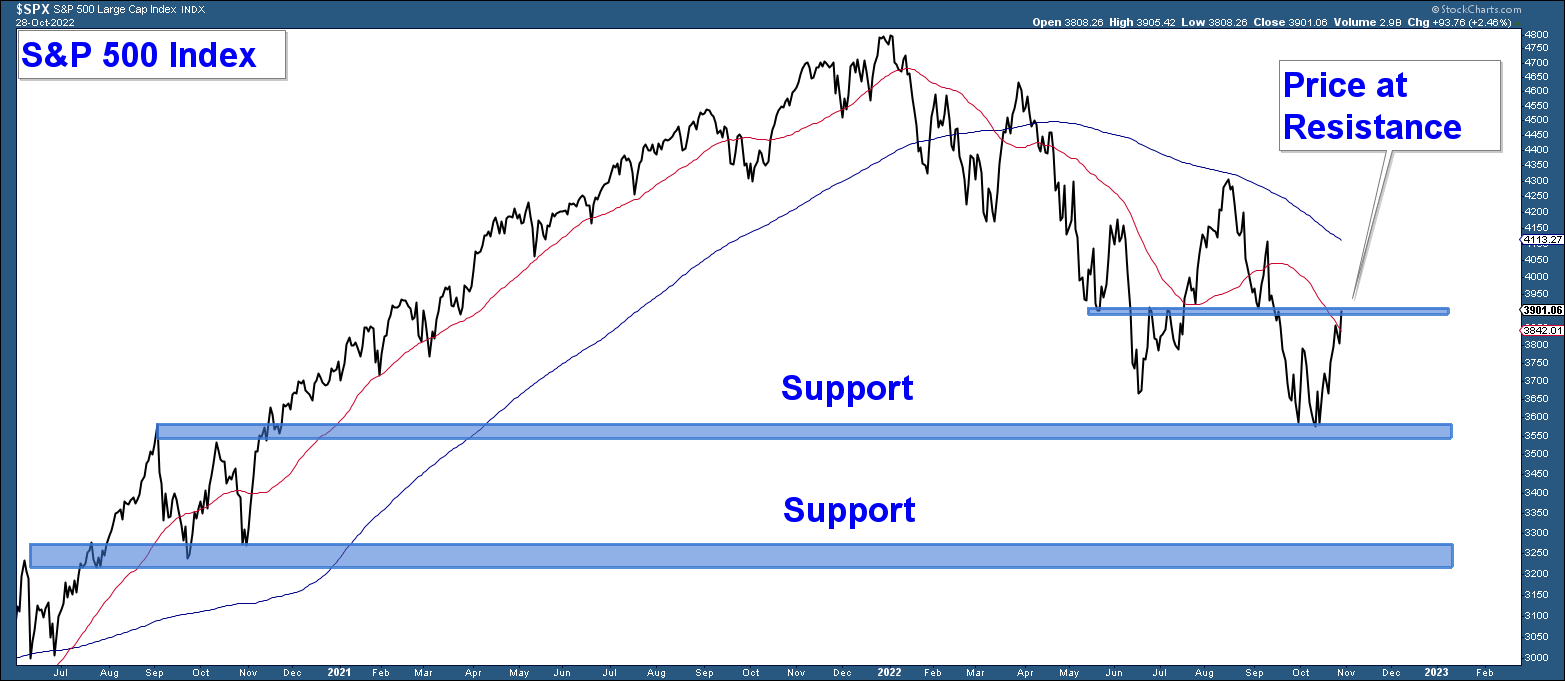

Below is a daily chart of the S&P 500. After breaching the June low, the index bounced and is now sitting at resistance. Short-term momentum is positive and a strong move above resistance would be bullish.

Historically, when the stock market experiences a high volume move lower that proceeds a high volume move higher, it tends to signal a market bottom. The rationale for this phenomenon is that the move lower on high volume depletes the pool of bearish sellers. The bulls are then able to take advantage of this dislocation and move the market strongly higher.

