Investing.com’s stocks of the week

We should see a somewhat firmer open for the Australian equity market, with our call currently sitting at 5550 (+18 points). The fairly flat open this morning in the FX markets suggest futures markets shouldn’t see too much volatility on open and our calls should be in-line. We may see some modest weakness in the Nikkei 225, but the Japanese index has gained for the past six weeks in a row, but as we know at this time of year it can be tough to short these markets when the underlying trends are just so powerful.

The leads from Wall Street are lacklustre, with the S&P 500 falling a mere 0.2%, but the losses were seen more substantially in the financials and to a lesser extent materials space. Whether this filters through to weakness on Aussie financials is yet to be seen. It has become quite apparent that inflation expectations have started to roll over, with US five-year inflation expectations falling five basis points (bp) on Friday to 1.97%. Some of the wind has come out of the selling in US fixed income, but the idea that ‘real’ (i.e. inflation-adjusted bond yields) have increased from -43bp (on the day of the US election) to currently sit at +23bp is starting to be seen as a stronger headwind for further equity appreciation. Higher ‘real’ bond yields are a genuine tightening of financial conditions.

The USD index has gained for eight of the past eleven weeks, helped by a sizeable increase in the yield premium demanded to hold US treasuries over German bunds and Japanese government bonds. We can take the US/German 10-year bond spread which at 222 basis points is the widest premium (in favour of the US) since 1999, thus it’s no wonder we have EUR/USD closing below the $1.1500 to $1.0500 range it’s been in since the beginning of 2015. Parity calls are now deafening, and it has to concern though that everyone is a USD bull here and there is no greater consensus trade for 2017 than being long the dollar.

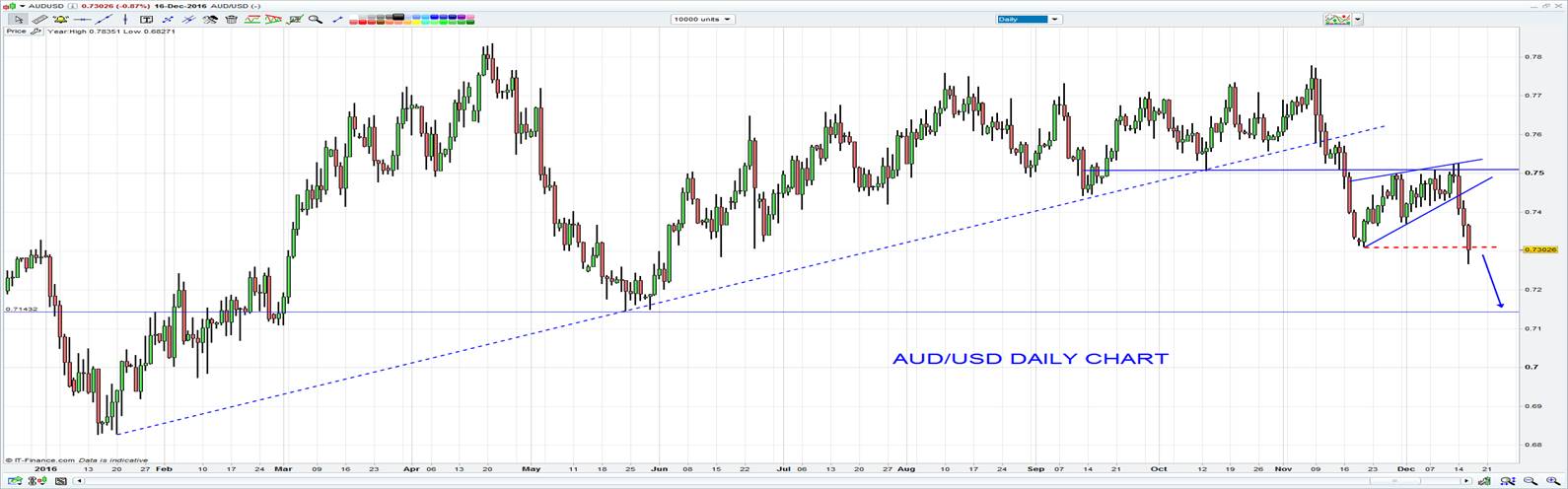

AUD/USD is also on the radars, with the exchange rate closing out Friday below the 21 November pivot low of $0.7310 and the lowest levels since June. Falls in bulks on Friday probably not helping, with steel, iron ore and coking coal futures falling 2.8%, 3.9% and 0.4% respectively.

We are now hearing that St Louis Fed President James Bullard has opened a can of worms by starting a discussion that the Fed should allow its $4.5 trillion balance sheet to shrink in 2017. This view seems earlier than most has expected and by allowing the bonds on its balance to mature, without rolling them over and re-investing the proceeds here would limit the need to raise interest rates three times in 2017. However, the combination of balance sheet contraction (at a time when the ECB and BoJ are still rapidly increasing their balance sheets through Quantitative Easing) makes it hard to be anything else other than a USD bull.

(EUR/USD – Orange line. The ratio of the Fed/ECB’s balance sheet – white line)

We need to ask whether the moves in the USD, driven by higher ‘real’ bond yields, will actually start to hurt the US equity markets and become a major headwind not just for emerging markets but the US economy?

This is a question for 2017 as trend and momentum are currently spurring on buyers and we all know this is one of the strongest times of year for most equity markets, including the ASX 200. There will be some focus this week on the Australian Mid-Year Economic and Fiscal Outlook, with Scott Morrison handing down his budget update and some belief that we could see a near-term response from anyone of the three main credit agencies upon hearing the new budget statistics. I am personally sceptical of a near-term downgrade, but sit in the camp that it shouldn’t affect economics in any real way over the medium-term even, although most economists would suggest this forecast is tough to predict.

The ADR’s (American Depository Receipt) of BHP, CBA and WPL are largely unchanged, but given the likely buying in Aussie fixed income one suspects it will be a day to be long REITS and higher yielding equities, with some buying in oil stocks.