One of the ways for us to understand the emotional state of the markets is to look at sentiment. The spectrum of fear and greed is wide and when tallying up all the different indicators from VIX, to put/call ratio to polls and money flows we generally wind up near the middle. At least that true in the long term, but in the short term we see anxiety, stress, worry and uncertainty in these very tools. The recent rise in volatility is not hard to pinpoint in terms or rationale, there are many worries out there that are on the front burner and so many uncertainties - Ebola virus being just one of them (seems as if something new and scary comes out each day - how is that for uncertainty?).

What's worrisome to most is the speed for which these moves are occurring. Everyone seems to 'know' this market rally has gone on too far and too long (sarcasm), yet every time we hear 'this is the end' the markets turn right back up again.

I have to give the market the benefit of the doubt for now but to be certain this recent activity has me concerned about a continuation of the trend.

Is it different this time? It sure feels the same as it did in prior downturns (sick to my stomach as the drops are sharp, swift and massive). I suspect at some point irrationality of just 'sell it all' as we seem to be seeing/hearing now will fade.

Problem is, at what level will that happen? If the chart and technicals show too much damage there will be resistance that is difficult to overcome.

But if we're looking at the markets from 10,000 feet up we can see some major extremes were reached Thursday and Friday. The disconcerting part is they were done so quickly.

The old adage, 'markets go up taking the escalator and go down taking the window' (hence, markets go down faster and more sharply than they rise).

So, let's take a look at some of these sentiment indicators and their readings from an objective point of view, match them up with the charts and see where we may be headed.

I always like to start with the VIX, or annualized 30 day volatility.

This indicator has moved up to levels not seen since February, a more than 90 move higher from late August.

I won't get into the reasons for the move here because any reason is good enough to hit the sell button and/or buy protection. That has been evident since September, and when the 'buy the dip' crowd failed to materialize last month (on a few occasions) then there was a market vulnerability.

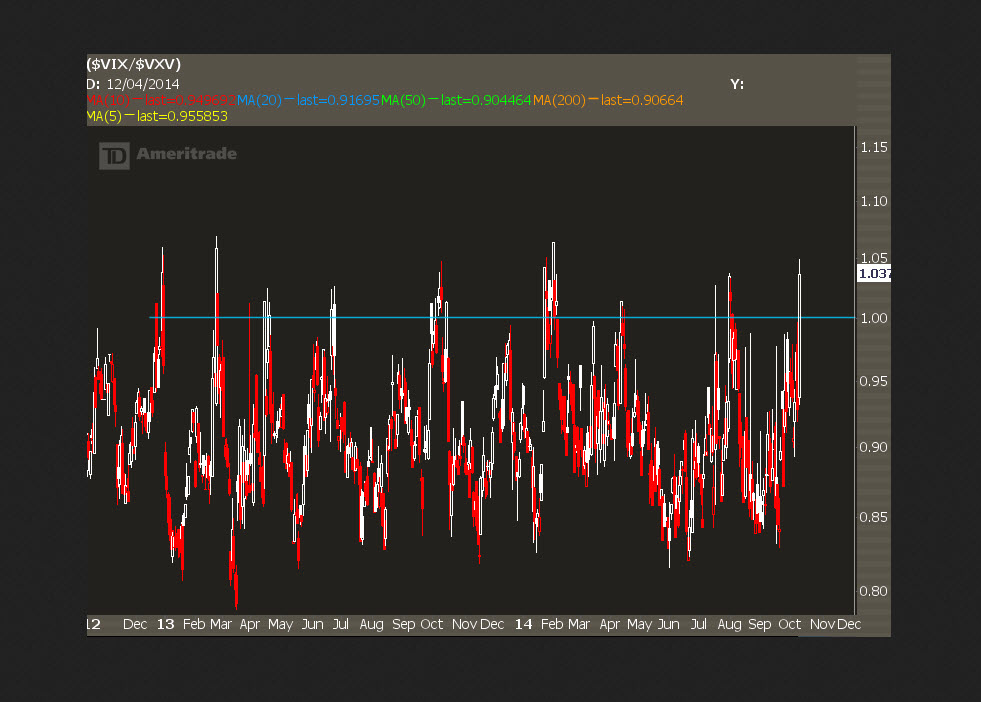

The good news - the VIX is sitting in rarefied air at the moment. See this chart of spot VIX and the term structure. For years this has occurred sharply but is unsustainable (see the chart above by Steve Place of investing with options, with shows the VIX/VXV ratio and how unsustainable a ratio over 1 has been since late 2012).

The put/call ratio has been showing the fear just as well as the VIX.

The total put/calls have recently hit some very high readings - the 21 moving average over .90, which is quite rare but augers a potential for a BIG rally when it turns back down. My good friend Larry McMillan of option strategist says that when this turns lower and under .90 then it is a very strong signal that predicts a 100 handle move in the S&P 500. (it is still rising, so any buy here is far too premature). Further, we saw equity put/call ratios over 1 on three occasions this week, also another rare deed. So, while not completely washed out yet this indicator is as stretched back as it could be.

Other indicators that I'm looking at with extreme readings are the CNN fear/greed poll, which came in Friday with a ONE! I'm not sure if it can go negative or to zero, but we'll soon find out! Investor polls are also trending toward a more defensive posture as well, with the AAII seeing a recent upswing in bears and weather vane also moving toward the bearish side. These are all coincident indicators, showing sentiment at the time are only secondary in trying to estimate the next move.

Finally, the McClellan Oscillator clocked in at some pretty extreme numbers Friday - the NASDAQ reading is -169 while the NYSE reading is a staggering -195. We've seen lower readings of course and that coincided with a 'that is enough, take it up' -- where most get whipsawed. The rubber band is stretched back far and has been for a month.

Bottom line, the ingredients are in place for a sharp snapback WHEN the selling subsides. I won't stick hand in and catch a falling knife and neither should you. Wait for things to settle down and pick your spots carefully. I don't believe the markets are set up for a fall here - especially with continued support from the Fed until the economy and unemployment are on safer ground.