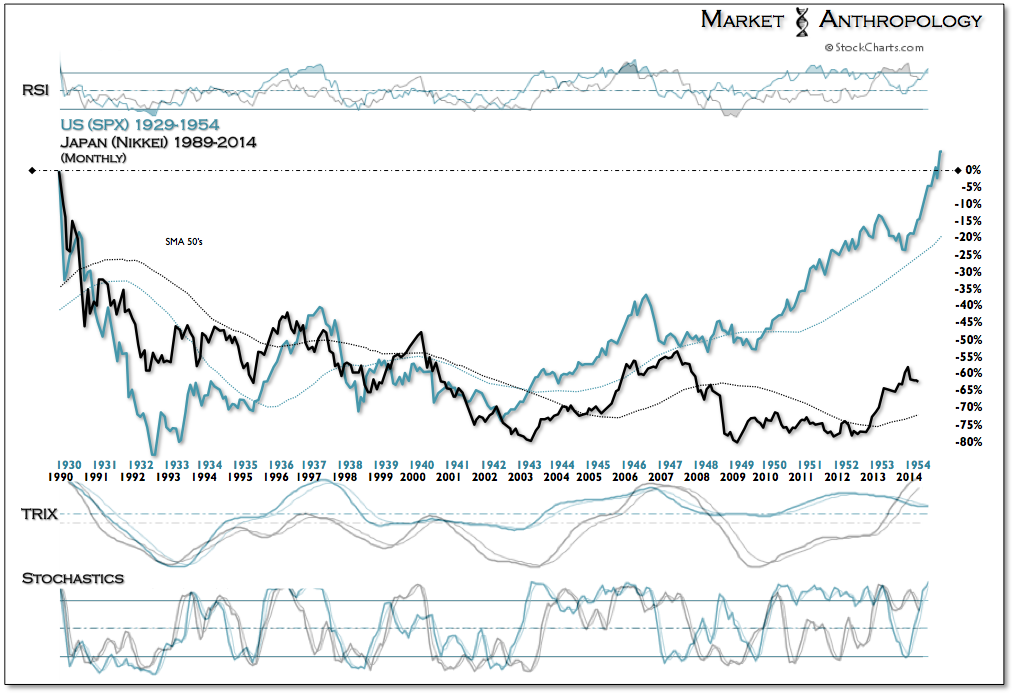

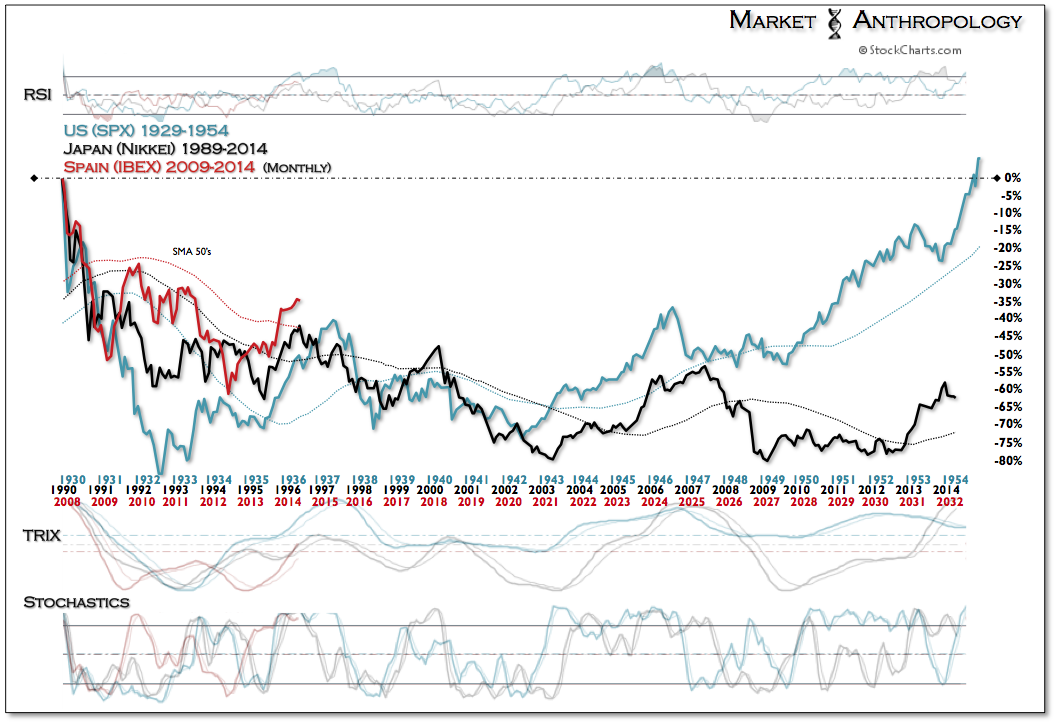

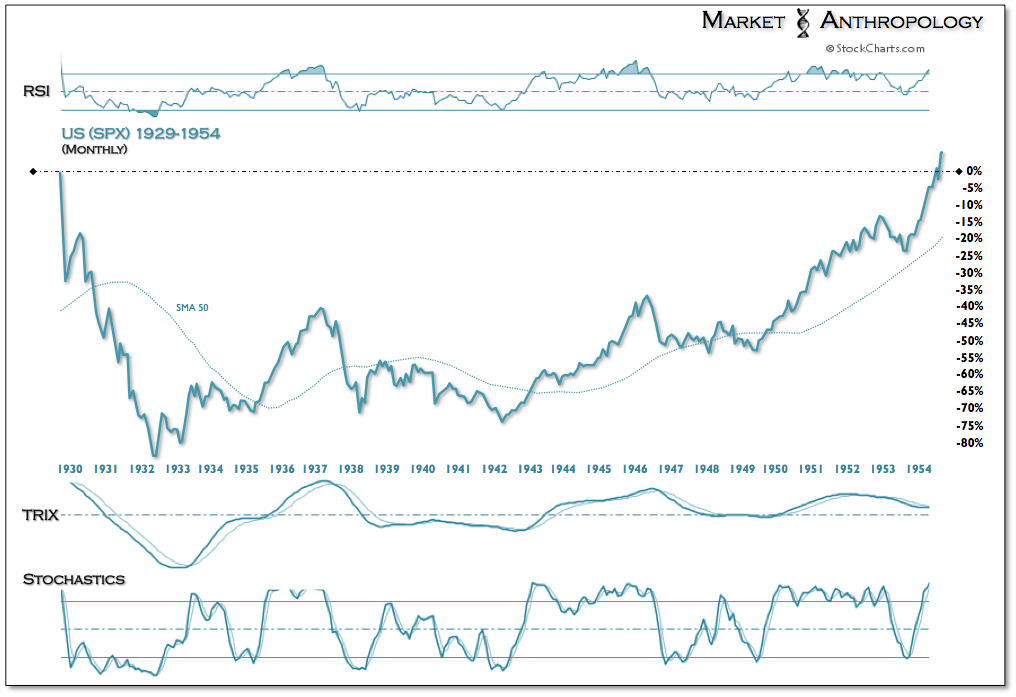

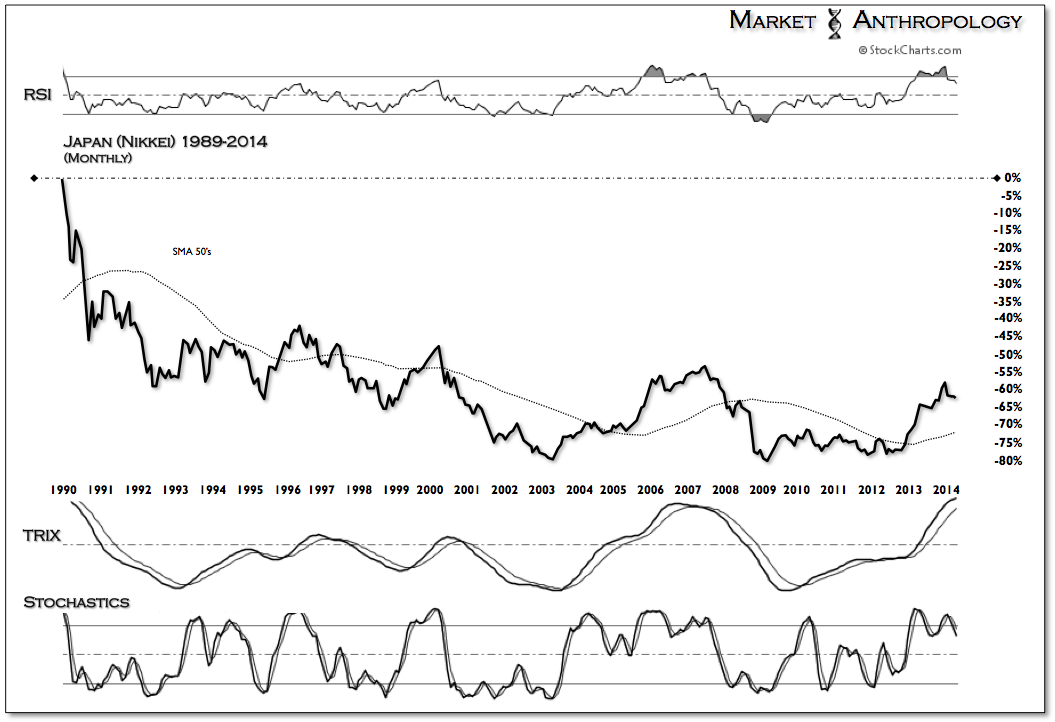

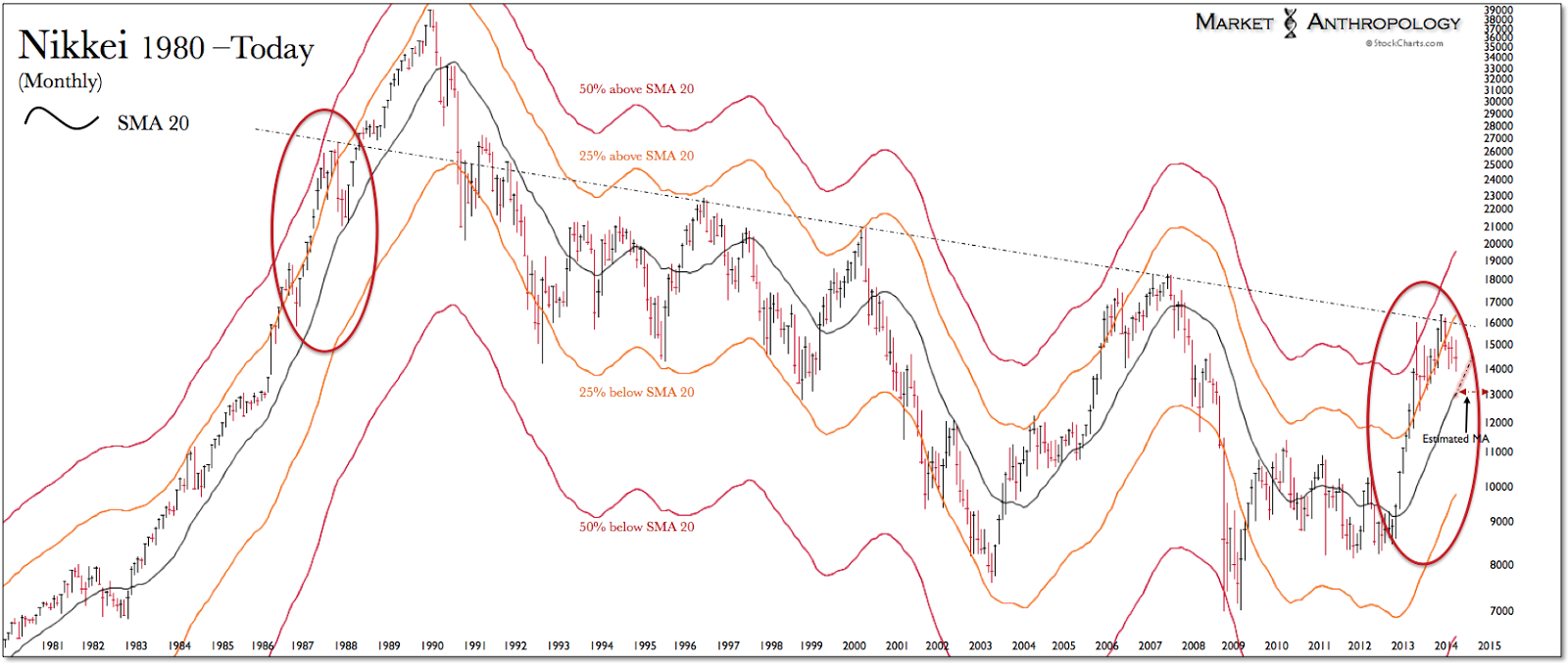

It took the Dow Jones Industrial Average and the S&P 500 basically twenty five years (give or take a month) to recapture the nominal 1929 secular highs. With Japan's Nikkei now trading well into its twenty fourth year since its secular peak in 1989, we thought we would take a quick comparative look at the two most cited deflationary spirals (as weighed by their respective equity market performances) and contrast them with the most recent European deflationary trend as expressed by Spain's IBEX index.

Both the SPX and the Nikkei contracted ~ 80% below their secular peaks. In the US, the equity market collapse was acute and reached a secular low less than three years from the 1929 high. For Japan, the contraction was more prolonged and eroding - reaching a secular low ~20 years from its 1989 high.

Both the SPX and the Nikkei contracted ~ 80% below their secular peaks. In the US, the equity market collapse was acute and reached a secular low less than three years from the 1929 high. For Japan, the contraction was more prolonged and eroding - reaching a secular low ~20 years from its 1989 high.

While the Nikkei has come under pressure in its twenty fourth year since making a secular high at the end of 1989, Spain's IBEX has trended higher, albeit traversing between positive and negative for the year on several occasions. It has essentially trended with the SPX but with a higher beta return. Our longer-term expectations this year have progressively become more bearish as the structure of both indexes have shifted from a flagging and consolidating pattern to what we suspect could become a cyclical top for both markets. With that said, we are far more bearish on the long-term prospects for Spain and the IBEX and see great similarities - both from an economic and market perspective, to Japan over the last quarter century.

Although it is likely too early to put on both sides of the trade, an alluring pairs trade (long Japan/short Spain) between these two deflationary cousins may have considerable open road to run as one market transitions out of deflation as the other cycles back in.