On Tuesday afternoon, the markets managed to avoid the large-scale sale. The initial decline of the US stock indices by more than 2% was mostly redeemed. Index S&P 500 lost 0.55%. In a moment Caterpillar (NYSE:CAT) And 3M (NYSE:MMM) shares were in decline significantly (by more than 10%).

Strictly speaking, their reporting was not bad, but investors were worried by the impact of tariffs on the prospects of companies. Caterpillar noted the anticipated increase in costs due to steel tariffs. Diversified 3M indicated a probable drop in revenues due to the volatility in foreign exchange rates.

Nevertheless, sharply declined shares found their buyers, significantly reducing the initial drawdown. A similar situation is observed on Asian bourses in the morning. The indices of China and Japan at the time of writing remain near the levels of the day opening.

However, American key indices S&P 500 and DJI, and Asian Nikkei 225 and Hang Seng remain below their 200-day moving averages. This may lead to a further sale of stocks by large funds that perceive this line as an important trend signal.

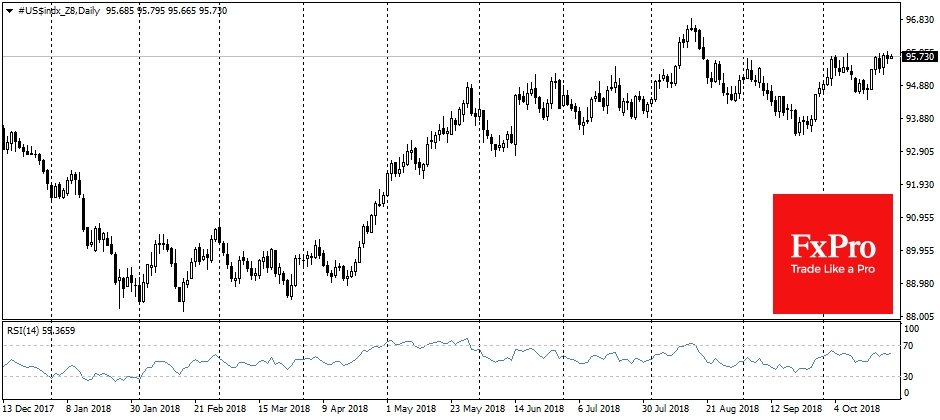

The currency market maintains a balance of forces supporting the dollar near the highs of the month. The dollar index has been traded near 95.70 level for the fifth day, as the focus of the markets shifted to the reporting of companies, as well as to the expectation of comments from major global central banks.

Later today, the Bank of Canada will announce its decision on the rates. The third increase by a quarter of a percentage point to 1.75% is expected this year. Hawkish tone of the comments is able to support the Canadian currency.

In the evening, the Beige book will be published, it is an economic review from the regional branches of the Fed. The attention of the market participants will be focused on the comments about the influence of import tariffs on the prices and profit and consumer activity.