Investing.com’s stocks of the week

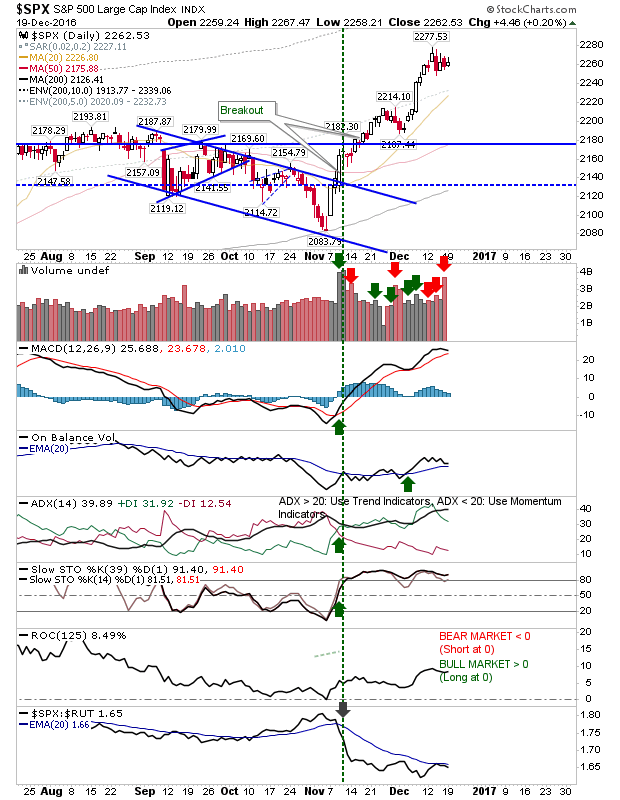

The indices had another inside day yesterday (in a series of inside days) to set up a good swing trade play. With the emergence of spike highs it would suggest a break lower is the favoured move (along with indices performing relatively weakly against their peers), but if shorts jump the gun and markers emerge from the coil higher then those shorts will be forced to cover - fueling fresh buying. The S&P is showing this coiling action best:

The NASDAQ has a sideways consolidation playing out with alternative buy/sell days which have resulted in little net change. Yesterday's volume we very light with Christmas fast approaching.

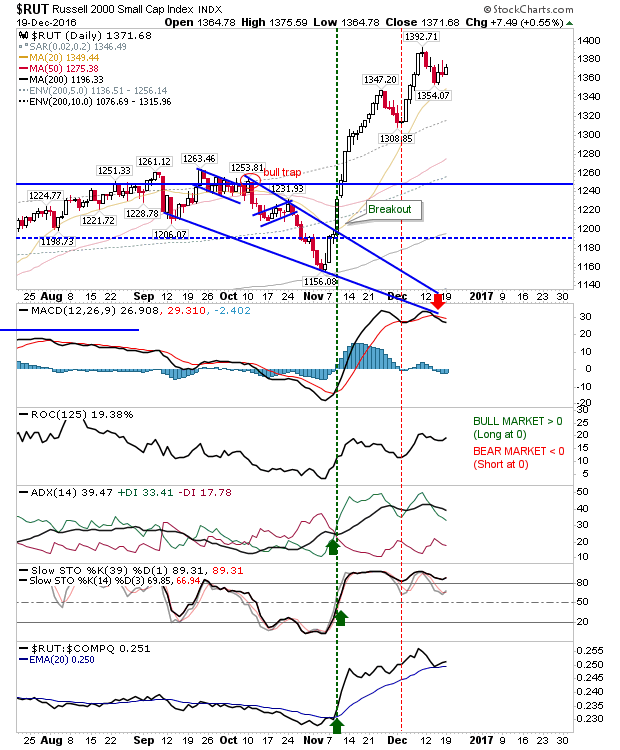

The Russell 2000 is the exception in that it's not coiling, and could be shaping a bull flag. The 20-day MA is playing as a possible jump point from support.

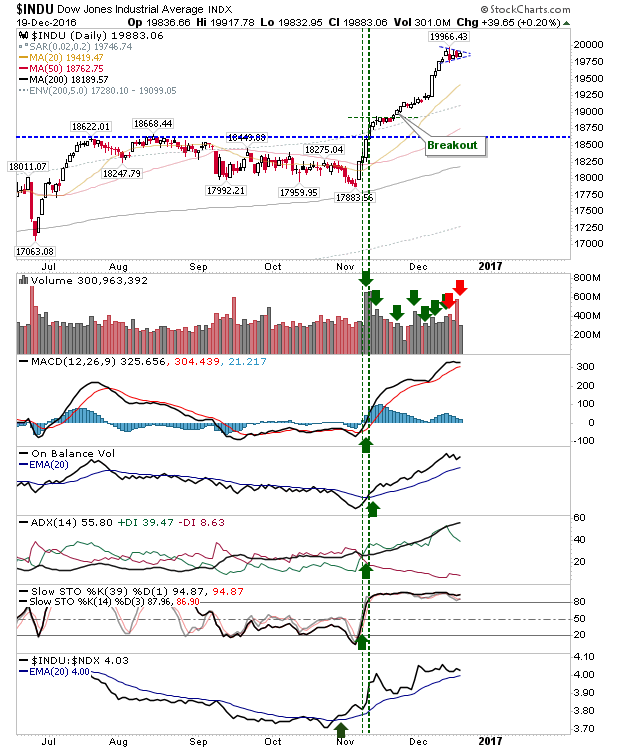

While the Dow is shaping a very tight coil

Santa may still have a few tricks up his sleeve, but the air is looking a little thin for bulls.