The duration of the advance that follows tends to depend on the market environment, meaning that during bull markets, it tends to signal a long-term bottom. During bear markets, it signals a shorter-term advance or tradable rally.

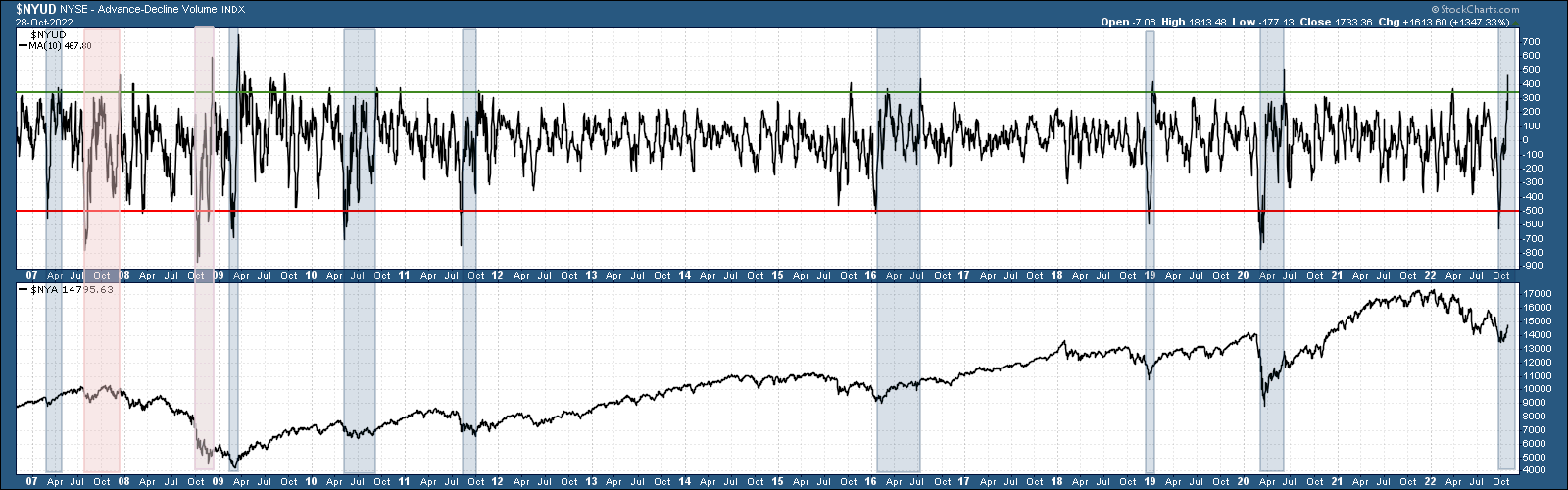

In the top panel below is a chart of the NYSE advancing minus declining volume indicator. This indicator tracks the total volume of advancing stocks minus the total volume of declining stocks on the NYSE exchange. I am using a 10-day moving average to smooth out the line.

The bottoming signal is initiated when there is a move below the red line that is followed by a move above the green line. Basically, charting the exhaustion of sellers followed by the dominance of buying interest.

I have highlighted those signals in red when they occurred during the last “major” bear market and in blue during all other instances.

The signals that occurred during bullish market environments (blue highlight) ended up signalling major market bottoms.

The signals that occurred during the 2008 bear market (red highlight) did not result in a long-term market advance; however, they were advances that you could take advantage of if you were nimble.

The current signal is on the far right side of the chart. We are in a bear market, so I am going to presume this advance is of the shorter-term variety. Enjoy it while it lasts.

Deterioration in market breadth began in early 2021 even though major market indexes didn’t peak until the beginning of this year.

