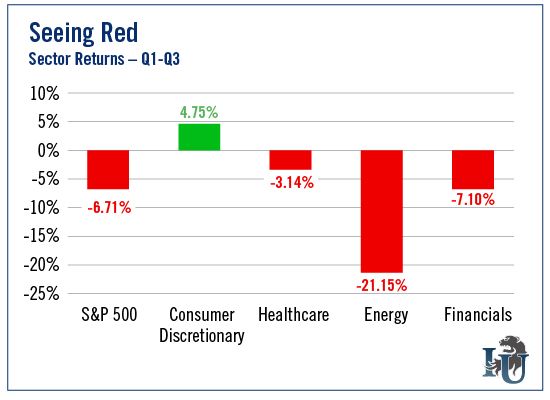

Year to date, the market has seen a lot of red. August and September, in particular, provided some dramatic swings.

But it hasn’t been bad for one particular sector...

In this week’s chart, we’re looking at the performance of Consumer Discretionary stocks. As you can see, it’s the only sector that locked in a positive return through the third quarter.

Why has Consumer Discretionary been the sole breadwinner? If you’ve been paying attention to U.S. economic data, this shouldn’t come as a complete surprise. Throughout the last few months, U.S. consumers have frequently been mentioned as a source of strength.

In a recent Investment U article, Matthew Carr referred to the American consumer as “the most powerful force in the global economy.” As buyers, we contribute more to global GDP than China.

Of course, just because this sector has performed well over the first nine months of 2015, that’s no guarantee it will continue...

Or is there?

We’re coming up on the biggest spending time of the year... the holiday shopping season. These are the pinnacle months for consumer spending.

Roughly 40% of all retailers’ revenue is generated in the fourth quarter.

So, with the sector primed for takeoff, what’s a good company to look at? How about L Brands (NYSE: N:LB), the parent company of Victoria’s Secret and Bath & Body Works...

It recently reported a better-than-expected comparable-store sales increase of 9% for September. That’s more than double expectations. With shares already up 11.8% YTD - and entering what Matt calls its “Prime Period” for sales - L Brands could easily continue higher.

But while Consumer Discretionary has performed well this year and continues to do so, you may be wondering what to expect from the rest of the market. If you read last week’s article, you know that even after a dismal third quarter, the fourth quarter could be a record breaker.

So far...

- The S&P 500 is up 6.90%

- Consumer Discretionary is up 6.73%

- Healthcare is up 2.49%

- Energy is up 11.78%

- The Financials sector is up 5.38%.

Granted, we’re only a few weeks into the quarter. But it’s already shaping up to be a strong end to the year. If you’ve been sitting on the sidelines, waiting for an opportunity to dive back into the markets, this could be it.

And if you’re still lacking the confidence? Well, perhaps all you need is a little coaching.