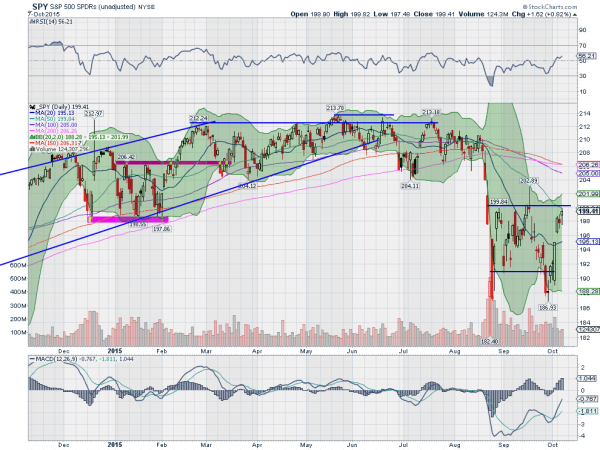

Here we sit in the light pre-market action Thursday, day 256 of the debate of whether the market is about to rollover or reverse higher. And the picture is not any clearer from the price action. Take a look at the chart below.

A flat top through all of 2015 until those fateful late August days culminating in the August 24th bottom. Since then the S&P 500 has not retest that extreme morning selloff level, but has come close. I have written recently about The Role of Symmetry in this consolidation and how it might play for a reversal higher starting next week. Some of my fellow market participants have noted the seasonal weakness in the markets that switches to strength next week. And for the stargazers, Mercury is coming out of retrograde. Bond market strategists are now calling for a 1.5% 10-yearTreasury yield if you want a contrarian signal.

All of that is good background information but got nothing to do with what will happen in the market this time on this day. I like to piece together a mosaic of many indicators and this type of background analysis to determine where the reward is best, to the upside or downside.

For the short term there was a strong move higher last Friday and it has seen continuation this week. But it leaves the S&P 500 right at the top of the consolidation zone. A push over the top and continuation would signal more continuation to the upside. And there are indicators that support more upward movement. The Bollinger Bands® are turned up and opening. The RSI is rising and at levels not seen since before the correction. The MACD is also bullish and rising.

But the SMA’s remain with a downward slope. The short 20 day SMA is leveling, which is a positive, but the 50 day SMA, right at Thursday’s close, is falling and price there could prove to be a catalyst for sellers. The longer dated SMA’s are all continuing lower.

So there is a backdrop for positive price action, along with more indicators that are positive than negative. From my read it suggests a move to the upside can continue. Lets see if it does.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.