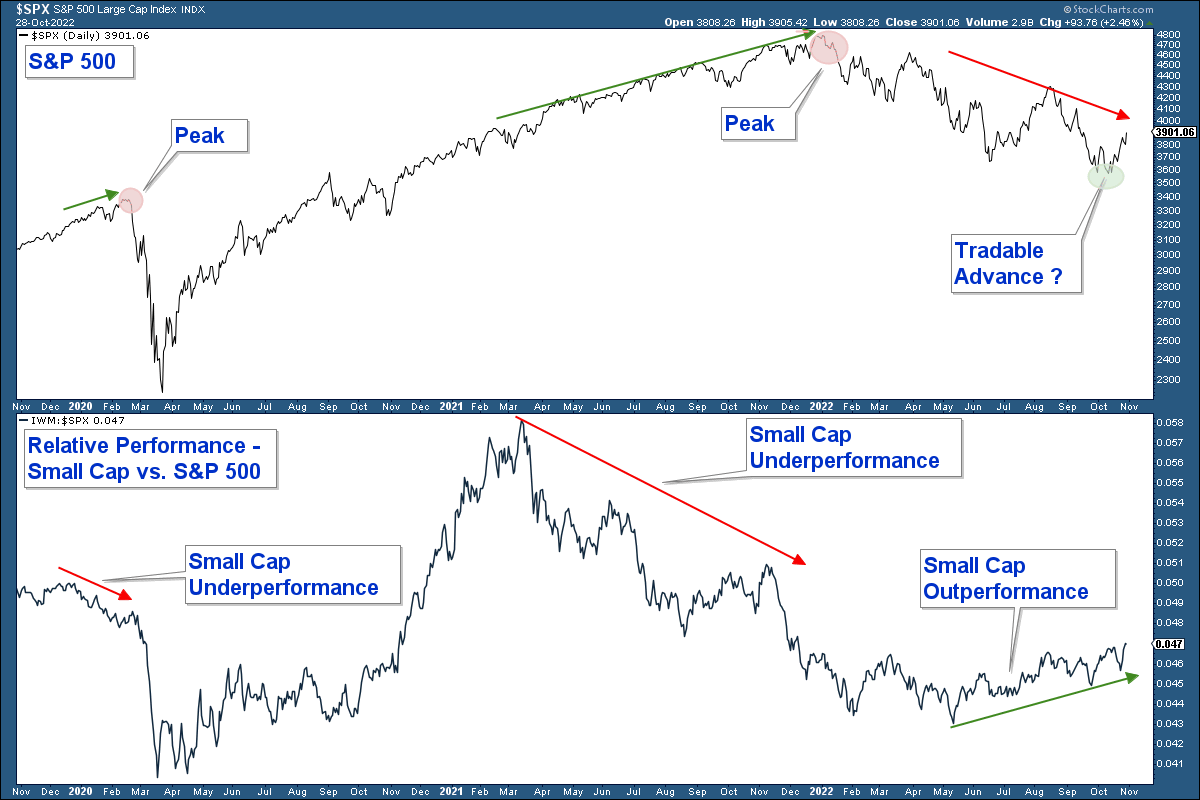

Below I have the S&P 500 Index charted in the upper panel and a relative strength chart comparing small-cap stocks to that index in the lower panel. When the relative strength line rises, it indicates that small-caps are outperforming. When it falls, small-caps are underperforming.

Notice the negative divergences that preceded the two previous market tops. The S&P was rising, however, small-cap underperformance was suggesting investors were becoming more bearish and moving out of risk-on assets.

Now, look to the right side of the chart and notice how small-caps have been outperforming the index since May.

Small-cap stocks are outperforming and this is a bullish market signal.

