Investing.com’s stocks of the week

Stocks finished yesterday mixed with the S&P 500 falling by 80 bps, and the Nasdaq 100 rising by 75 bps. There was a rotation of sorts back into technology and out of the cyclical stocks. Hard to say if it is a one-day event or not at this point. Everything has run very fast and very hard, and just about everything is overbought.

The QQQ finished the day up at $243.40, and now has an RSI of almost 74. Meanwhile, the ETF is at the upper end of its rising wedge/trading channel.

In regular times when the market wasn’t trying to torture me and make my life miserable, this would be a sign of a market that is ready to reverse. However, this market wants to make this process as painful for me as possible, so the thought has crossed my mind that the wedge could lead to a melt-up. Yes, in regular times, a rising wedge is bearish. In times when nothing makes sense and stocks can go from $10 to $130 in one day (SEE – DUO), reversal patterns can quickly become continuation patterns.

The VIX continues to creep up yesterday, closing over 27. Again, this isn’t worrying yet, but it is the second day in a row that VIX has increased.

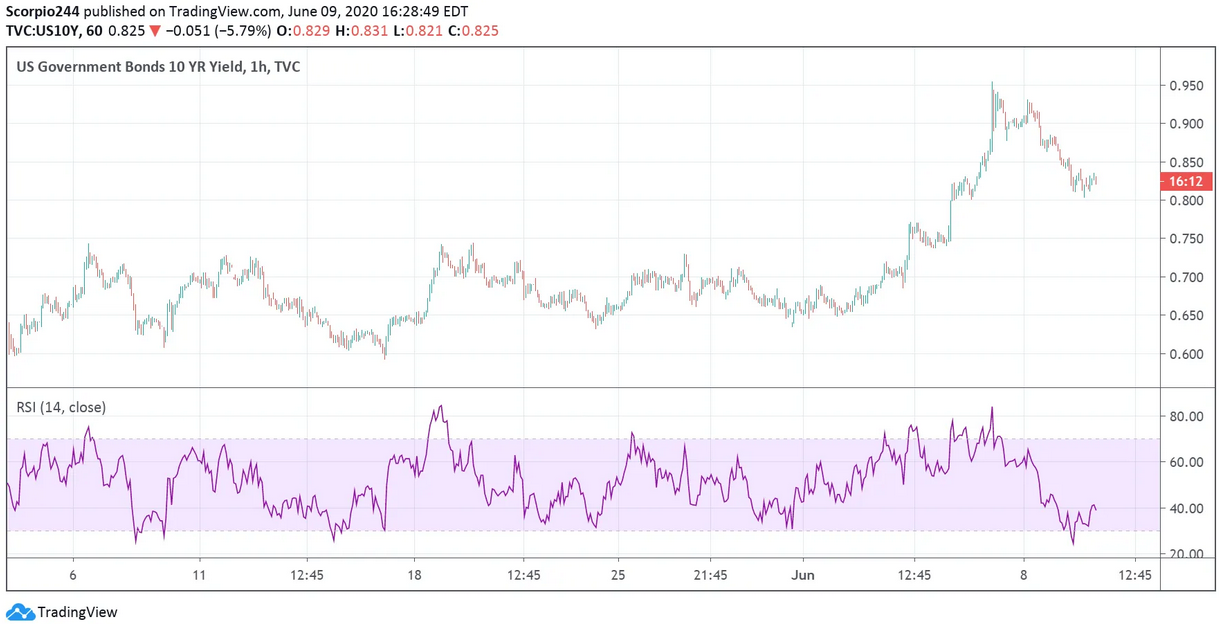

The move higher in the VIX comes as yields fell too.

Perhaps some positioning and defensiveness is being taken ahead of the Fed today. There is a great deal of risk because it seems unclear to me just what the Fed will do or say. Sure they will do what it takes to support the economy, but what about the markets. Rates aren’t going anywhere, with or without the Fed. As I have noted, the Fed has been slowly winding down its purchases of Treasuries. Yesterday, they bought just $1.75 billion Treasuries. It feels like that number goes down every day.

So if the Fed suggests or indicates QE is ending or being tapered down, it seems it could be a catalyst for a market turnaround. I could easily make an argument for either case.

Alibaba

Alibaba (NYSE:BABA) could have further to run from here, perhaps back to its all-time highs.

Tesla

Tesla (NASDAQ:TSLA) could be forming an ascending triangle, and that means a breakout and move above $1000 could be very near.

PayPal

Perhaps PayPal will fall one day soon; it seems closer, so far, no dice.

Square

Square (NYSE:SQ) has this perfect little trading channel and is very close to an all-time high. If the channels hold that may be all that matters.