Yesterday, I pointed out that the markets were severely overvalued relative to earnings.

Today, I’m going to show you just how extended the S&P 500 is.

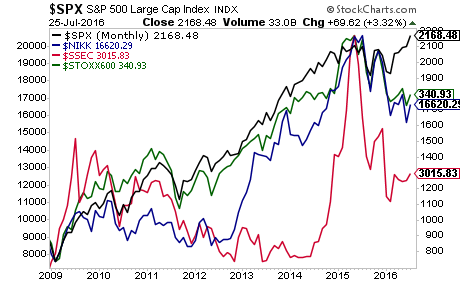

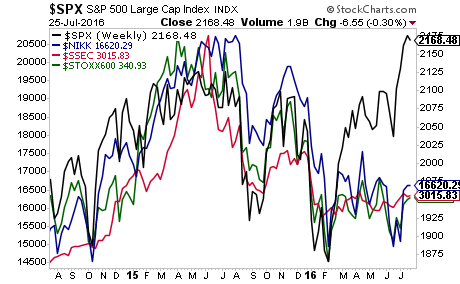

This is a chart showing the U.S. (black), compared to Japan (blue), China (red) and Europe (green).

As you can see, the S&P 500 has completely disconnected, not just from earnings, but from every other major stock index in the world.

We have a success rate of 72% meaning we make money on more than seven out of 10 trades. And thanks to careful risk management we’ve seen triple-digit returns on invested capital every year since inception.

And if you go back to the 2009 lows, the divergence is even more extreme.

A Crash Is Coming

Imagine if you’d prepared for the 2008 Crash several months ahead of time. Imagine the returns you could have seen if you had started prepping in July 2008 instead of waiting for the disaster to unfold.

I can show you how.

However, I cannot continue this incredible track record with thousands of investors following our strategies.

Based on what’s happening in the markets, we’ve extended the deadline for our current offer.