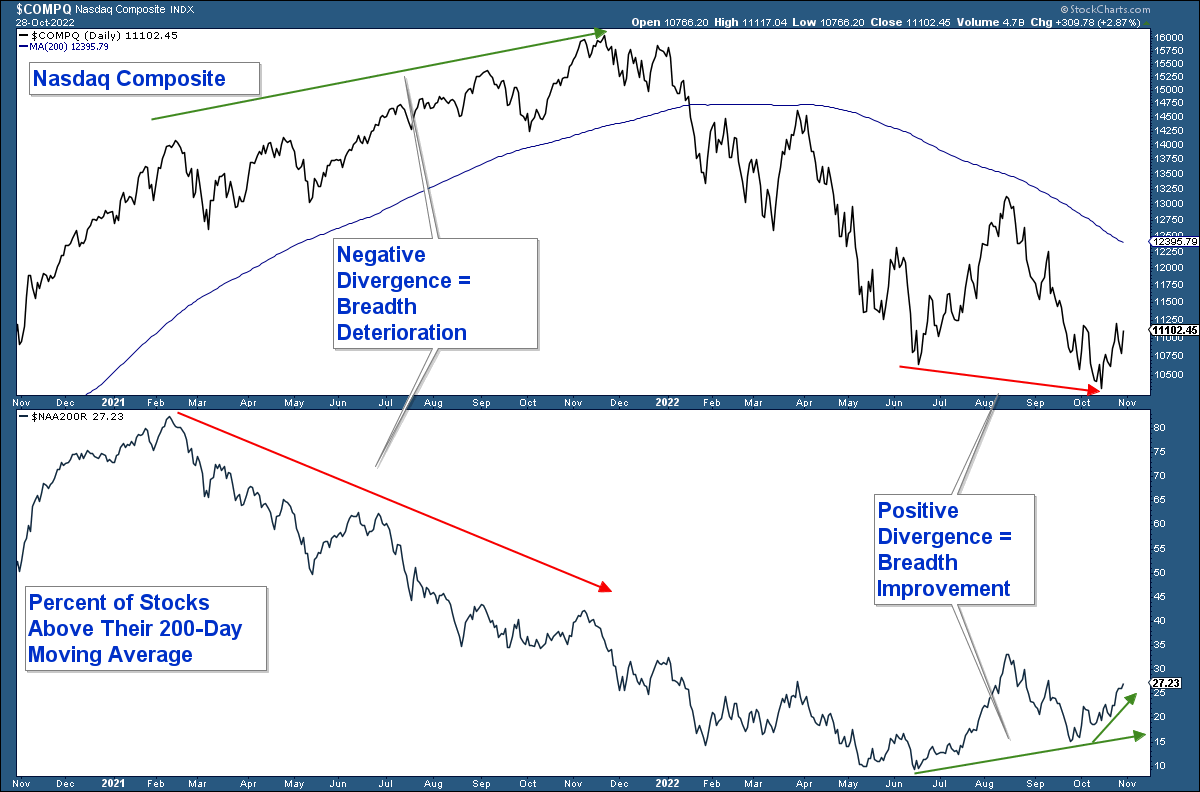

Below is a chart of the NASDAQ Composite Index in the upper panel and the percentage of those stocks within the index above their respective 200-day moving average in the lower panel.

Throughout last year, the index was advancing higher. However, the number of stocks within that index above their 200-day moving average was declining. In other words, market breadth was deteriorating, suggesting internal weakness.

Now look to the far right, and notice the exact opposite scenario. Market breadth has been improving.

Positive market breadth in the NASDAQ Composite Index is a bullish market signal.

There are a number of reasons why I think that the recent lows are the beginning of a shorter-term tradable advance and not a major market bottom, such as:

- Major market sectors like communication services and consumer discretionary are still displaying weakness.

- A recession is likely to occur next year given the Fed has been raising rates aggressively.

- We still haven’t seen a strong move higher in the VIX, which typically signals a longer-term market bottom.

The technical evidence suggests this advance could last for a number of weeks and, thus, money can be made by those investors who are nimble. I believe it will be an advance that rewards good stock picking because there seems to be a substantial difference in the performance of different sectors and industry groups.