It’s no secret that the broader market has been rough on investors these past few weeks.

For one thing, we’ve had to contend with that whole yuan fiasco, which sent the Dow plummeting more than 1,000 points.

Uncertainty about the Fed raising interest rates has also made the markets skittish (though it should be less of a concern after Thursday’s announcement... at least for a while).

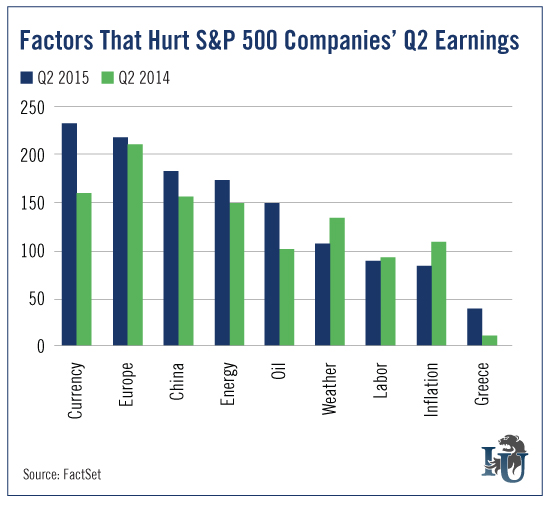

And to top it all off, crummy second quarter earnings packed on the downward pressure. This is the focus of today’s chart.

Simply put, sales were down; profits were down. And as a result, for the second quarter, year-over-year earnings for the S&P 500 are expected to drop 2.2%.

Our chart shows us which factors hurt S&P 500 companies’ earnings the most.

FactSet analyzed conference call transcripts from 417 S&P 500 companies. They then used this data to determine which factors - currency, oil prices, weather, etc. - were most harmful to the companies’ second quarter earnings.

The results should come as no surprise. With more than 45% of total revenue for all S&P 500 companies coming from outside the U.S., currency affected earnings the most - specifically, the strong dollar.

And we called it. Back in March, we featured a chart showing how the U.S. Dollar Index affected the S&P Foreign Exposure Index. (The S&P Foreign Exposure Index consists of the 47 S&P 500 companies that derive 50% or more of their revenue from foreign markets.)

From the article: “If this trend continues, the drop in our Foreign Exposure Index could very well start weighing down the entire S&P 500.”

For the short term, things look bleak. Second quarter earnings were poor. Third quarter earnings are estimated to decline 2.9%. However, there is a light at the end of the tunnel...

Next month, the third quarter will end and many companies will enter into what is historically their most profitable quarter. Now is the perfect time for investors to shop for quality companies trading at bargain-bin prices.

Or as our Chief Investment Strategist Alexander Green wisely opined on Monday: “Just as every dog has its day, every asset class has its bull market. So when you find one that is unquestionably cheap, you need only buy... and show a little patience.”