Wednesday, the Fed announcement continued past promises of reducing their bond-buying program and keeping interest rates low. The 120-billion-dollar bond-buying program will first look to reduce 15 billion per month beginning near the end of the year before it moves towards raising interest rates.

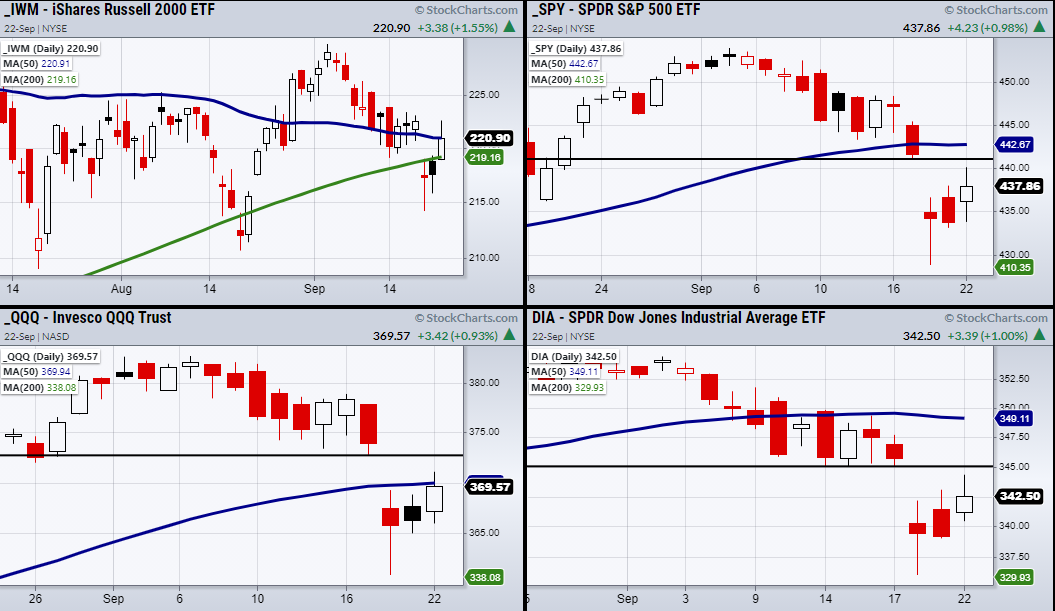

Looking through the eyes of the major indices both the S&P 500—SPDR® S&P 500 (NYSE:SPY) and the Dow Jones via SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA) held over their prior days' high but were not able to clear the gap created from Monday.

This is a pivotal price level to clear.

On the other hand, the Russell 2000—iShares {0|Russell 2000} ETF (NYSE:IWM) and the NASDAQ 100 Invesco QQQ Trust (NASDAQ:QQQ) tested their 50-DMA before closing below them.

While traders watch for a strong end-of-week rally, the Fed’s announcement hasn’t given us any new information. This shows that the market neither has more incentive to run higher nor reason to break any lower based on the latest update. Having said that, from a technical standpoint both IWM and QQQ need to clear their 50-DMA while both the DIA and SPY need to fill their gap created from Monday.

As seen on the chart, if these levels can’t be reached, stay cautious, as the market continues to show how quickly it can sell off.

ETF Summary

- S&P 500 (SPY) 441.02 gap to fill.

- Russell 2000 (IWM) Needs to clear the 50-DMA at 220.91 and hold.

- Dow (DIA) 345.06 gap to fill.

- NASDAQ 100 (QQQ) 369.94 minor resistance.

- KRE (Regional Banks) Needs to clear both the 50-DMA and 200-DMA over 64.

- SMH (Semiconductors) 260.43 support.

- IYT (Transportation) 245.54 support. Resistance 249.69.

- IBB (Biotechnology) 169.42 the 50-DMA support.

- XRT (Retail) Testing resistance from the 50-DMA at 94.80.

- Junk Bonds (JNK) 109.50 support. 110.12 high to clear.

- IYR (Real Estate) Support range 107.80-105.24.

- XLP (Consumer Staples) 71.35 gap to fill.

- GLD (Gold Trust) 167.45 gap to fill.

- SLV (Silver) 20.52 minor support.

- USO (US Oil Fund) 51.40 resistance.

- TLT (iShares 20+ Year Treasuries) Now needs to hold over 151.57

- USD (Dollar) Needs to hold over 92.89.

- DBA (Agriculture) Watching to clear the 10-DMA at 18.59.

- VBK (Small Cap Growth ETF) 285.74 the 50-DMA. Needs to clear and hold over 293.

- GREK (Greece) 27.70 low to hold